Record fourth quarter sales fail to lift SSI earnings

Heavy consumer spending in the historically strong fourth quarter blunted the impact of weaker sales early in 2024 for luxury goods distributor SSI Group Inc., whose overall earnings saw a slight decline.

In a stock exchange filing on Tuesday afternoon, SSI said its bottom line for 2024 dipped by 2.7 percent to P2.51 billion also as operating expenses increased.

Net sales climbed by 8.2 percent to P29.9 billion, buoyed by the fourth quarter performance, which saw sales jump by 11.4 percent to P9.7 billion. It was SSI’s highest quarterly performance.

Higher selling and distribution costs, however, contributed to operating expenses rising by 15.8 percent to P10.5 billion at end-December.

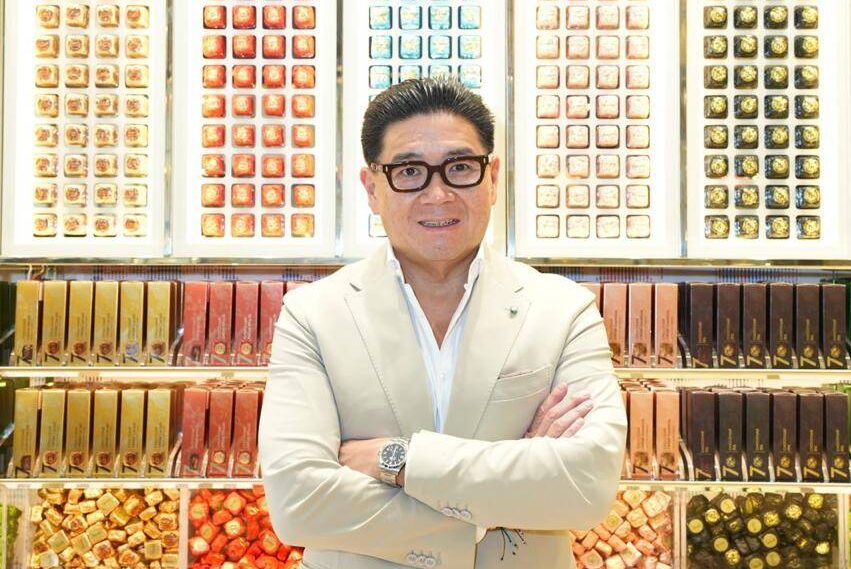

Tantoco-led SSI is the official distributor of international brands in the Philippines, including Lacoste, Gap, Marks and Spencer, Zara and Old Navy. Its food portfolio includes Saladstop!, Shake Shack and Venchi, which opened in the country last November.

Year-on-year, SSI’s personal care, food and home category posted the highest sales growth at 15.5 percent. It was followed by the luxury and bridge category at 12.6 percent; casual, 11.3 percent; footwear, accessories and luggage, 7.8 percent; and fast fashion, 0.9 percent.

SSI ended the year with 588 stores across the country spanning 119,579 square meters and 99 brands.

Although the company saw stronger sales overall, it can be noted that SSI had a relatively weak performance in the first nine months of last year, particularly in the footwear, accessories and luggage categories.

Still, SSI president Anthony Huang cited the “enduring strength” of their brand portfolio and the group’s overall reach in attracting “discretionary demand and [maintaining] a strong presence in the country’s leading retail hubs.”

“As we move into 2025, we remain focused on delivering world-class retail experiences and preserving operational flexibility in what may be a year marked by both opportunities and challenges,” he said in a disclosure.