Lower May inflation pushes down T-bill rates

Yields on short-dated local debts of the government eased during Monday’s sale of Treasury bills, as the release of cooler inflation data stoked expectations of an interest rate cut this month.

This, in turn, allowed the Bureau of the Treasury (BTr) to upsize its offering.

Auction results showed the BTr raised P28.6 billion via T-bills, higher than the P25 billion that it initially planned to borrow.

Total demand for the debt securities reached P98.3 billion, 3.9 times bigger than the original size of the issuance.

Michael Ricafort, chief economist at Rizal Commercial Banking Corp., said the milder inflation in May increased the odds of another rate cut at the June 19 policy meeting of the Bangko Sentral ng Pilipinas.

State statisticians reported last week that the consumer price index (CPI), which measures the average change in prices that consumers pay for a basket of essential goods and services, rose 1.3 percent year-on-year last month, slightly below the annual increase of 1.4 percent in April.

“So, some investors locked in relatively higher T-bill yields before the BSP and T-bill yields go down further,” he added.

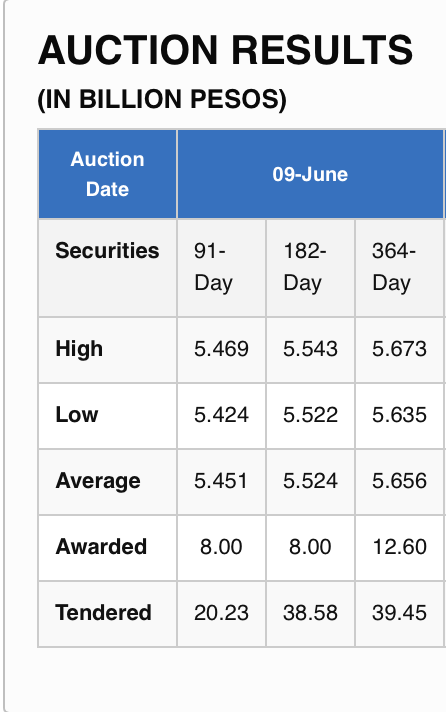

Dissecting the BTr’s report, the 91-day debt paper fetched an average rate of 5.451 percent, lower than the 5.452 percent seen in the previous auction.

The average rate for the 182-day T-bill fell to 5.524 percent from 5.565 percent previously.

Lastly, local creditors sought an average yield of 5.656 percent for the one-year tenor, cheaper than last week’s 5.680 percent.

A welcome approach in Congress