Raslag planning to raise P2B for new solar farm

Listed Raslag Corp. is targeting to issue this July up to P2 billion worth of preferred shares to beef up capital for a new solar project.

In a disclosure to the local bourse on Monday, the company said its board of directors had approved a plan to issue up to 15 million preferred shares, through private placement, to raise at least P1.5 billion.

If the firm sees high demand from the selected institutional investors, Raslag will issue additional shares worth P500 million.

Raslag said it had tapped BPI Capital Corp. as the sole issue manager, lead underwriter and bookrunner for the fundraising.

According to Karl Geo Origeneza, Raslag chief finance officer, the group was still looking at where to allocate the proceeds but noted that the biggest chunk would go to the Raslag-7 project, which requires an estimated investment of about P4.8 billion.

The official said Raslag hoped to finish the solar development by 2027.

The firm is likewise looking at acquiring a parcel of land for the project’s switching station.

Last year, the company also bared plans to purchase parcels of land in Sta Rosa, Nueva Ecija, for around P807.73 million. The sites would likely house the Raslag-7 and Raslag-8 projects.

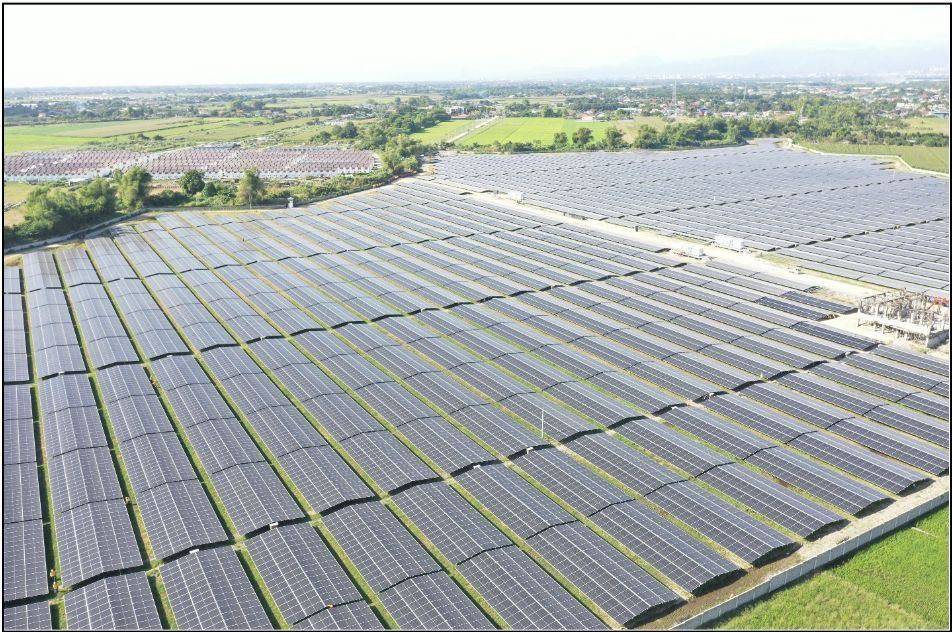

In October, the group activated Raslag-4 in Pampanga. It has a 36.646 megawatt peak (MWp)—its maximum potential output, which can power around 24,000 homes per year.

The company’s other operational solar farms include the 18.01-MW Raslag-3, the 10.046-MW Raslag-1, and the 13.141-MW Raslag-2, all of which are located in Pampanga.

Raslag is aiming to expand its portfolio to at least 1,000 MW of renewable energy capacity by 2035.

Chaired by industry veteran Peter Nepomuceno, the company debuted on June 6, 2022 at the Philippine Stock Exchange, where it raised P700 million.