Loan growth eased to 16-mo low in Oct

Bank lending slowed to a 16-month low in October, as the widening graft scandal that has implicated high-ranking government officials continued to erode business and consumer confidence, threatening to dampen the central bank’s efforts to spur growth.

Latest data from the Bangko Sentral ng Pilipinas (BSP) showed outstanding loans from big lenders, excluding their short-term placements with the central bank, climbed by 10.3 percent from a year earlier in October to P13.79 trillion.

This marked the slowest pace of credit growth since June 2024, when loans expanded by 10.1 percent.

The deceleration comes as the BSP presses ahead with a rate-cutting campaign aimed at supporting an economy weighed down by the corruption probe and by external pressures, including global trade uncertainties.

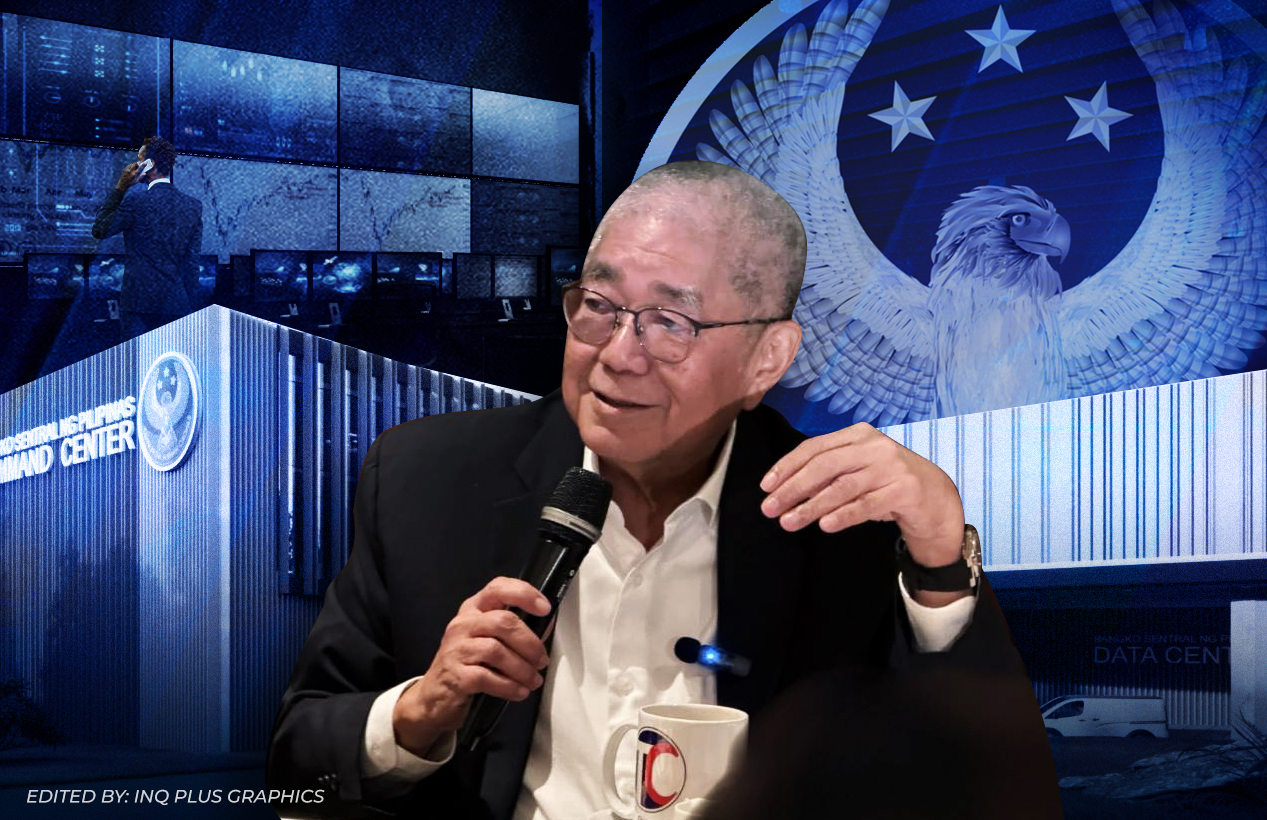

Since August last year, the central bank has reduced its benchmark rate—which guides banks’ lending costs—by 1.75 percentage points, to 4.75 percent. Governor Eli Remolona Jr. has signaled more easing may be in store.

But analysts said the central bank’s easing moves have been slow to filter through the financial system. Average lending rates at big banks stood at 7.817 percent in September, only about 3 percent lower than at the end of last year, BSP figures show.

Experts said the stickiness of borrowing costs, combined with weakening sentiment, risks blunting the effect of the central bank’s progrowth efforts.

“Consumer borrowing is cooling as families become more cautious amid inflation pressures and disaster-related income losses, while businesses are delaying expansion because of uncertainty linked to governance issues, stalled public projects and softer demand,” said John Paolo Rivera, a senior research fellow at the state-run Philippine Institute for Development Studies.

“Monetary easing works best when firms are confident enough to borrow and invest,” Rivera added.

The BSP said loans to businesses grew by 9.1 percent in October to P11.6 trillion, no faster than the preceding month.

Bank lending to manufacturing companies contracted by 8.4 percent at a time when the “ber” months are keeping factories busy to meet the holiday demand. By contrast, credit to the real estate sector grew 9.9 percent, while loans to retailers climbed 11.7 percent, both accelerating from September.

Outstanding consumer loans, meanwhile, climbed by 23.1 percent to P1.85 trillion, the slowest growth in two years or since October 2023’s 22.8-percent expansion.

Credit card receivables posted a slightly slower increase of 29.2 percent, while motor vehicle loans growth eased to 17.6 percent. Salary-based general-purpose consumption loans also expanded at a softer pace of 5.8 percent.

“To make the rate cuts effective, the BSP must pair them with clear communication and trust-building measures, while businesses should focus on resilience and efficiency,” Jonathan Ravelas, senior adviser at Reyes Tacandong & Co., said.