PH to grow faster but below gov’t target as headwinds persist

At the age of 68, Lourdes Eclarinal should be enjoying her retirement like a typical senior citizen receiving monthly pension.

But instead, she spends the day selling rags at a transport terminal near a shopping mall in the business district of Alabang, south of the capital region, to raise money for her grandkids’ school allowance.

“I can still work,” Eclarinal says in Filipino as she sits at a shady pathwalk to escape the high noon heat. “Prices are going up, you know. I don’t want to be a burden to my family.”

Eclarinal is one of the Filipinos who find it hard to see better times ahead as rising consumer prices squeeze household budgets and the entire economy.

Results of a recent Pulse Asia survey show that the majority of Filipinos have consistently identified inflation as the most urgent national concern that they want the Marcos administration to tackle first. At the same time, the difficult economic situation created by high consumer prices has prompted the government to temper its growth ambitions for 2024.

But analysts believe even the less optimistic outlook would be difficult to achieve as consumption, a traditional growth driver, creaks under the weight of high inflation and rising borrowing costs.

Headwinds

Government spending may emerge as the economy’s saving grace, they say, although a tight fiscal space will limit the support to growth.

The inter-agency Development Budget Coordination Committee (DBCC) has watered down its gross domestic product (GDP) growth target for 2024 to 6.5 to 7.5 percent, from the previous projection of 6.5 to 8 percent expansion.

The less upbeat outlook is expected. At present, the biggest worry for the government is the prolonged El Niño dry spell, which is predicted to last until the second quarter of 2024 and may push up food and power costs.

Another challenge for the economy is the high interest rate environment that can hurt consumption and investments. Despite inflation easing back to the government’s 2 to 4 percent target range in December last year, the Bangko Sentral ng Pilipinas (BSP) says it deems it necessary to “keep monetary policy settings sufficiently tight until a sustained downtrend in inflation becomes evident.”

In terms of foreign trade, the DBCC expects merchandise imports, on one hand, to return to growth mode at 7 percent in 2024 following a projected 3-percent contraction in 2023 on the back of “stronger infrastructure investments and increased domestic production capacity. “

The DBCC’s new imports forecast for this year, however, is less hopeful than the old projection of 8-percent expansion. Imports are a good indicator of demand especially in an economy like the Philippines, which is reliant on consumption to power up growth.

On the other hand, the DBCC says that while exports might have collapsed by 3 percent in 2023, they are anticipated to show a 7-percent expansion this year.

