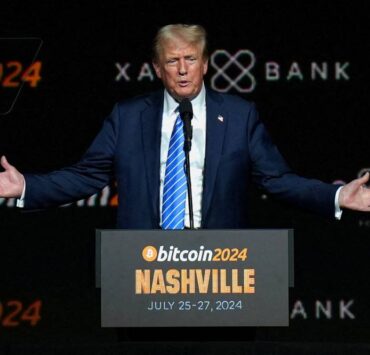

PSEi surrenders 7,000 on Trump win

The local bourse surrendered its hard-fought 7,000 level on Friday as investors continued to price in the risks of a second Donald Trump presidency and an economic slowdown.

By the end of the session, the benchmark Philippine Stock Exchange Index (PSEi) retreated further and shed 0.53 percent, or 37.26 points, to 6,977.18.

The broader All Shares Index likewise lost 0.20 percent, or 7.84 points, to close at 3,883.80. Value turnover was at P6.35 billion for 682.45 million shares, stock exchange data showed.

The PSEi has been holding on to the 7,000 level for nearly two months, fluctuating up to 7,400 as traders remained anxious over the high-stakes US elections.

Japhet Tantiangco, research manager at Philstocks Financial Inc., said investors were mostly pricing in the “possible implementation of protectionist policies in the US” following Trump’s win.

Experts earlier explained that the Republican frontrunner was seen to implement higher import tariffs, thus increasing interest rates.

Likewise, Tantiangco noted that the country’s economic growth slowing to 5.2 percent in the third quarter added to the negative sentiment.

Property firms slightly bounced back after Thursday’s selloff, gaining by 0.35 percent. Investors dumped conglomerates, which are said to be among the most impacted by Trump’s comeback to the White House, as the subsector declined by 1.16 percent.

Zobel family-led real estate giant Ayala Land Inc. was the most actively traded stock as it went down by 1.27 percent to P31 each.

It was followed by BDO Unibank Inc., down 0.68 percent to P147; Bank of the Philippine Islands, down 1.43 percent to P138; SM Prime Holdings Inc., up 1.42 percent to P28.60; and SM Investments Corp., down 2.55 percent to P916 per share.