PH current account gap narrowed in Q3

The Philippines’ current account deficit narrowed in the third quarter as dollar outflows were tempered by a smaller trade deficit.

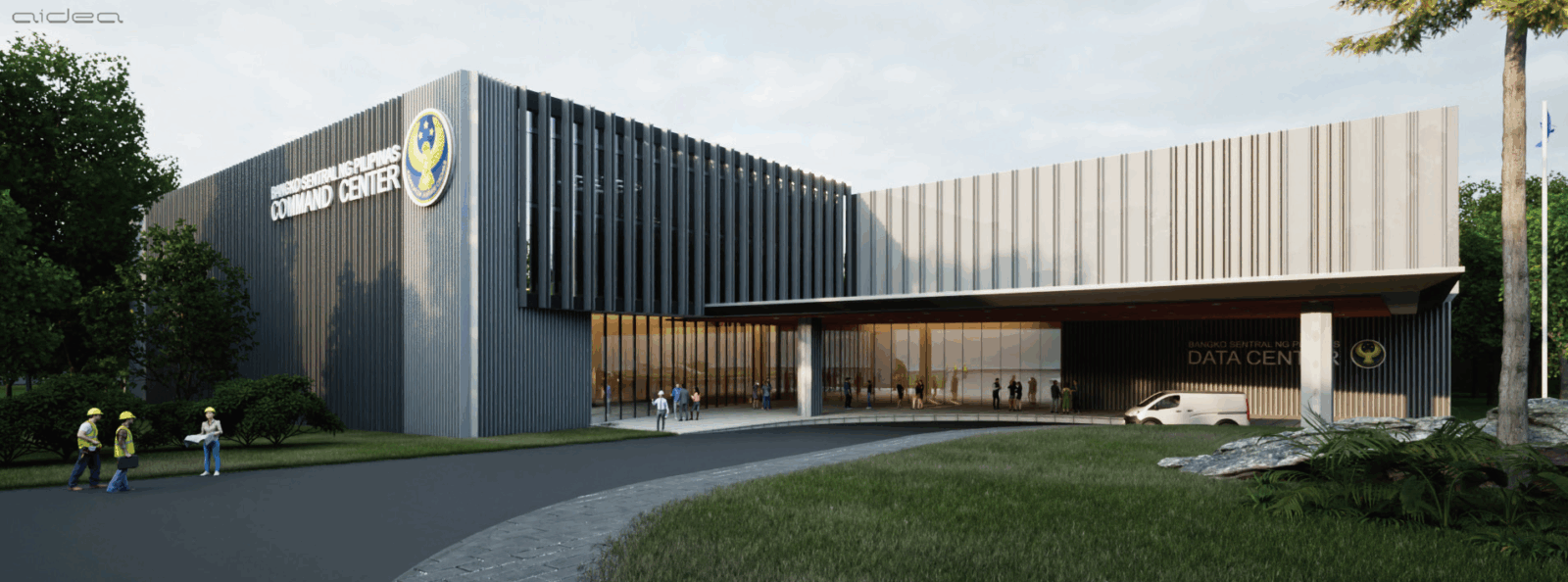

Latest data from the Bangko Sentral ng Pilipinas (BSP) showed the current account balance—the broadest measure of trade because it includes investments—swung to a deficit of $3.2 billion, equivalent to 2.8 percent of gross domestic product (GDP).

This marked a 39-percent improvement from the $5.3 billion current account gap recorded in the same period last year—back when the deficit accounted for 4.8 percent of GDP.

As it is, the current account deficit-to-GDP ratio in the first nine months reached $12.5 billion or 3.6 percent of GDP. That ratio, however, landed above the 3.3-percent projection of the central bank for the whole 2025.

“The current account posted a deficit … due largely to the trade in goods gap, as imports exceeded exports,” the BSP said.

“Imports were supported by demand for telecommunications equipment, electrical machinery and passenger vehicles. Exports remained resilient on strong global demand for manufactured goods, minerals and electronics,” it added.

The current account tracks dollar flows from trade in goods, as well as trade in services like business process outsourcing or BPOs. The gauge also covers Philippine investments abroad and remittances of Filipinos overseas.

Including the private sector in governance