Not just BPOs, Pogos: Gov’t drives office demand

Government agencies are emerging as among the key drivers of demand in the office sector as more seek to migrate from decades-old buildings to modern facilities, according to Leechiu Property Consultants.

In its latest property market report, Leechiu Property said government office leasing demand in the first half of the year had shot up by more than 700 percent to 113,000 square meters (sq m) from just 14,000 sq m in the same period last year.

Mikko Barranda, commercial leasing director at the real estate brokerage firm, told reporters on Thursday that they had seen a lot of government offices take space in the past six months.

These were “very large agencies that have either moved or relocated and upgraded into new buildings,” Barranda said during a press briefing.

“Normally, we wouldn’t put the government [sector] isolated as a demand driver, but the amount of space they’ve taken in the first six months is worthy to really show the impact of how they’ve grown,” he added.

He also clarified, however, that while there were potentially more government office leases in the pipeline, it was still too early to tell whether this would be the trend for the entire year, as these agencies need to conduct long public bidding processes before securing new facilities.

“It’s good, at least in the interim, that [government demand] is another layer helping the market in terms of leasing demand,” he added.

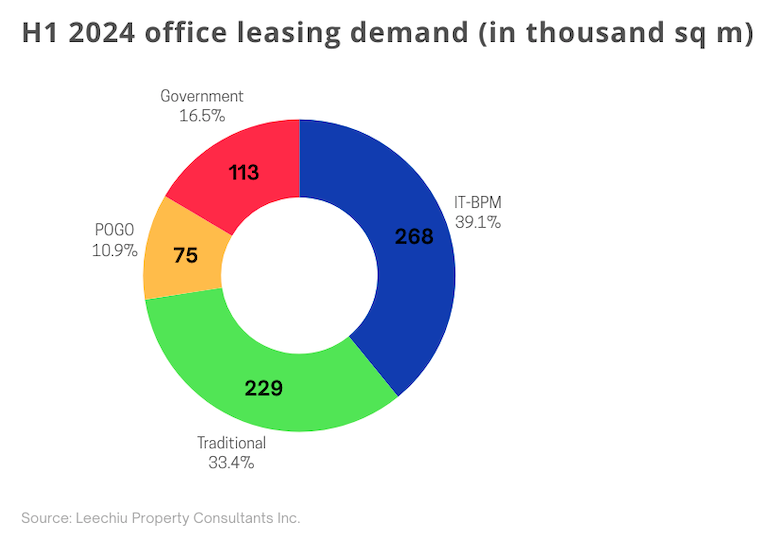

Total office space demand in the first six months of the year went up by 24 percent to 685,000 sq m. Of this, government offices accounted for 16.5 percent.

The information technology and business process management (IT-BPM) industry took up the biggest share of the pie at 268,000 sq m, representing 39.1 percent.

It was followed by traditional offices at 229,000 sq m, or 33.4 percent. Philippine offshore gaming operators accounted for 75,000 sq m, or 10.9 percent.

Leechiu Property explained that companies relocating and expanding their offices had driven leasing demand in the first half.

“Most occupiers have leased in buildings that are five years old or newer,” the company said in its report.

By the end of the year, Barranda said a total of 786,000 sq m would be added to the current office supply, which meant that demand still needed to catch up.

“If we’re able to continue demand at the same trajectory and absorb supply that’s on our way, the supply pipeline would drop by as much as half,” he said. —With a report from Erica Ann C. Villasorda