Inflation data in the United States lifts global equities, but the dollar falls

NEW YORK/LONDON — The dollar fell and major US stock indexes rose on Tuesday on news that US consumer inflation picked up less than expected in April when President Donald Trump unveiled a raft of tariffs that has wreaked havoc on global markets.

European shares edged higher for a fourth straight session, and global equities also gained.

Crude oil prices rose, boosted by a temporary cut in US-China tariffs.

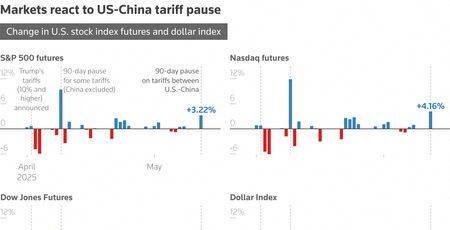

The US and China said on Monday they would pause their trade war for 90 days, bringing down reciprocal duties and removing other measures while they negotiate a more permanent arrangement.

The agreement has reignited investor appetite for stocks, cryptocurrencies and commodities and Tuesday’s inflation figures helped power that move.

The Bureau of Labor Statistics said its consumer price index rose 0.2 percent in April, bringing the annual increase down to 2.3 percent from 2.4 percent.

Economists polled by Reuters had forecast a monthly rise of 0.3 percent and a yearly rise of 2.4 percent.

The report was good news, said Bill Adams, chief economist for Comerica Bank in Dallas, in a note. “Inflation should be manageable for most consumers and businesses in 2025.”

The S&P 500 and the Nasdaq advanced on the softer-than-expected inflation numbers and easing of U.S.-China trade tensions. The S&P 500 rose 42.36 points, or 0.72 percent, to 5,886.55 and the Nasdaq Composite rose 301.74 points, or 1.61 percent, to 19,010.09.

UnitedHealth slides

The Dow Jones Industrial Average fell 269.67 points, or 0.64 percent, to 42,140.43, under pressure from UnitedHealth’s slide after the company suspended its annual forecast and its CEO stepped down.

The dollar pulled back from sharp gains in the prior session on the inflation data. It was last down 0.79 percent against a basket of currencies.

The euro rose up 0.94 percent at $1.1191.

“The report basically indicates that the Fed needs to be very cautious and that the stand that they have taken is probably the right course, for now,” said Peter Cardillo, chief market economist at Spartan Capital in New York.

European shares ended slightly higher, ending up 0.1 percent, around their highest level since late March.

Emerging market stocks fell 5.03 points, or 0.43 percent, to 1,156.82.

MSCI’s broadest index of Asia-Pacific shares outside Japan closed 0.51 percent lower at 603.95, while Japan’s Nikkei rose 1.43 percent to 38,183.26.

Reuters, the news and media division of Thomson Reuters, is the world’s largest multimedia news provider, reaching billions of people worldwide every day. Reuters provides business, financial, national and international news to professionals via desktop terminals, the world's media organizations, industry events and directly to consumers.