Mall vacancy rate to shrink back to prepandemic level in 2026

Vacancy across retail spaces in Metro Manila is seen to decline back to prepandemic levels by next year, especially with foreign brands accelerating their expansion in the Philippines.

Real estate broker Colliers Philippines found that vacancy among retail spaces in the capital region had reached 11.4 percent as of end-September. This is already near the 9.3-percent vacancy recorded in the third quarter of 2019.

By the fourth quarter of next year, Colliers is anticipating this level to further shrink to 9.5 percent and 8.2 percent by 2027.

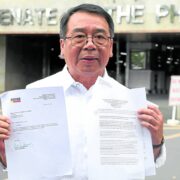

Colliers research director Joey Bondoc attributed this improvement to the entry of foreign retail brands that typically occupy up to three floors of shopping mall space.

“Foreign brands have been coming to the Philippines. Some of them already left [previously], but they’re now returning, so it’s a huge comeback for them,” Bondoc said during a press briefing last week.

A prominent returning entrant is grocery chain Makro, which first debuted in the Philippines in 1996 before officially exiting in 2009.

Ayala Corp. subsidiary ACX Holdings Corp. recently signed a partnership deal with Thai firm Makro ROH Co. Ltd. to launch a new entity, M&Co Corp., which will operate Makro stores in the Philippines. The first branch is set to open within the Ayala Cloverleaf Estate in Quezon City.

Apart from this, many foreign brands have also been steadily widening their footprint across the country and establishing flagship stores in major cities.

For example, Japanese brand Muji, which opened its first Philippine store in 2010, now has 11 branches. It opened its first flagship store in Glorietta 3, taking up 2,600 square meters of retail space with its own bakery, coffee shop, as well as alteration and embroidery services.

Other similar brands expanding are Anko, Ikea and Nitori.

The food and beverage and fast fashion industries are also among the biggest occupiers. According to Colliers, the former took up 43 percent of upcoming retailers in the third quarter, while the latter accounted for 34 percent.

In choosing to expand in the Philippines, these stores are attracted by the aggressive refurbishment of major developers and their focus on “experiential retail,” Bondoc pointed out.

“These concepts occupy humongous retail space and entice customers to stay longer and spend more,” he said.