MM office rentals seen steady until year-end

Rental rates in Metro Manila’s office space market are expected to remain steady during the second half of this year, averaging by a little over P1,000 per square meters (sqm) per month as vacancy rates remain elevated despite improving occupancy levels.

Data released by global real estate services firm Santos Knight Frank on Tuesday showed that the average monthly rental rates in the urban metropolis during the first half of the year was at P1,022 per sqm.

This is lower than the monthly rate of P1,035 per sqm the company reported during the first quarter this year and the rate of P1,048 per sqm it recorded for the whole of 2023.

“I would expect it to be pretty similar to what it is now. It may fluctuate five pesos or so one way or the other,” Santos Knight Frank’s senior director Morgan McGilvray told reporters during a press conference at the Makati Shangri-La Hotel.

Based on their annualized data, rental rates have been falling for two straight years since 2022.

It averaged at P1,121 per sqm in 2021, P1,077 per sqm in 2022, and P1,048 per sqm in 2023.

From January to June, rental rates were the highest in Makati at P1,256 per sqm per month.

This was followed by Taguig with P1,250 per sqm per month, the Bay area with P972 per sqm per month, Quezon City with P823 sqm per month, Ortigas with P820 per sqm per month, and Alabang with P788 per sqm month.

Vacancy rates

Asked when vacancy rates would likely go back to the single digit levels like it was before the pandemic, McGilvray said that it could take several years before the office market could recover.

“I guess it would take five years more or less. I don’t think that’s terribly optimistic,” he said when asked about the matter during the same event,

Still, he expressed optimism that the industry would eventually reach it given the sector’s performance in the last few years.

During the first six months of the year, vacancy rates in Metro Manila’s office market was seen at 18.9 percent.

This is an improvement from the 20.9 percent vacancy rate during the first quarter and the 21 percent during the whole of 2023.

Annualized data from Santos Knight Frank puts it at 20.3 percent in 2022, 20.2 percent in 2021, 10.5 percent in 2020 and 4.4 percent in 2019.

POGO shutdown impact

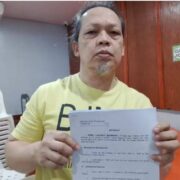

“I think it’s too early to make any kind of statement. We need to wait and see how this will be implemented,” Santos Knight Frank chairman and chief executive officer Rick Santos said when asked what impact the government’s recently announced plan to ban Philippine Offshore Gaming Operators (POGOs) will have on the sector.

Despite this uncertainty, Santos said that major property developers in the country have already taken de-risking measures in their portfolios a few years back that will cushion any impact.