Consensus

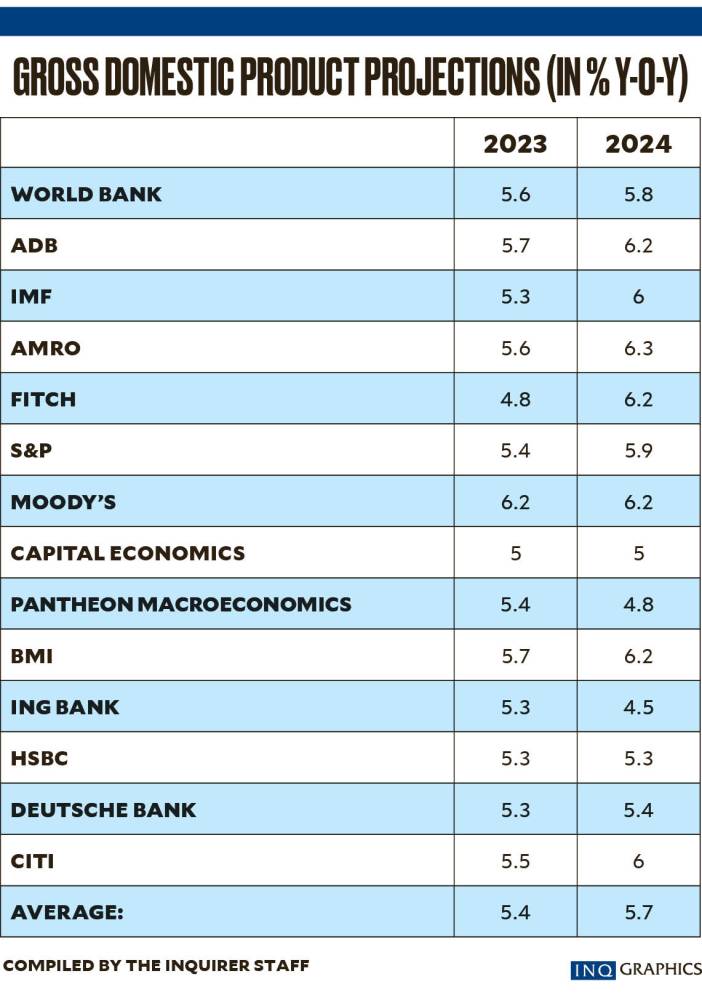

Already, various institutions expect the Philippine economy to underperform state targets this year, with the World Bank projecting growth to settle at 5.8 percent from the estimated 5.6 percent expansion in 2023. The Philippine Statistics Authority will release the official GDP numbers for 2023 on Jan. 31.

According to World Bank, persistently high inflation amid volatility in global commodity prices, as well as the high cost of borrowing for businesses and households have affected private investments. A full implementation of recent reforms designed to make the Philippines more attractive to foreign capital is needed to mitigate these challenges, the Washington-based lender says.

Meanwhile, Manila-based Asian Development Bank has painted a much better outlook than World Bank, but it also believes that a below-target growth is likely this year at 6.2 percent, from 5.7 percent in 2023, due to rising costs of living and borrowing money.

Overall, Inquirer’s compilation of GDP projections from 11 reputable institutions yields a consensus forecast of 5.4 percent expansion for 2023, and 5.7 percent growth for 2024.

Among the forecasters, the Asean+3 Macroeconomic Research Office (Amro) has the most optimistic outlook in 2024 (6.3 percent) while Dutch financial giant ING Bank has given the least bullish prediction (4.5 percent).

“The Philippines faces significant challenges in achieving the government’s growth target due to headwinds from higher interest rates, not only domestically but also globally,” Domini Velasquez, chief economist at China Banking Corp., says in an interview.

“The sluggish recovery in China further exacerbates these difficulties,” she adds.

Gov’t spending to the rescue?

Ruben Carlo Asuncion, chief economist at Union Bank of the Philippines, says the economy can draw some strength from government spending in order to bring growth within the Marcos administration’s target range.

But even that would not be easy as the state grapples with a high budget deficit that may limit public spending, Asuncion adds.

Finance Secretary Ralph Recto says the government is planning to borrow a total of P2.46 trillion from creditors at home and abroad this year to help plug a projected budget hole of P1.4 trillion, which is equivalent to 5.1 percent of GDP.

Based on latest government forecasts, it is only in 2027 that the budget deficit, as a share of the economy, is expected to return to prepandemic level at 3.2 percent.

“The critical part of GDP that the government has direct control of is its spending. Like in third quarter 2023, we’ve seen that the national government’s spending has a huge impact on economic growth for the period,” Asuncion says.

“One of our important assumptions in our nowcasting exercise is the risk to the downside as we highlight tempered fiscal spending in this last quarter of 2023. The government renewed its emphasis on the budget deficit and debt management to ease potential risk to the sovereign’s investment credit rating,” he adds.

Structural reforms

Chinabank’s Velasquez agrees with Asuncion on the potential of government expenditures to supercharge growth, adding that the economy can get strong support from “brisk and well-timed” infrastructure spending, as well as from the full implementation of key reforms that are designed to attract more job-generating foreign direct investments (FDI).

“The government’s higher budget allocation allows for sufficient room to invest in infrastructure projects that can stimulate economic activity,” she says.

“Moreover, the country stands to benefit from various liberalization reforms as long as it continues its efforts in improving the ease of doing business and reducing unnecessary transaction costs,” she adds.

For Leonardo Lanzona, economist at Ateneo De Manila University, the “failure” to come up with a solid post-pandemic recovery plan is the main reason why the government is bound to miss even its less rosy outlook this year.

“The failure to develop a comprehensive recovery program right after the pandemic has led to low private investments and limited domestic production,” Lanzona says.