JTI plays the long game as habits evolve

After more than five decades of development of heated tobacco and with more than a decade of investing in this emerging product category, Switzerland-based Japan Tobacco International (JTI) is betting big on what is anticipated to be the next main revenue stream not just for the company but for the entire global industry.

Tokyo-based parent entity Japan Tobacco Group, which is also in the businesses of pharmaceuticals and processed food, has earmarked an outlay of 450 billion yen or about $3 billion on “reduced risk products” (RRPs or “alternative” products) over the 2024-2026 period.

RRPs include not just heated tobacco—featuring leaves that are exposed to heat but not burned, unlike traditional cigarettes—but also e-cigarettes or vapes that involve liquids with nicotine and flavors as well as products that contain nicotine or tobacco that are ingested or applied to the skin (like nicotine pouches).

According to JTI vice president Kazuhito Sumimoto, their three-year investment in RRPs covers capital expenditures, sales promotions and research and development.

“One of our ambitions [based on the current three-year business plan] is to recoup by 2028 our investments in RRPs and reach profitability,” he told visiting journalists in Tokyo last November.

During that visit, seven markets were represented, mostly European countries—Slovakia, Romania, Greece, Czechia, Hungary.

The Philippines and Kazakhstan represented JTI’s Asian markets, although the latter is more closely associated with the European cluster.

This shows how Japan Tobacco’s bread and butter remains to be the European markets—both Western and Eastern (former parts of the Soviet Union).

And while JTI intends to keep putting money in combustibles—the tobacco that users light up and which produce smoke—in order to grow and continuously improve the profitability of these traditional products, the company is prioritizing investment in heated tobacco.

At the same time, it intends to explore other RRP segments.

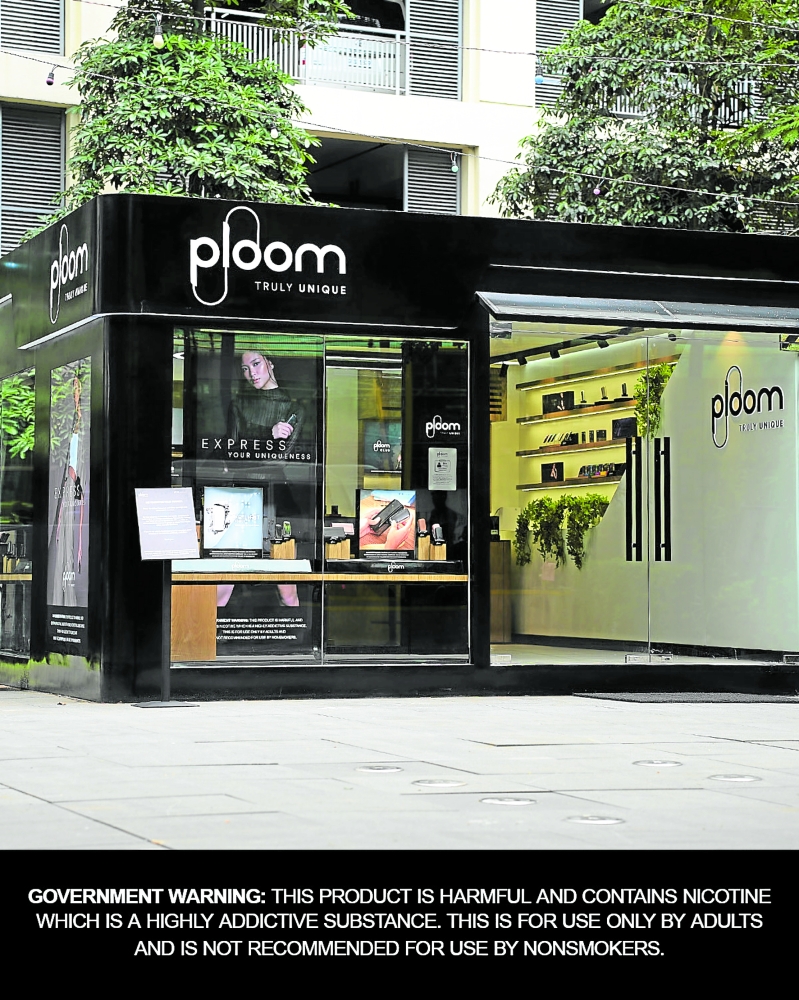

Thus, JTI launched Ploom X—the latest generation of its heated tobacco product line—in Japan in 2021 and after that in increasing aggressiveness across other markets.

Noticeable bloom

In the JT Group’s financial performance report for the third quarter of 2024 issued in October, president and chief executive officer Masamichi Terabatake notes a significant Ploom volume growth of 40 percent. This helped push up total sales volume by 2.2 percent year-on-year.

“The geo-expansion of Ploom, our investment priority, has now reached 23 markets, and in Japan, the largest Ploom market, we continued to gain share in [this] segment reaching 11.8 percent quarter-to-date,” Terabatake says.

The following month, in November, JTI Philippines brought in Ploom X, touting that it was the first launch in Asia outside of Japan.

The company describes Ploom as having been designed to meet the changing needs and demands of adult smokers.

With “no smoke, no ash and less tobacco smell,” the product is aimed at a broader consumer base.

Regarding this, health authorities such as the Food and Drug Authority in the United States and the National Health Service in the United Kingdom note that no tobacco product is safe and that alternative products are not risk-free, although the health risks of different tobacco products “exist on a spectrum” or are varying.

JTI acknowledges this and echoes this by stating that while it is tagged as RRP, “this does not mean that the use of Ploom X Advanced is safe or eliminates health or addiction risks associated with tobacco use. No tobacco product is safe.”

“Ploom is flourishing in markets where it is present and we are eager to grow the brand here in the Philippines,” says Erika Viveiros, marketing director at JTI Philippines.

Market heats up

Indeed, “geo-expansion” for heated tobacco is a key buzzword in JTI’s business plan.

It took two years for Ploom X to reach 12 markets outside Japan, but this almost doubled just last year, including the Philippines.

This put JTI closer to its goal of having Ploom in 40 markets worldwide by 2026.

In Japan, where JT Group’s heated tobacco has been in the market for 10 years, the category now accounts for two-fifths or 40 percent of demand.

Still, only one out of three of JT’s factory complexes—the one in Yokohama—is engaged in making refills or tobacco sticks. The heating devices themselves are made in Europe.

In Yokohama, JTI manufactures 18 types of Ploom refills, including the brand Mevius (formerly Mild Seven).

According to JT Group director Ichiro Kawai, they expect that the combustibles business will decline by 2 percent by 2035. At the same time, the heated tobacco category will rise by 8 percent.

“After 2035, heated tobacco may be the biggest market,” says Sumimoto.