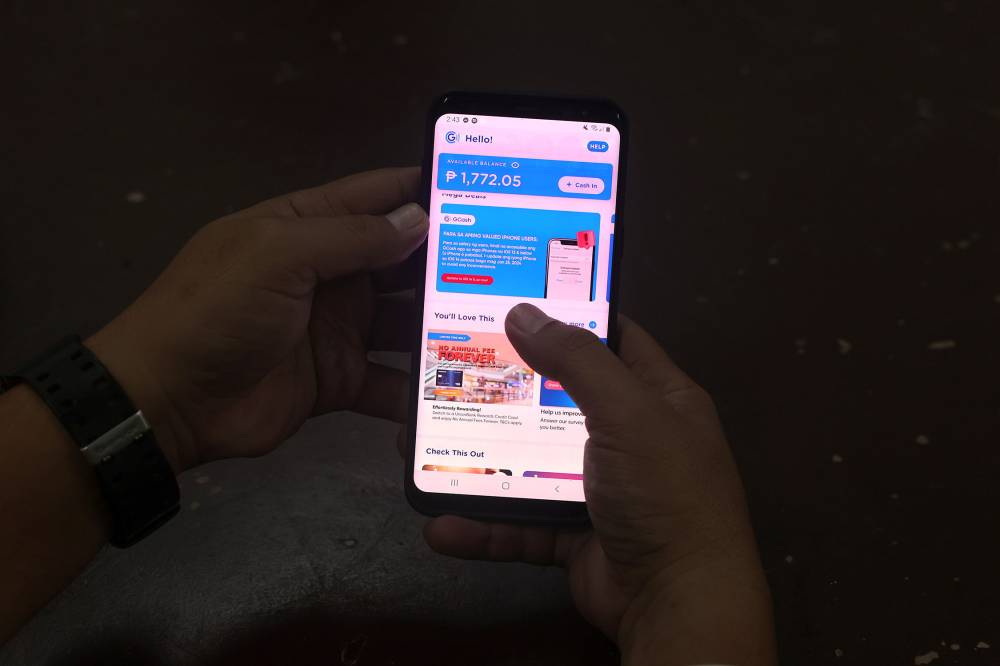

Pinoys’ trust in e-wallets, apps ‘growing’

Amid the shift to digitalization since the onset of the pandemic, Filipinos have become accustomed to using e-wallets and banking apps to manage their finances, according to a study by analytics firm Adjust.

In its “Finance App Insights” report, Adjust noted that Filipinos spent nearly 15 minutes per session when accessing their digital financial service apps during the second quarter.

This is longer than the global average of 6.38 minutes.

At the same time, the firm noted a 22-percent increase in finance app downloads in the April to June period from the earlier quarter.

“The rapid adoption of financial apps in the Philippines has reshaped how Filipinos manage their finances,” said April Tayson, regional vice president for Southeast Asia, South Asia, Australia and New Zealand at Adjust.

“It underscores growing consumer trust in digital platforms and presents a critical opportunity for the financial industry to double down on delivering seamless, accessible digital solutions to maintain a competitive edge,” Tayson added.

Financial inclusion

The digital banking services have allowed consumers to transfer money and make payments with a few taps on their mobile phones. The shift in consumer behavior has been supported by the COVID-19 lockdown measures, forcing the public to transact online.

E-wallets, in particular, have also been helping to widen financial inclusion in the country because they require less documentary requirements during signups.

In fact, a 2021 survey by the Bangko Sentral ng Pilipinas (BSP) showed that 56 percent of Filipinos now own formal financial accounts, driven by the popularity of e-wallets.

With digital payments gaining further ground, local financial technology player Mochi estimated that 67 percent of retail payments this year would be settled via online platforms.

The BSP in 2019 launched QR Ph to promote digital payments. It is a QR (quick response) code-based solution that can be scanned at point-of-sale for quicker transactions.