New Zeland central bank cuts rates by 50 bps to help revive frail economy

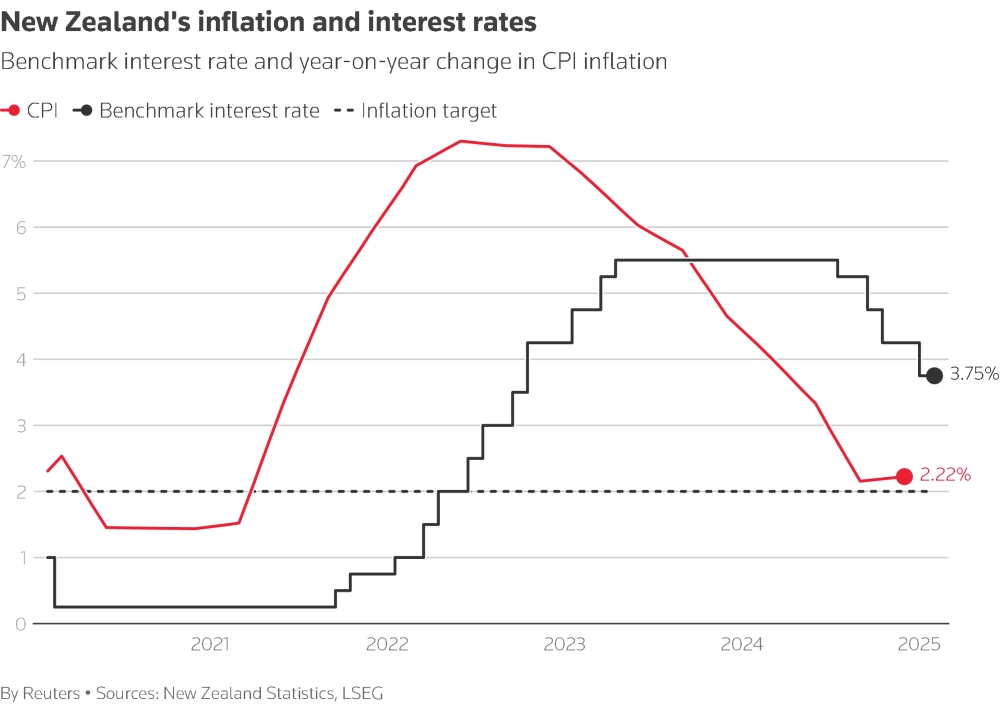

WELLINGTON — New Zealand’s central bank cut its benchmark rate by 50 basis points to 3.75 percent on Wednesday and flagged further reductions in borrowing costs amid moderating inflation as policymakers sought to revive a struggling economy.

The Reserve Bank of New Zealand Governor Adrian Orr said the board is forecasting a lower terminal rate than in its November projections, and expects two more 25-basis point rate cuts in April and May subject to economic conditions evolving as expected.

The rate track pushed it broadly in line with market pricing and reinforced the RBNZ’s dovish stance in contrast with a more cautious approach in Australia and the US, denting the New Zealand dollar and sparking a rally in 90-day bank bill futures.

“If economic conditions continue to evolve as projected, the Committee has scope to lower the OCR further through 2025,” the RBNZ said in its accompanying policy statement after the cut met market expectations in a Reuters poll.

Orr, speaking at a press conference, said: “We are looking at lowering the official cash rate a little bit quicker than what we projected back in November…We have our projection of the OCR being around 3 percent by year end.”

Tamed inflation

The RBNZ’s new projection has rates at 3.45 percent by June, and at 3.1 percent in the fourth-quarter, down from the November estimate of 3.2 percent, helped by inflation moving to the middle of the bank’s one percent to 3 percent target.

The central bank has now cut rates by 175 basis points since August in a much needed boost for an economy emerging from a deep recession.

“The main message from today’s Monetary Policy Statement is the lowering (again) of the Official Cash Rate track. The RBNZ are signaling more cuts, sooner,” said Kiwibank chief economist Jarrod Kerr.

The RBNZ said it is well placed to respond to future inflationary shocks but added that global uncertainty, particularly led by US President Donald Trump’s tariff policies, pose risks to the economy.

“The RBNZ’s aggressive 50-basis point cut to 3.75 percent shows its determination to revive the economy, despite inflation risks and global uncertainties like Donald Trump’s re-election as US President,” said Junvum Kim, senior sales trader at Saxo Asia Pacific.

Several of the large banks in New Zealand including Westpac, ASB Bank, Kiwibank and Bank of New Zealand cut mortgage rates following the cash rate announcement.

Bill futures rallied as markets priced in a 93 percent chance of an easing in April and have rates near 3 percent by year-end, which is seen as the bottom of the cycle.

The kiwi dollar slipped 0.3 percent to $0.5683 but rebounded to last fetch $0.5707.

Global tariffs

A global front-runner in withdrawing pandemic-era stimulus, the RBNZ lifted rates 525 basis points since October 2021 to curb inflation in the most aggressive tightening since the official cash rate was introduced in 1999.

The punishing borrowing costs, however, took a heavy toll on demand and tipped the economy into recession in the third quarter of last year – the worst downturn outside of the pandemic since 1991.

The weakened state of the economy has added urgency to policymakers’ efforts to stimulate demand. The government has already abandoned hopes for a return to budget surpluses, seeing deficits for the next five years.

New Zealand’s annual inflation has come off in recent months and is currently at 2.2 percent, but the central bank said a volatile period ahead will probably see it increase to 2.7 percent in the third quarter before moderating again.

“Lower interest rates will encourage spending, although elevated global economic uncertainty is expected to weigh on business investment decisions,” the RBNZ said.

Reuters, the news and media division of Thomson Reuters, is the world’s largest multimedia news provider, reaching billions of people worldwide every day. Reuters provides business, financial, national and international news to professionals via desktop terminals, the world's media organizations, industry events and directly to consumers.