PH more attractive in eyes of fintech players, says alliance

The Philippines has become more attractive as an investment hub for financial technology (fintech) players after the country finally exited the dirty money “grey list,” according to the Fintech Alliance PH.

Lito Villanueva, founding chair of the industry group, told the Inquirer that more investors would likely bet on local fintech players given the improving prospects of the country.

Paris-based watchdog Financial Action Task Force (FATF) decided to remove the Philippines in February from the grey list, which includes countries under increased monitoring as they address “strategic deficiencies in their regimes to counter money laundering, terrorist financing and proliferation financing.”

“With us being out of the grey list, we’re expecting more investors to come to the Philippines,” he said on the sidelines of Surfin AI Fintech Forum in Taguig last week.

Economic growth

Apart from this, Villanueva noted that the country’s economic standing is also boding well for the industry.

“We have a huge consumption-based economy,” he said.

The Fintech Alliance official added that Filipinos are usually technology-savvy, making the country a suitable environment for fintech startups.

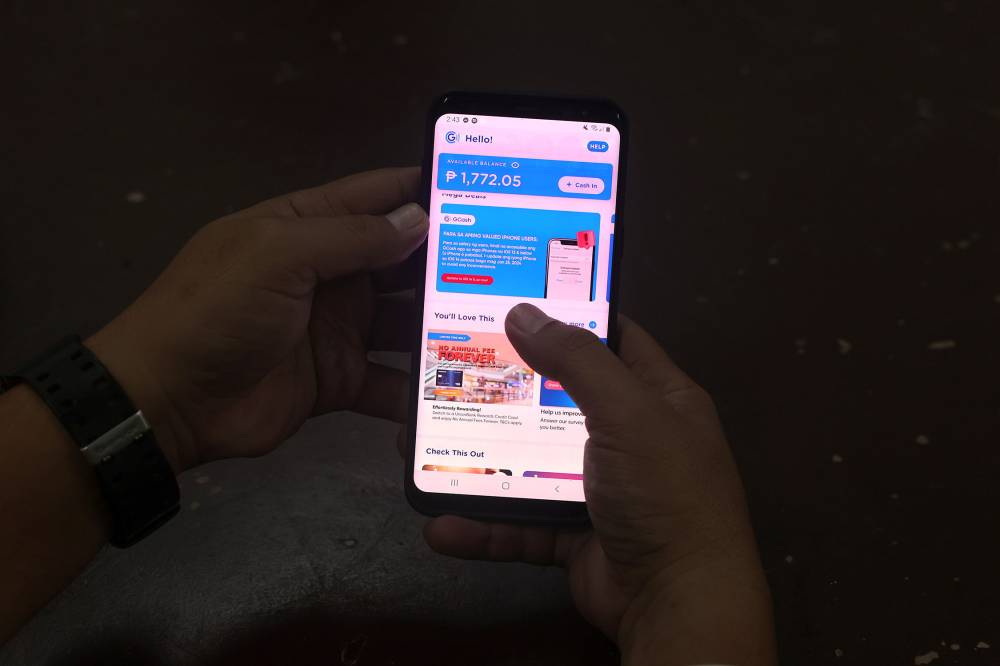

Villanueva said the Philippines having two unicorns, Ayala-led GCash and Pangilinan-led Maya, also indicates the growing interest in the local scene.

Fresh funding

Last year, GCash achieved a valuation of $5 billion after receiving capital infusion from Ayala Corp. and MUFG Bank Ltd. Maya became a unicorn with a $1.4-billion valuation in 2022.

Other players have been receiving fresh funding as well.

For example, International Finance Corp. (IFC), part of the World Bank Group, poured in $7 million last year in First Circle, which offers smart banking solutions to small and medium-sized enterprises.

In addition, IFC likewise invested $7 million in Salmon Group Ltd., which provides short-term loans to consumers underserved by traditional banks.

According to Fintech Alliance, the Philippines has 335 fintech companies, most of which are offering payment services.

“We’re still trying to promote all the other fields of financial inclusion or digital inclusion in our country,” he said, citing e-wallets and lending, among others.