From bottlenecks to breakthroughs: The changing face of PH logistics

While navigating an archipelago of more than 7,000 islands isn’t easy, packages are finding their way from Manila’s bustling ports to remote villages in Mindanao with increasing efficiency—thanks to a logistics industry that is changing how Filipinos shop and businesses operate. Now valued at over $55.65 billion, the Philippines’ logistics market is simplifying the geographic complexity of island-to-island delivery and the digital revolution is transforming how Filipinos shop and businesses operate.

According to the Philippines Logistics Market Outlook to 2030, a report recently released by global consulting and advisory firm Nexdigm, 82 million internet users are primarily driving a projected $17 billion e-commerce market, allowing the country’s logistics industry to maintain a steady compound annual growth rate of 6 percent from 2024 to 2030.

The report, which employed a rigorous four-step methodology to analyze the complex logistics landscape across the Philippines, reveals how the country’s 74-percent internet penetration rate has created unprecedented demand for last-mile delivery services, with approximately 41 million online shoppers driving the need for efficient logistics solutions.

The growing middle class and shifting consumer behaviors have further amplified demand for diverse logistics services, particularly those tailored for e-commerce operations.

E-commerce boom

Last-mile delivery has emerged as a critical differentiator for customer satisfaction and retention among retailers across the country.

On top of this e-commerce boom, surging foreign investments exceeding $10.5 billion and the government’s ambitious $25 billion infrastructure commitment across the country are contributing to the logistics market’s growth.

In terms of location, major cities naturally dominate the Philippines’ logistics landscape—particularly Manila, Cebu and Davao. As the capital, Manila serves as the key hub for both domestic and international freight activities. Cebu has established itself as a center for vibrant trade activities, while Davao stands out for its agricultural logistics capabilities.

These urban centers benefit from strategic locations and developed infrastructure, encompassing significant transport hubs that enhance connectivity to local and international markets. With nearly 47 percent of the Philippines’ population living in these areas as of 2023 and continued urbanization projected, the demand for efficient logistics solutions in these metro hubs continues to intensify.

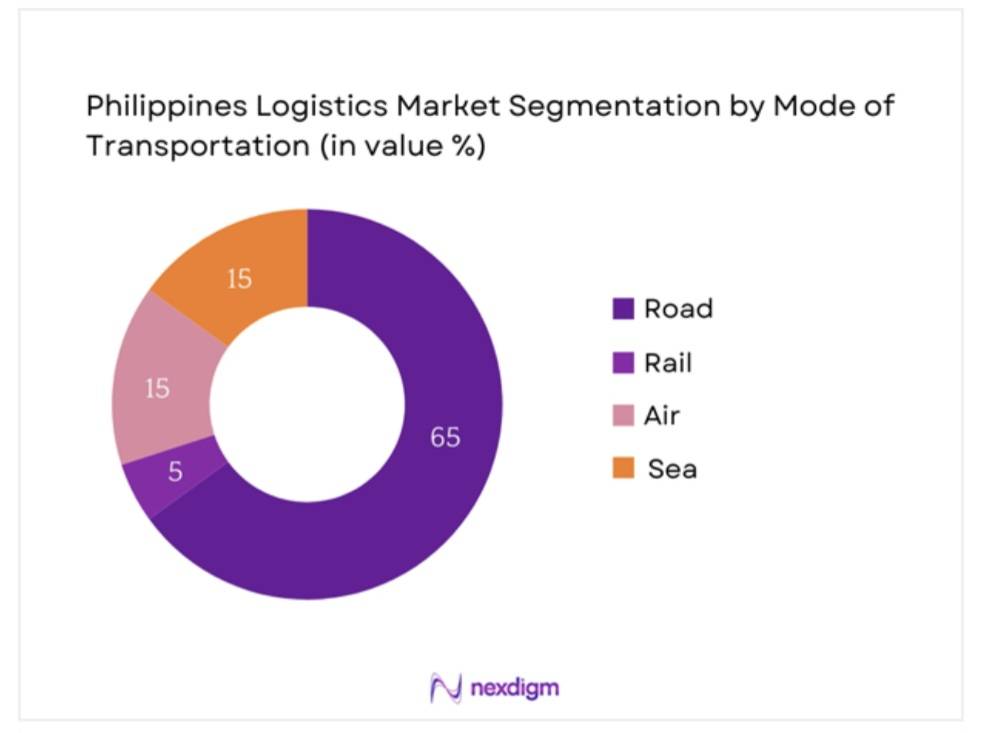

The report also shows that road transport is the top mode of delivery, accounting for the largest market share due to its extensive network that facilitates goods movement to both urban and rural areas. The road transport segment is favored for its flexibility, accessibility, and ability to adapt to the changing demands of the logistics sector.

Among service types, freight forwarding leads the market, primarily driven by the growing complexity of global supply chains and the need for expert management of logistics operations. This segment encompasses a comprehensive range of activities essential for businesses looking to optimize their supply chain management.

Key players, tech innovation

Focusing on the market’s key players, the report states that Philippine logistics is dominated by major companies such as Aboitiz Transport System Corporation, 2GO Group, and International Container Terminal Services, Inc.—established organizations with comprehensive networks and diversified service offerings that enable them to meet growing market demands.

Other significant market participants include DHL Supply Chain Philippines, LBC Express, XPO Logistics, Kuehne + Nagel, and various international logistics providers, creating a competitive landscape that spans both domestic and international service capabilities.

As the industry continues to grow, automation and artificial intelligence are expected to likewise revolutionize inventory management and shipping processes, the report states. Companies are increasingly adopting integrated software solutions to optimize supply chain operations and enhance real-time tracking capabilities. The incorporation of warehouse management systems, transport management systems, IoT-enabled tracking, blockchain documentation, and AI-powered routing and scheduling is transforming traditional logistics operations.

However, despite these positive growth prospects, the industry still faces challenges: Regulatory compliance remains a major hurdle, with the Philippines currently ranked 133 out of 190 in the World Bank’s Doing Business report. Businesses must navigate complicated import/export documentation requirements and transportation safety standards, which can make logistics operations more difficult to implement and lead to delays and increased expenses.

High transportation costs present another substantial challenge, with the Philippines ranking 60th globally in the Logistics Performance Index, which the report characterizes as “relatively low.”. Average inter-island shipping costs can reach $500 to $1,000, primarily due to congestion, inadequate infrastructure, and fuel prices heavily influenced by global markets. These elevated costs affect both logistics service providers’ operational margins and consumer prices.

Looking ahead, the Philippines logistics market is generally expected to show significant growth over the next five years, especially with the expected expansion of e-commerce in the country. Growing urbanization and developments in telecommunications infrastructure are also expected to contribute positively to the market’s growth, cementing logistics’ crucial role in the country’s broader economic development strategy. As the industry evolves, the integration of sustainable logistics practices and advanced technology solutions will likely become key differentiators for service providers seeking competitive advantages in this dynamic sector.

Read the full report here: https://www.nexdigm.com/market-research/report-store/philippines-logistics-market-research-report/