PSE earnings surged 57% to P1.2B last year on PDS stake remeasurement

The consolidation of its additional stake in the country’s bond trading platform resulted in a 57.5-percent surge in the earnings of the Philippine Stock Exchange (PSE) last year to P1.21 billion.

In a statement on Monday, the operator of the local bourse said its revenues were flat at P1.4 billion, while expenses increased by 14.9 percent to P861.67 million on higher depreciation and maintenance fees.

Other income ballooned by 166 percent to P836.32 million.

According to PSE, its profit gain came after the value re-measurement of its previously held equity interest in Philippine Dealing System Holdings Corp. (PDS).

The PSE in February reached several agreements with the Bankers Association of the Philippines and other PDS shareholders for the takeover valued at P2.32 billion.

More than a decade in the making, the deal will allow the country to have a unified marketplace for the trade of both debt and equities.

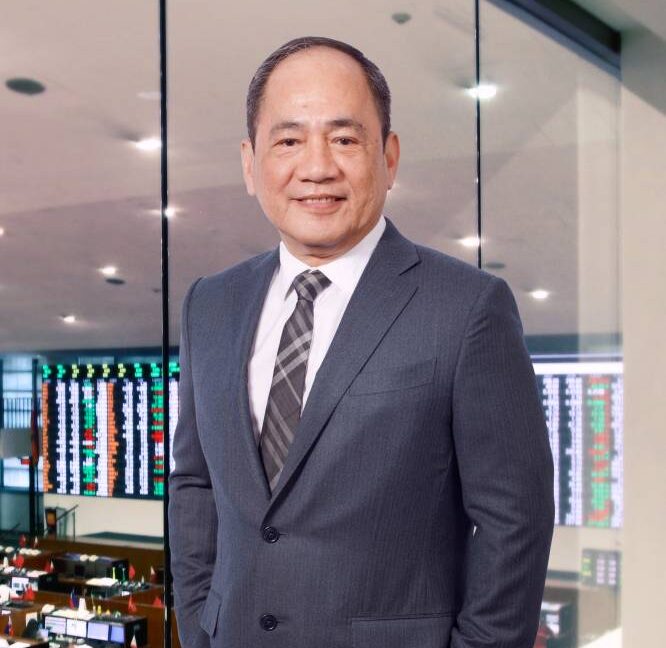

PSE president and CEO Ramon Monzon said the acquisition, which was first proposed in 2012, would provide “a significant boost to our market development initiatives and bottom line.”

“Our post-acquisition objectives will be focused on the seamless integration of both entities to fully realize synergies, efficiencies and risk management benefits,” Monzon said.

“We will also continue to pursue and complete the initiatives that PDS has already started on the fixed income and depository businesses to further expand investor participation and protection in our market,” he added.

As of Feb. 24, PSE held 78.33 percent of PDS, from 20.98 percent previously.