Keeping a war chest for health crises tops Pinoys’ priorities

To lead a healthy life and run one’s own business—this is what Filipinos want to ultimately achieve, as revealed by a recent report, The Filipino Dream by the Boston Consulting Group (BCG).

The study uncovers what drives the Philippines’ economic aspirations and how big businesses can support such goals in 2025 and beyond.

Based on surveyed 1,500 Filipinos, the report is authored by BCG’s managing director and senior partner Anthony Oundjian, managing director and partner Julian Cua, principal Lance Katigbak, senior associate Anjeli Panis and lead knowledge analyst Lilian Cheong.

Findings show that 58 percent of respondents prioritize financial security for health emergencies, while 56 percent dream of starting their own businesses.

According to the report, Pinoys are spending more on healthcare products, particularly health supplements such as cough remedies made from lagundi (chaste tree), capsules with mangosteen extract and herbal food supplements for sore throats and body aches.

Moreover, the report states that while 60 percent of Filipinos reported having a health plan, only 65 percent of them said they felt prepared for an emergency.

As for Pinoys’ entrepreneurial dreams, the report says that, “Filipinos are not trying to create the next Facebook—they are simply trying to sell a few extra items to build some additional financial stability.”

Citing data from the Department of Industry, BCG says this is reflected by the number of new business registrations even through the pandemic, between 2019 and 2023, which was counted at 984,000. These were mainly composed of simple, traditional businesses such as sari-sari stores and karinderya.

Providers

The report goes on to segment Filipino “dreamers” into four categories—the Providers, the Trailblazers, the Guardians and the Rebuilders.

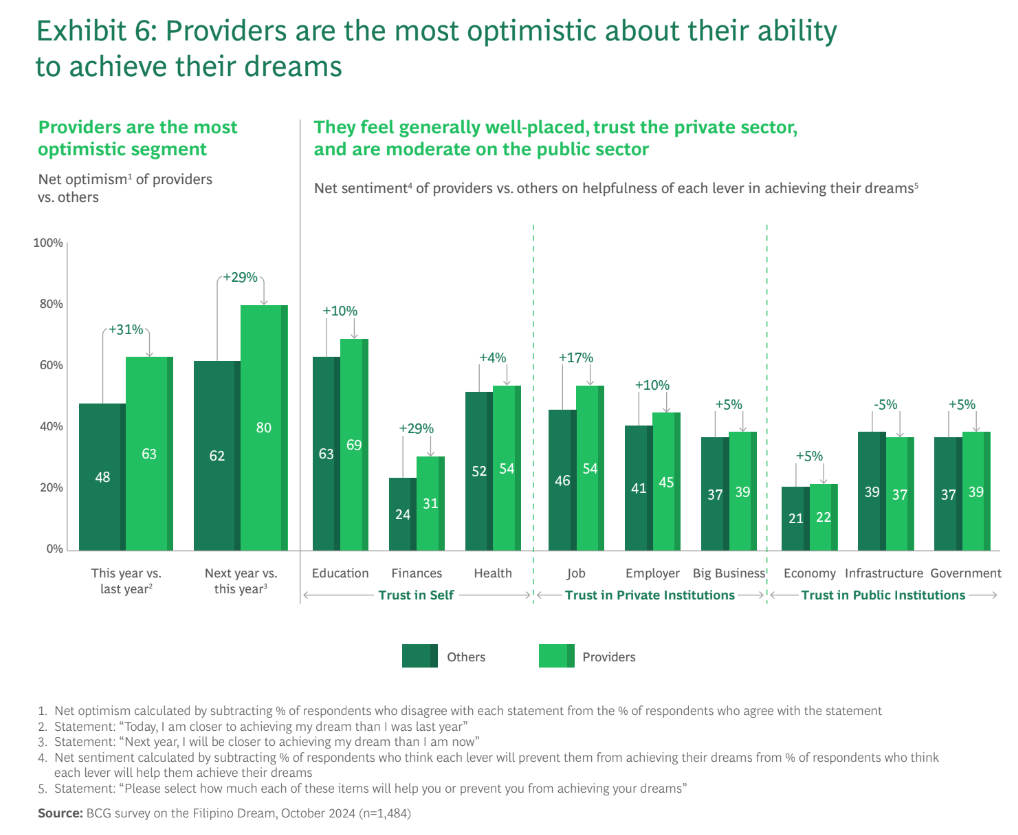

Providers are the largest segment, comprising 35 percent of the population. These are primarily working-class, millennial women who make purchasing decisions through the lens of family benefit, often sacrificing personal desires for collective well-being.

The Trailblazers, who make up 27 percent of the population, are the Gen Z students and young professionals who prioritize independence and lifestyle upgrades. Their willingness to trade stability for opportunity makes them early adopters and trendsetters, albeit having limited purchasing power.

