PH banks on rate cuts to spur 2025 growth

Miriam Sanchez, a 55-year-old housewife in Cavite, has a big wish this year: more affordable consumer prices.

“We’ve been tightening our belt since last year,” she says in Filipino. “I hope we can have a break from high prices in 2025.”

Sanchez is not the only one who has this wish. In its latest nationwide survey released in January, pollster Pulse Asia had reported that 72 percent of Filipinos still considered inflation as an urgent national concern.

And there are enough reasons for people to be worried about high prices. Recall that inflation hovered above the 2 to 4 percent target range of the Bangko Sentral ng Pilipinas (BSP) for most of 2023, prompting the central bank to deliver interest rate hikes that tempered consumption and weighed on economic growth at the time.

But now that inflation has been tamed and is expected to remain target-consistent, the BSP has started unwinding its previous tightening actions by cutting borrowing costs, a move that is expected to boost consumer spending and investments this year.

This, in turn, might help the Marcos administration hit its economic growth target for this year, but not without powering through headwinds.

Hitting the target

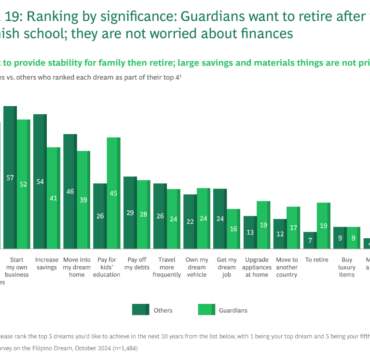

Based on projections compiled by the Inquirer from 11 institutions, gross domestic product (GDP) might grow by 6.1 percent in 2025. If this prediction comes to pass, economic expansion this year will settle within the 6 to 8 percent target of the government for this year until the end of President Marcos’ six-year term in 2028.

At a recent webinar, analysts at BMI Research, a unit of the Fitch Group, says that the ongoing easing cycle of the central is expected to give the economy a much-needed shot in the arm.

“The main driver is monetary policy loosening,” BMI, which pencils in a 6.3 percent growth this year, says.

“So about 150 basis points (bps) of cuts by the end of 2025 should help boost the Philippine economy going forward,” it adds.

As it is, the BSP has so far delivered three quarter-point rate cuts to the benchmark rate that banks typically use as a guide when pricing loans, with the first reduction announced in August last year. Such a move is meant to spur bank lending in an economy that gets around 70 percent of its fuel from consumption.

And additional easing moves are on the table this year after BSP Governor Eli Remolona Jr. had hinted at another rate reduction once the Monetary Board convenes again in February, the first rate-setting meeting of the policymaking body for 2025.

It’s all thanks to a benign inflation that still sits comfortably within the 2 to 4 percent target band of the BSP despite the onslaught of powerful storms late last year. In a commentary, analysts at Bank of America says price growth in the Philippines will likely stay within the government’s target this year.

“Another factor which helped consumption improve was the inflation conditions turning more benign–particularly for food and energy. This in turn provided more flexibility for discretionary spending,” BofA says. The bank, however, projects a GDP growth of 5.9 percent this year, lower than the official target.

Limited support

But while the ongoing easing cycle is seen as a major growth booster this year, the possibility of fewer interest rate cuts might limit the ability of monetary policy to push up economic growth.

This, after the second election victory of US president-elect Donald Trump had stoked expectations of slower rate reductions of the US Federal Reserve as he threatens to stoke a global trade war with inflationary tariffs.

At home, many observers believe that the BSP might have to match the shallow easing of the Fed to avoid pressuring the peso.

“With the Fed cutting cycle itself appearing curtailed and small, the BSP, despite having high real rates, can only reduce policy rates slowly and by a much smaller magnitude,” BofA says.

Jun Neri, lead economist at Bank of the Philippine Islands, shares the same view.

“With the outlook for inflation remaining favorable, the BSP has room to cut interest rates further this year. However, global uncertainties may limit the extent of monetary easing,” Neri says in a commentary.

“Rate cuts in the first half of the year appear feasible, but the latter half may bring challenges as the Federal Reserve could shift its policy stance in response to President Trump’s policies,” he adds.

But beyond monetary policy, Neri says the upcoming elections in May is another source of support for the economy.

“Election spending is another tailwind that could provide a boost to the economy. Historically, GDP growth is faster in election years, driven by heightened economic activity fueled by election-related spending in various regions,” Neri, who projects a growth of 6.3 percent in 2025, says.