PH net external liabilities rise to $69B

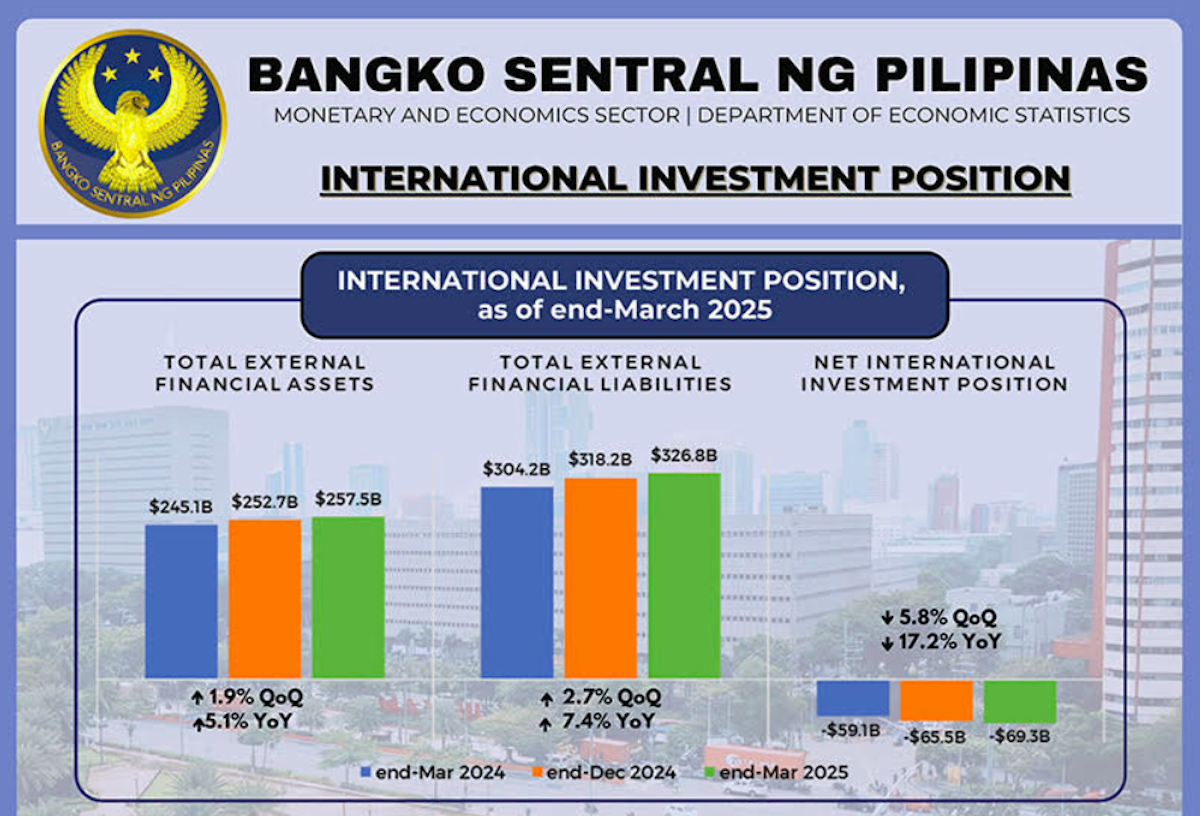

The Philippines’ international investment position (IIP) was pegged at a net external liability of $69.3 billion at the end of March this year.

This was 5.8 percent higher than the $65.5 billion three months earlier at end-December.

The Bangko Sentral ng Pilipinas (BSP) updates the IIP every quarter. It is basically the country’s balance sheet that shows the Philippines’ external financial assets and liabilities.

The BSP said in a statement that, in the first quarter of 2025, foreign investments in the Philippines increased more than Philippine investments abroad did.

“This development was driven by a 2.7-percent expansion in the country’s external financial liabilities, which outpaced the 1.9 percent growth in the external financial assets,” the central bank said.

As of last March 31, the outstanding external financial liabilities stood at $326.8 billion. Meanwhile, outstanding external financial assets were pegged at $257.5 billion.

Compared with the level seen a year earlier, the net external liability jumped by 17.2 percent. It registered at $59.1 billion at the end of March 2024.

Over the 12-month period, external financial liabilities increased by 7.4 percent to $304.2 billion.

Meanwhile, the BSP said the Philippine balance of payments (BOP) is expected to register a deficit equivalent to about 1 percent of gross domestic product this year.

“While the domestic economy benefits from steady growth, low inflation and ongoing structural reforms, these are offset by global trade uncertainty, heightened geopolitical risks and weakened investor confidence,” the BSP added.

Latest BSP data show that the BOP registered a deficit of $298 million last May. There were more payments going out than going in.

For the five months up to the end of May, the BOP incurred a deficit of $5.8 billion.

FCDU loans

Bank loans denominated in foreign currencies and granted in the first quarter of 2025 amounted to $15.78 billion.

Compared with the previous quarter, this meant a 0.2-percent decrease in foreign currency deposit unit (FCDU) loans.

The amount also meant a decline of 1.8 percent compared with the first quarter of 2024. That is based on data from the Bangko Sentral ng Pilipinas.

Local and foreign banks that operate in the Philippines extend FCDU loans to support economic activities that require foreign exchange.

Borrowers that need these include importers as well as businesses and individuals with foreign currency payables or needs.

Among main Philippine-based borrowers in the first quarter, merchandise and service exporters accounted for $2.44 billion. This represented about a quarter of the period’s total.

Other big borrowers were towing, tanker, trucking, forwarding, personal and other industries, as well as power generation companies.