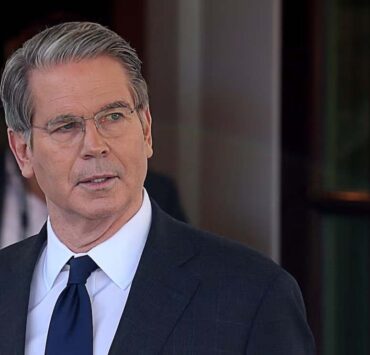

No risk of Beijing weaponizing treasuries, says Bessent

U.S. Treasury Secretary Scott Bessent in an interview with Yahoo Finance on Tuesday dismissed concerns over China weaponizing its Treasuries despite bond market volatility and added there was no risk of China potentially using its robust Treasury pile to inflict economic pain on the United States.

“If Treasuries hit a certain level or if the Federal Reserve believed that a foreign — I won’t call them an adversary — but a foreign rival were weaponizing the US government bond market or attempting to destabilize it for political gain, I am sure that we would do something in conjunction with each other, but we just haven’t seen that,” Bessent said. “We have a big tool kit.”

Second-biggest lender

China is the second-biggest foreign holder of US government debt after Japan, holding almost $761 billion of bonds in January.

“If they (China) sell Treasuries, then they would have to buy RMBs, and it would strengthen their currency. And they’ve been doing just the opposite,” Bessent said.

He added that it is not in China’s best economic interests to sell.

US President Donald Trump has slapped tariffs of 145 percent on Chinese goods this year as part of broader reciprocal duties on all US trading partners.

That prompted ridicule and criticism from Beijing, which retaliated by jacking up levies on US goods to 125 percent.

Reuters, the news and media division of Thomson Reuters, is the world’s largest multimedia news provider, reaching billions of people worldwide every day. Reuters provides business, financial, national and international news to professionals via desktop terminals, the world's media organizations, industry events and directly to consumers.