PH banks’ profits may feel strain from lower rates–Fitch

Lower interest rates in the Asia-Pacific (Apac) region amid the ongoing easing cycle of central banks would have the most impact on the profitability of lenders in the Philippines and China, especially if banks in these countries won’t take remedial action to boost earnings, according to Fitch Ratings.

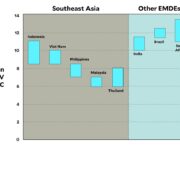

In a commentary, Fitch said net interest margins, a key driver of banks’ earnings and profitability strength, would likely shrink by 20 to 40 basis points (bps) in the Philippines in the next two years as the Bangko Sentral ng Pilipinas (BSP) proceeds with its rate-cutting cycle to boost the economy.

The debt watcher had the same projection for lenders in China—where rate cuts are part of a massive stimulus package to revive the Chinese economy—as well as in Hong Kong, Singapore and India.

But Fitch said most banks in these economies have “headroom” to absorb the impact of lower rates “due to margin expansion in recent years.”

For one, Philippine banks have increased their exposure in higher-yielding—but riskier—consumer credit. Meanwhile, the lower reserve requirement ratio should give local lenders more available cash to lend.

”Margin pressure partially offset by a shift towards higher-yielding retail loans, recovering corporate loan demand and lower funding costs due to reduced reserve requirements by the regulator,” Fitch said of the Philippine banking sector.

Twice reduced

So far this year, the BSP trimmed the key lending rate twice by a total of 50 bps to 6 percent. The first cut amounting to a quarter percentage point happened in August, with Governor Eli Remolona Jr. aiming for a “calibrated” easing cycle.

But Remolona also floated the possibility of a pause this month, citing persistent price pressures. Nevertheless, the BSP chief said an economy that posted a weaker-than-expected growth in the third quarter might prompt the central bank to cut rates again in December to perk up demand.

As the easing era goes on, Remolona also said it is possible to eliminate the reserve requirements for banks within his term, a move that would create an easy liquidity condition for the economy.

Zooming out, Fitch said it expects the regional easing cycle to be “gradual,” allowing most banks to still benefit from some of the margin expansion in the steep tightening cycle in 2022 and 2023.

“We forecast moderate policy rate cuts across most Apac markets, although we expect average short-term rates to fall by about 100-200 bp between 2023 and 2026 in the Philippines, New Zealand and Indonesia, while in Japan we expect tightening,” the credit rater said.