Remittances grew faster in Nov to $2.91B

Overseas remittances from Filipinos rose at a faster pace in November 2025, lifted by the seasonal surge as migrant workers sent extra cash home for holiday and Christmas spending.

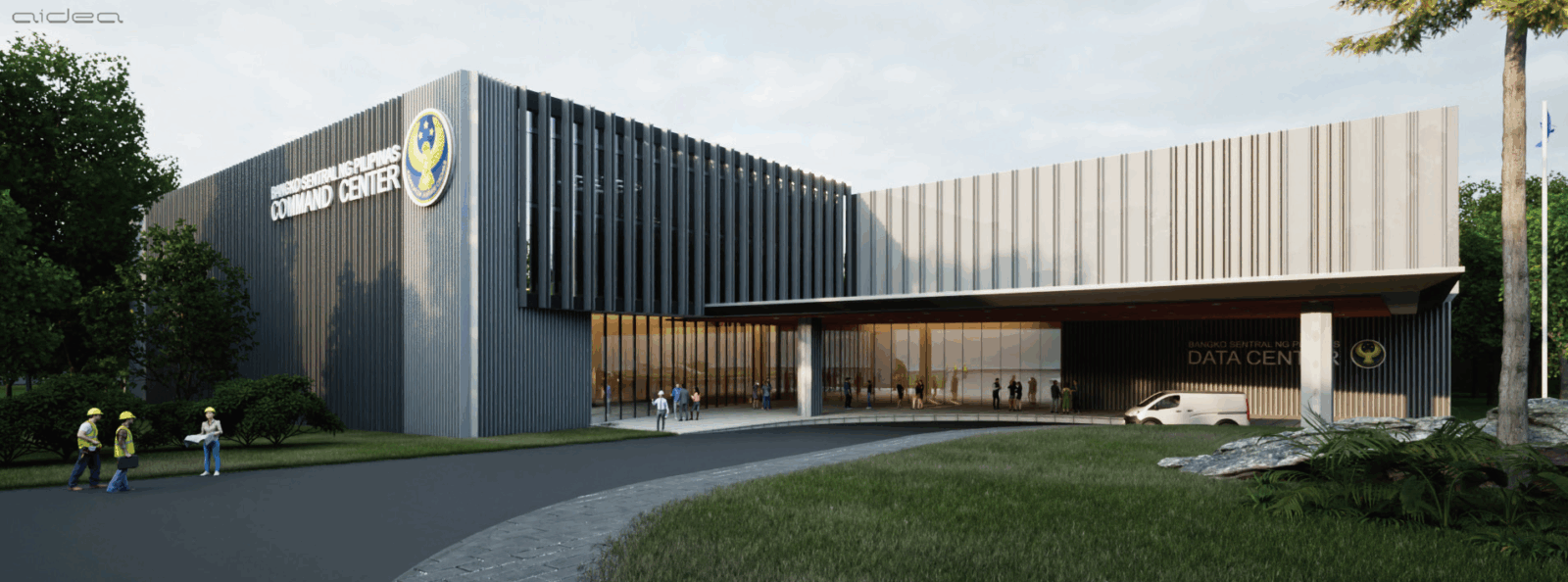

Cash remittances coursed through banks rose 3.6 percent from a year earlier, reaching $2.91 billion, the latest data from the Bangko Sentral ng Pilipinas (BSP) showed. That marked an acceleration from October, when remittances grew 3 percent.

But month-on-month, inflows fell by 8.2 percent. Jonathan Ravelas, senior adviser at Reyes Tacandong & Co., said the sequential decline was “really just a timing story.”

“A lot of the holiday money was already sent in October, which is why we saw that month heavy with remittances—partly due to preholiday transfers and even typhoon‑related aid being front‑loaded,” Ravelas said.

“So, by November, the flow naturally softens before the big December surge. It’s not a red flag—just the usual seasonal lull after an early push from OFWs (overseas Filipino workers),” he added.

For the first 11 months of last year, inflows totaled $32.11 billion, a 3.2-percent increase. The figures suggest remittances are tracking above the central bank’s projection of a 3-percent growth for 2025, with total inflows expected to reach $35.5 billion.

The United States remained the single largest source of remittances in the January-to-November period, accounting for 40 percent of the total, the central bank said.

But that figure comes with a caveat: many remittance centers abroad route their transfers through correspondent banks based in the US, inflating America’s share.

This was followed by Singapore with a 7.1-percent share, and Saudi Arabia, where 6.4 percent of inflows came from.

Such a performance helped temper the weakness of the peso, which faced volatility in the last few months of 2025 amid a widening corruption scandal that battered business confidence.

But in a recent research note, economists at ANZ Research said the peso’s slide may deepen once the seasonal lift from holiday remittances fades, possibly weakening to around 60 to the dollar by the end of the first quarter of 2026, before clawing back ground at a measured pace over the rest of the year.