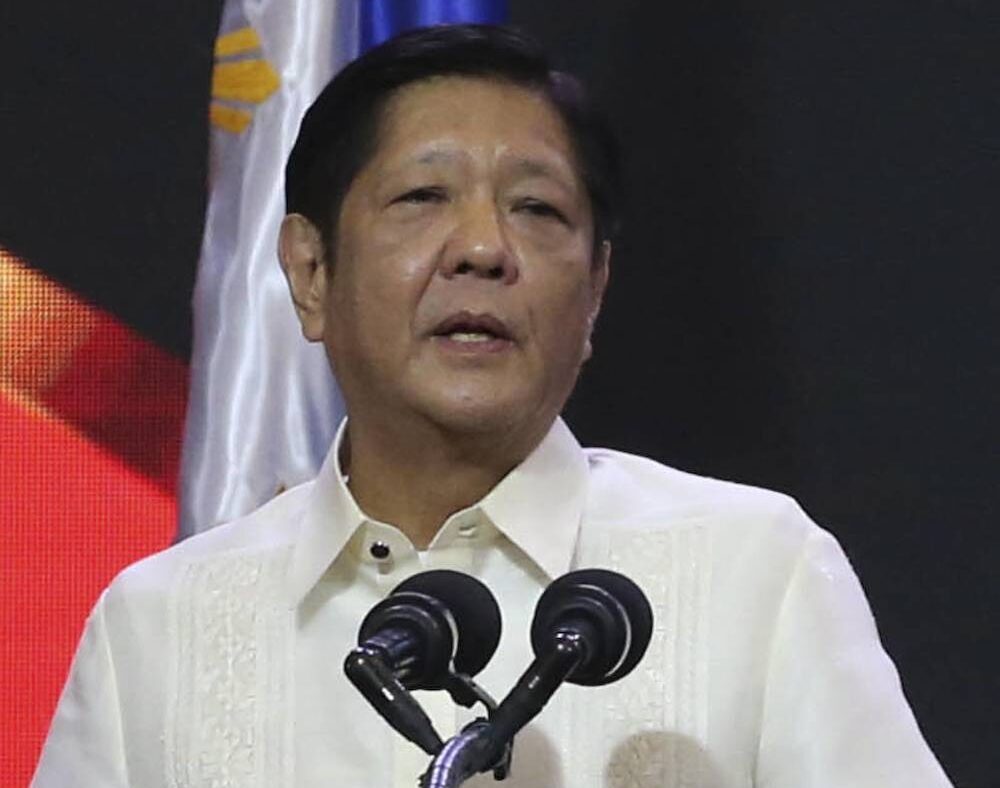

Marcos gov’t to revisit ’25 growth targets amid ‘uncertainties’

Economic officials of the Marcos administration will revisit their macroeconomic targets amid “uncertainties” that are threatening the entire global economy, the government’s top socioeconomic planner said.

Speaking to reporters, Secretary Arsenio Balisacan of the National Economic and Development Authority (Neda) said the key data releases in the second quarter would be a major consideration for economic managers in deciding whether to adjust their targets or keep them.

“We’ll see. There are many things happening. Especially with all this uncertainty in the global economy. We need to revisit [our targets],” Balisacan said.

“We don’t have any data right now except for inflation and employment. But we need economic performance information. It’s too early to change [the targets] at this point,” he added.

Gross domestic product (GDP), the sum of all products and services created within an economy, expanded at an average rate of 5.6 percent for the entire 2024, a year marked by strong typhoons and massive flooding.

While that pace of expansion was a little faster than the 5.5-percent growth in 2023, the latest reading fell short of the revised 6 to 6.5 percent goal of the Marcos administration, marking the second year of below-target GDP growth.

Shallow easing

For this year until the end of President Marcos’ term in 2028, the government is targeting to make the economy grow between 6 percent and 8 percent.

But some analysts believe a shallow easing cycle could hold back the economy from posting a stronger growth.

At its first policy meeting for this year, the BSP decided to keep the benchmark rate that banks typically use as a guide when pricing loans to 5.75 percent, citing the need to defend the economy and the inflation outlook against “unusual” uncertainties coming from a slew of tariff actions in the United States.

The good news is a benign inflation that eased more than expected in February could provide the central bank more room to further cut borrowing costs.

Moving forward, Balisacan explained that the government must be both “flexible” and “watchful” to counter the external headwinds.