National ID gives more Filipinos ‘face value’

There was a joke in newsrooms during martial law about how a favored few got bank loans simply through “face value.” It was a reference to the notorious “behest loans” granted to individuals or corporations favored by powerful government officials.

But with the rollout of the new Philippine Identification System (PhilSys), it seems that millions—not just a favored few—of Filipinos will now be able to enjoy the privilege of availing of financial services simply by face value.

This was a message delivered during the recent 3rd Philippine Identity Summit convened by the Philippine Statistics Authority (PSA).

Government officials and representatives of the private sector and the academe agree that PhilSys will be transformative and will speed up the achievement of the goal of inclusion and ensure that no Filipino will be left behind as the country moves towards a digital future.

Secretary Ivan Uy of the Department of Information and Communications Technology (DICT) says the issuance of the national ID “is not just a technical achievement but a step toward inclusion, empowerment and national development.”

It will ensure the seamless delivery of services and promote government transparency and accountability.

Uy says PhilSys ensures that every Filipino is recognized and has access to public services. Even the marginalized, he adds, will now have access to services they deserve.

DICT Undersecretary David Almirol says the national ID makes verification of a person’s identity so much faster and more accurate, reducing, if not completely eliminating, the possibility of fraud.

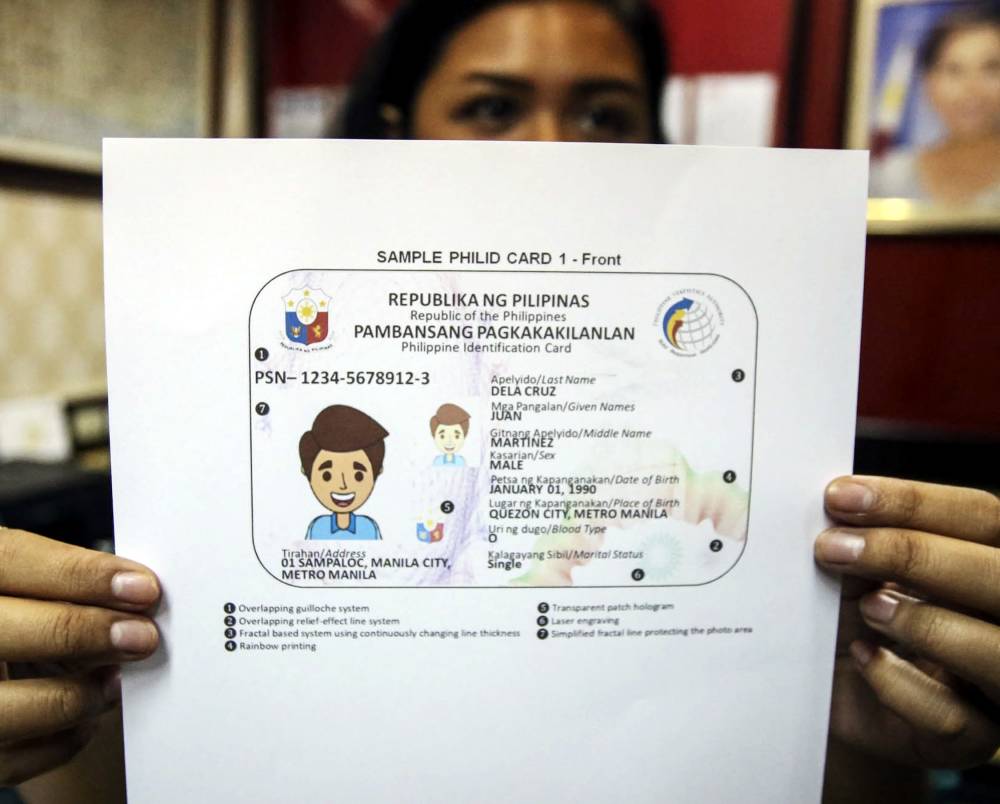

Scanning the ID’s QR code will reveal the details that will verify and validate the cardholder’s identity as details about a person, including biometrics information, are embedded in the new government-issued identification card.

But even without the physical card, by simply providing his/her basic identity information, such as full name, date of birth, etc. and his/her “face value” through a photograph, accurate identity verification can still be done.

PhilSys’ eVerify program’s database will allow the quick validation of a person’s identity. Almirol adds that eVerify is also adapted to situations where connectivity is a problem. “Just show yourself. The system can be accessed for verification even if connectivity is an issue,” he says.

Superior verification

Some ID card holders have complained, however, that the proof of identification is not accepted by some banks and retail establishments when they use credit cards because of its lack of signature.

For the Asia United Bank (AUB), among the first financial institutions to fully embrace PhilSys, this has never been a problem.

Laidy Claire dela Rosa, the bank’s chief compliance officer who participated in one of the summit’s panel discussions, says, “The lack of a signature is not that relevant for a digital foundational ID.” She adds, “The objective is to identify the person and the verification [using the national ID] is quite superior because it requires a ‘liveness’ test—biometrics verification, instead of a signature.”

Dela Rosa points out that the national ID is meant to identify a person, eliminating identity theft and discouraging scammers, fraudsters and money launderers. “The purpose of a signature is to provide proof that the client is authorizing or confirming [the transaction/s], but there are other more secure ways to confirm transaction/s such as OTP (one-time password), password, security token and e-verification (liveness test).”

“The records of the clients as well as their specimen signatures and identity verification made through eVerify are stored in our client database … that [includes] records of the trail of how a client was verified and proof that the client signed in front of the banker through an iPad. The bank will still have the verified signature specimen stored in our database, readily available for future reference,” she explains.

She says some transactions may still require signatures.

The AUB compliance officer says, from their experience, the identity proof fraudsters often use is the TIN (tax information number card), as it is easy to fabricate and the picture used for it does not have to be taken in front of a government person.

Although the Unified Multi purpose ID card is not as easy to forge with its physical security and the accompanying picture taken in the office of the issuing agency, dela Rosa says “Recto craftsmen” (people along CM Recto Avenue in Manila who can forge any document, from diplomas to government IDs) are still able to make passable copies of the card.

With the national ID, however, since the photograph is key to verifying a person’s identity, Recto craftsmen may have to look for other sources of income, she says.

She expects that majority of their clients’ transactions will be confirmed in the future through the national ID’s eVerify program, as “live biometrics is almost impossible to be stolen or replicated”.

During the summit, the Philippine Digital Transformation Lab, jointly undertaken by PSA, the University of the Philippines and the Modular Open Source Identify Platform, was launched. It will be based at UP Diliman, Quezon City.

Some 85 million national IDs have so far been distributed and a growing number of government agencies and private entities are accessing eVerify. Uy’s message to Filipinos with national IDs: “Don’t fall in line; go online.”