Philippine 2025 inflation slows to 1.7%, a 9-yr low

Inflation in the Philippines climbed at the end of 2025 as late-season storms and holiday demand pushed food prices upward, the Philippine Statistics Authority (PSA) reported on Tuesday.

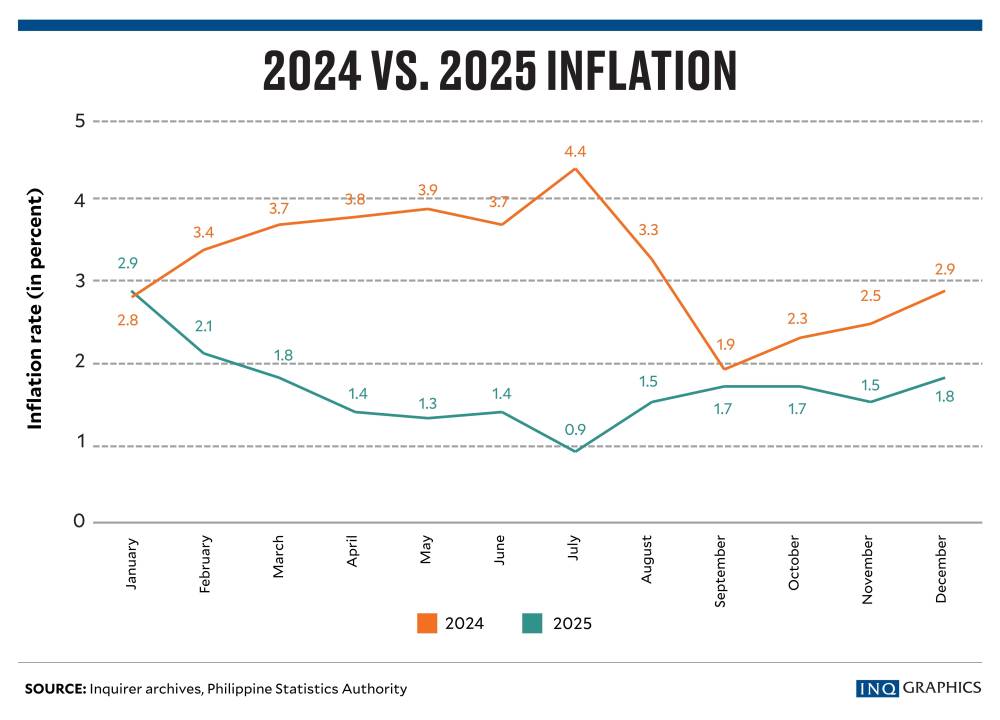

The December reading came in at 1.8 percent, up from 1.5 percent in November. Even so, inflation remained subdued, staying within the Bangko Sentral ng Pilipinas’ (BSP) 1.2- to 2-percent forecast range for the month.

It was also above the 1.5-percent median estimate of 11 economists polled by the Inquirer.

The result capped 2025 with a full-year average inflation rate of 1.7 percent, the slowest since 2016, when it stood at 1.3 percent. This marks the 10th consecutive month that inflation undershot the central bank’s 2- to 4-percent target.

Higher food costs

Reversing the previous month’s decline in food costs, higher prices in December were driven by late-season typhoons and holiday demand, PSA Undersecretary and National Statistician Dennis Mapa said.

Food and nonalcoholic beverages, which make up nearly a third of the consumer basket, rose 1.4 percent in December. This accounted for 97.5 percent of the overall inflationary pressure for the month.

According to Mapa, while rice prices continued to decline, higher vegetable costs—driven by Typhoon “Uwan’s” impact on farms—surged to 11.6 percent in December, up from 4 percent, offsetting the rice price drop.

Holiday demand also contributed to the pressure, with price increases seen in meat, flour, bread and bakery products.

Economists at Chinabank Research, who expect inflation to inch up in 2026, said inflation remains under control despite the December uptick.

“Still, barring new shocks, price pressures are projected to remain manageable moving forward,” they said. “This outlook for benign inflation would likely allow the BSP to offer more support to the economy through additional policy rate cuts.”

On Dec. 11, the BSP had already slashed the policy rate by a quarter point to 4.5 percent to cushion the economy from the third-quarter slowdown, partly due to the widening fallout from the flood control scandal.

Purchasing power

John Paolo Rivera, a senior research fellow at the Philippine Institute for Development Studies, said price pressures were broadly contained for the year, but typhoon-related spikes could temper fourth-quarter growth.

“This low inflation (full-year average) supports household purchasing power, but the disaster-related price increases likely coincided with lost incomes and disrupted activity, which could temper consumption and shave some momentum off Q4 growth,” he said.

“Overall, inflation is not the constraint, as the bigger issue for Q4 is weather shocks and execution, not just prices,” Rivera added.

Reflecting cautious optimism, Jonathan Ravelas, senior adviser at Reyes Tacandong & Co., said the full-year average gives consumers more spending power, but the December spike shows that short-term risks remain.

“The impact is mixed: higher food prices may pinch wallets in the short term, but overall low inflation supports consumption and keeps the economy resilient. Still, upside risks to inflation remain,” he said.

For its part, the Department of Economy, Planning and Development (DepDev) said the Philippine economy was on track to remain resilient against price pressures despite ongoing headwinds.

“Building on this momentum, the government will continue to pursue prudent fiscal and monetary coordination and advance structural reforms to sustain the downward inflation trend,” DepDev Secretary Arsenio Balisacan said.

Meanwhile, the Department of Finance (DOF) said the record-low full-year average inflation reflected the government’s “strong, coordinated approach,” noting that it came in below the 4.2 percent global inflation rate projected by the International Monetary Fund for 2025.

“The DOF is committed to implement necessary measures to keep inflation manageable and ensure that Filipino families are protected from price shocks,” Finance Secretary Frederick Go said.