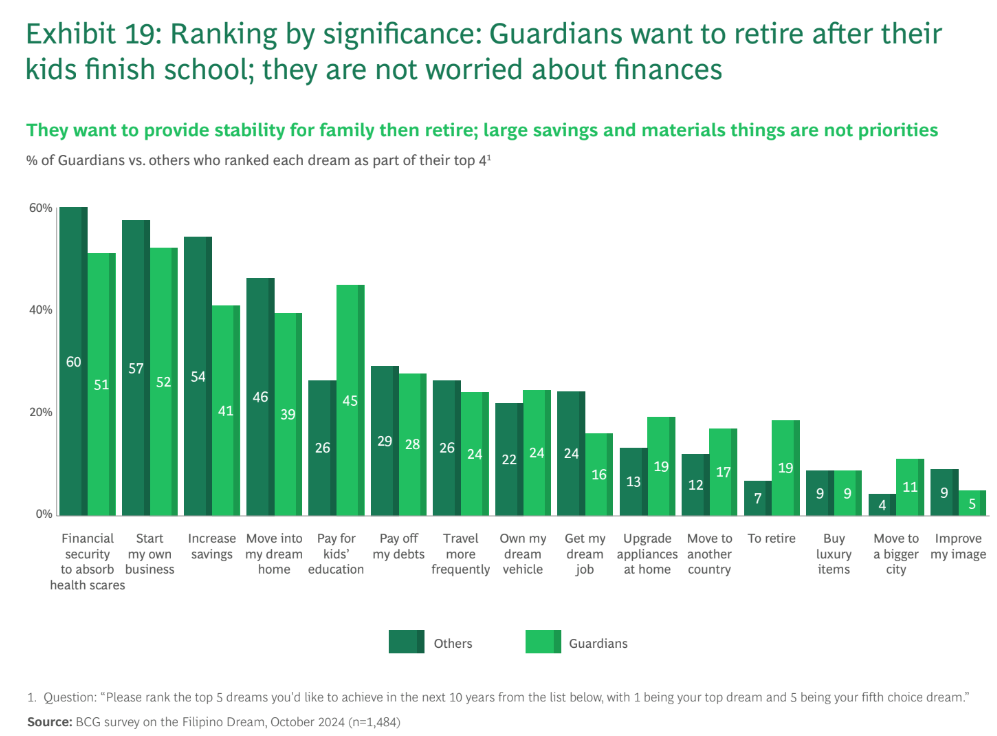

The Guardians (26 percent), in contrast, are predominantly older and rural-based, and are focused on achieving stability that will allow them to retire comfortably after meeting family obligations. This segment tends to be more conservative in spending, prioritizing long-term security over immediate gratification.

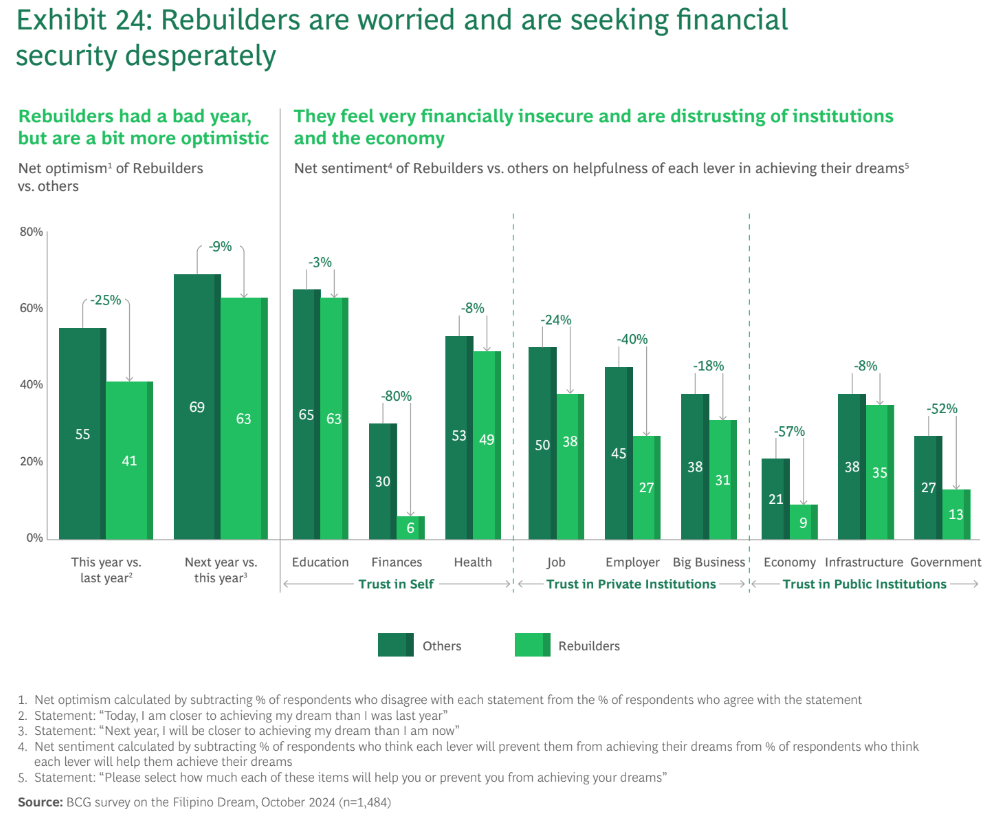

Finally, there are the Rebuilders (12 percent)—millennial freelancers and self-employed individuals working to recover from pandemic-related setbacks. Their focus on financial recovery while maintaining lifestyle preferences creates unique consumption patterns and opportunities for businesses.

As these findings come at a crucial time, when the Philippines continues to navigate postpandemic economic recovery and rising inflation concerns, the BCG report highlights how understanding the Filipino dream and these consumer segments can help large corporations. While two consumers might pursue the same product—say, a savings account—their reasons might differ dramatically. A Provider might view it as a family emergency fund, while a Trailblazer might see it as a stepping stone to independence.

New strategies

In crafting their 2025 strategies, businesses can therefore expect success from:

- Developing segment-specific value propositions that acknowledge different motivations and needs;

- Building trust through products and services that deliver on segment-specific promises;

- Creating flexible offerings that can serve both personal and entrepreneurial needs;

- Maintaining focus on financial security and health-related products across segments; and

- Recognizing that while segments have distinct characteristics, they share common dreams of security and progress.

“At the end of the day, if we can create value for consumers by helping them provide for their families, gain personal independence, retire comfortably or bounce back financially, we will have earned the right to capture some of that value for our shareholders,” the report reads.