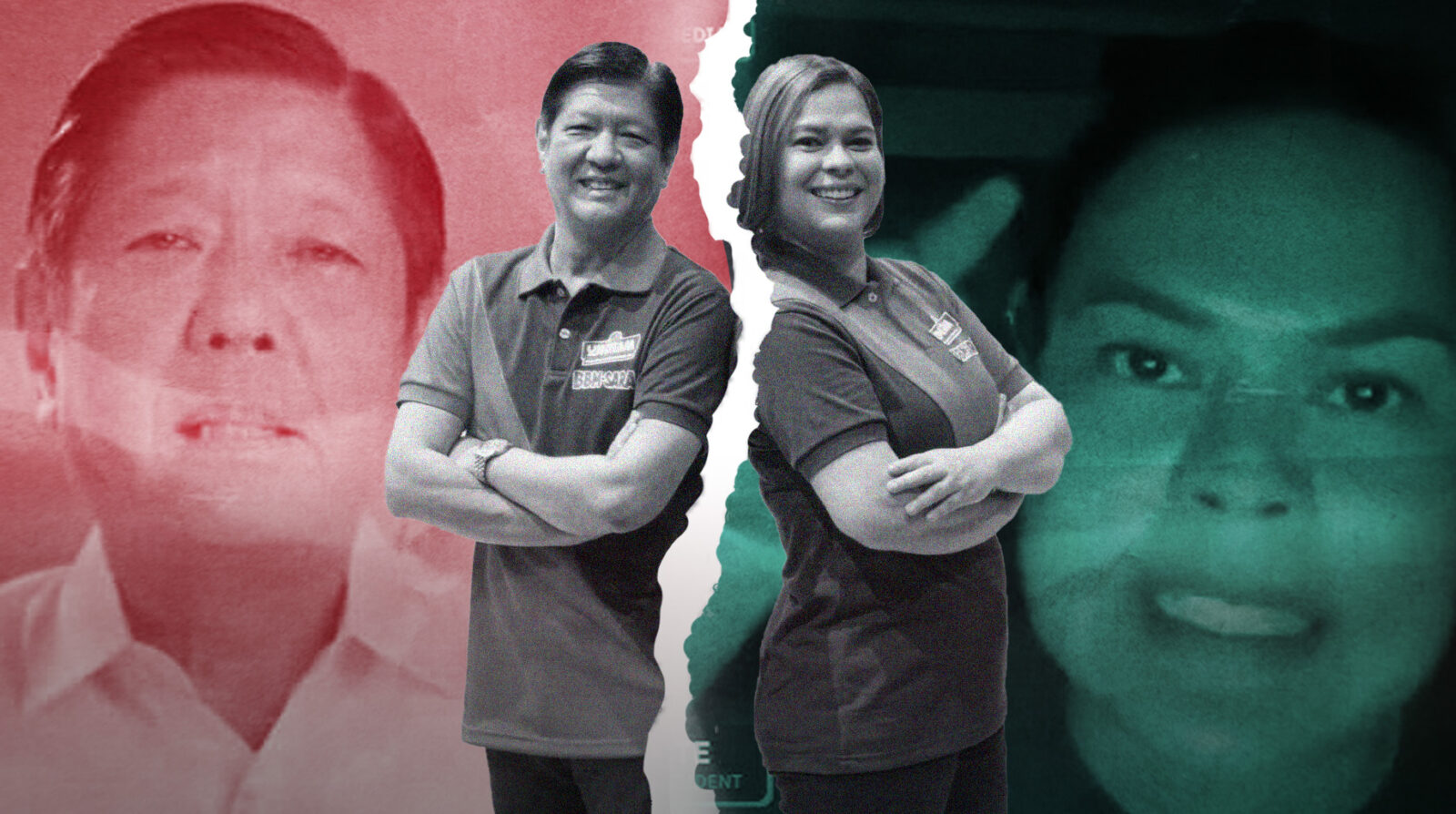

Economic risks from ‘UniTeam’ feud flagged

Political instability amid the simmering feud between President Marcos and Vice President Sara Duterte could emerge as a major source of economic risk, especially if the conflict would lead to “weak” results in the 2025 midterm polls and disrupt policy continuity, Nomura said.

In a commentary, the Japanese investment bank said the Marcos-Duterte clash was in the “mix” of external and domestic sources of risks to the economy, along with weaker global growth, escalating tensions in the West Philippine Sea and resurgence of oil and food prices.

“Domestically, a weak result during the midterm elections for the administration and its allies could reignite political risks, as well as a continued intensification of the conflict between President Marcos and Vice President Duterte,” Nomura said.

What was once known as the “UniTeam” alliance broke up after Duterte had verbally attacked the President amid congressional scrutiny on the use of confidential funds by the Office of the Vice President. Allies of the administration have control of the House of Representatives.

The feud further escalated after Duterte told a press conference that she had asked someone to kill the President, the first lady and the Speaker if she dies. That outburst had been cited in an impeachment complaint filed by progressive political groups against the Vice President.

All eyes on midterm polls

For now, the economic team said they remain “undeterred” by political noise, adding that the work to bag an “A” credit rating for the government continues and that investors would rather focus on reforms.

Anthony Lawrence Borja, political science professor at De La Salle University, said the breakdown of the Marcos-Duterte relationship would likely consolidate support for administration bets during the 2025 midterm elections.

“The force of money and patronage politics is on the side of the administration,” Borja said.

“Along with Sara Duterte’s declining popularity, these could reduce the feud’s adverse effects on both the midterm elections and overall support for the administration,” he added.

Nomura, meanwhile, believed that an election win for Marcos’ allies would help the administration sustain its economic agenda, including the increased spending on infrastructure development.

“Our current view is that President Marcos and, by extension, his allies are still doing well and are likely to control Congress. This might lead to a wider current account deficit as infrastructure spending is a top priority of President Marcos,” the bank said.