Graft probe slows growth, but PH still poised for higher credit rating

The Philippines is navigating a tricky economic and political landscape, yet a major debt watcher says it is still poised to outperform its peers—a performance that could keep the country on track for a long-sought upgrade in its credit rating.

S&P Global Ratings described the recent slowdown as “modest,” noting that the country’s credit metrics are expected to strengthen over the next one to two years. The agency expects the government’s twin deficits—budget and current account—to narrow, bolstering its financial buffers enough to support a higher rating.

But progress may not be smooth.

The ongoing investigation into anomalous flood control projects and the political fallout from impeachment complaints against President Marcos have weighed on government focus and stalled some infrastructure work.

“The government has devoted much attention to the investigations into the alleged misuse of funds and address the impeachment complaints against the president,” S&P said. “At the same time, some infrastructure projects have been halted.”

Last year, S&P affirmed the Philippines’ triple B plus rating, citing “above-average” economic growth potential and a “strong” external position. The agency also maintained a positive outlook, leaving the door open for the country to reach an A rating—the next rung up on the scale—within 12 months to 24 months. An upgrade would mark a major milestone for the Philippines, lowering borrowing costs and improving investor confidence.

The Marcos administration has acknowledged that its anticorruption drive has slowed progress toward an A rating. Economic officials trimmed the government’s revenue target for 2026 to P4.82 trillion from an earlier P4.98 trillion, as the graft scandal dampened economic activity.

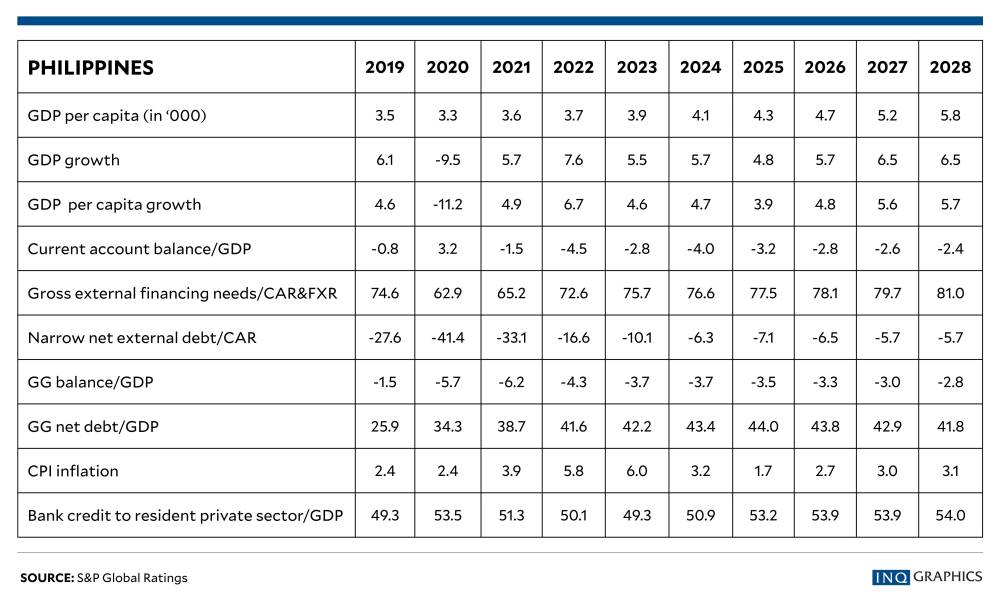

Data from the Philippine Statistics Authority showed gross domestic product grew just 3 percent in the fourth quarter of 2025—the slowest pace outside the pandemic in more than 14 years. Full-year growth settled at 4.4 percent, missing the government’s 5.5-percent to 6.5-percent target.

Meanwhile, government debt grew faster than the economy, rising 10.31 percent in 2025. This pushed the debt-to-GDP ratio to 63.2 percent, above the 60-percent threshold generally considered manageable for emerging markets.

Recovery

Still, S&P sees recovery ahead. The agency projects growth to rebound to 5.7 percent in 2026 and accelerate to 6.5 percent in 2027 and 2028.

“Despite a likely economic slowdown, we still expect the Philippines to remain an outperformer among peers at similar levels of average income,” S&P said. “The drag on fiscal revenue may also have only a modest impact on the general government deficit since capital spending will also be lower.”

The coming years will test the government’s ability to balance fiscal discipline, anticorruption reforms and economic growth. How quickly it can resolve ongoing investigations and restart stalled infrastructure projects could be decisive not only for the country’s credit rating but also for sustaining investor confidence and public trust.

For now, the Philippines remains in a delicate but promising position: a country slowed by scandal, yet still moving forward on the path to stronger creditworthiness.