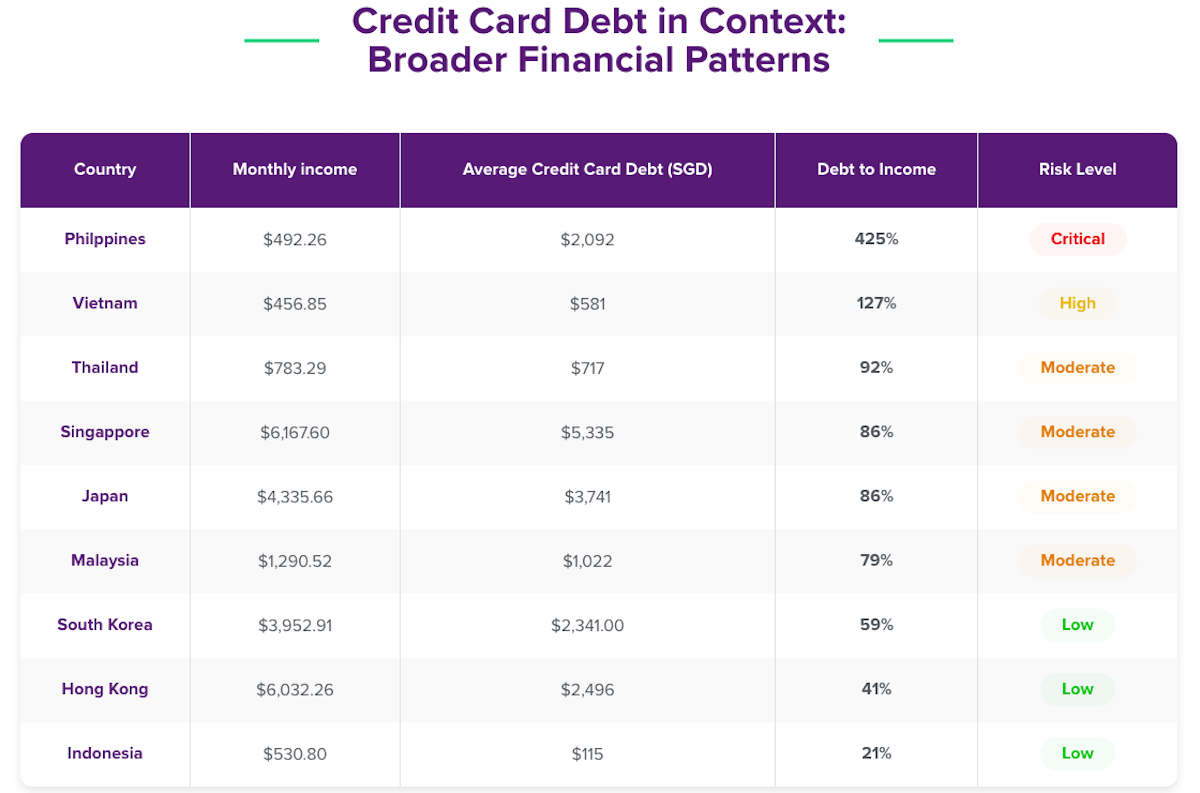

PH credit card debt reaches ‘critical risk’ levels

Credit card debt in the Philippines is at a “critical” risk level as the typical borrower owes more than four times their monthly income, according to Singapore-based fintech firm Roshi Pte Ltd.

The company, which describes itself as a “loan marketplace,” came out with a report on credit card borrowing patterns across the region.

Findings show that Singaporeans had the highest monthly income in Southeast Asia at S$6,167.60, equivalent to about P273,000.

Roshi said this higher earning capacity partially explains Singapore’s high average credit card debt at S$5,335 (P236,000).

The company said the amount represents a manageable percentage of monthly income for many cardholders.

“Unlike regional neighbors, Singapore’s debt levels are supported by strong income capacity and advanced financial infrastructure, positioning cardholders to manage obligations effectively,” Roshi said.

Meanwhile, Roshi sees “another interesting pattern” in the Philippines, which shows that income doesn’t always correlate directly with credit card debt.

In the Philippines, the average credit card debt was pegged at S$2,092 or about P92,800 at current exchange rates. Roshi also pegged the average monthly income here at $492.26 or about P21,900.

Such an amount of credit card debt was recorded despite low overall household leverage in the Philippines—borrowings represent only 11.7 percent of gross domestic product.

This relation shows “a specific preference for card-based borrowing among those with access to formal financial services,” Roshi said.

The company added that the 425-percent debt-to-income ratio in the Philippines—the worst in the region—indicates a “severe financial stress.”

The ratio “far exceeds regional norms and suggests potential financial vulnerability among Filipino cardholders,” it added.

Elsewhere in the region, Indonesia showed the lowest ratio at just 21 percent, to which Roshi assigned the “low risk” label.

This was attributed to limited credit card penetration in a primarily cash-based economy.

Meanwhile, Vietnam was nearest to the Philippines’ situation with a 127-percent debt-to-income ratio — “high risk.”

“This reflects rapid financial modernization and increased credit adoption in this emerging economy,” Roshi said.