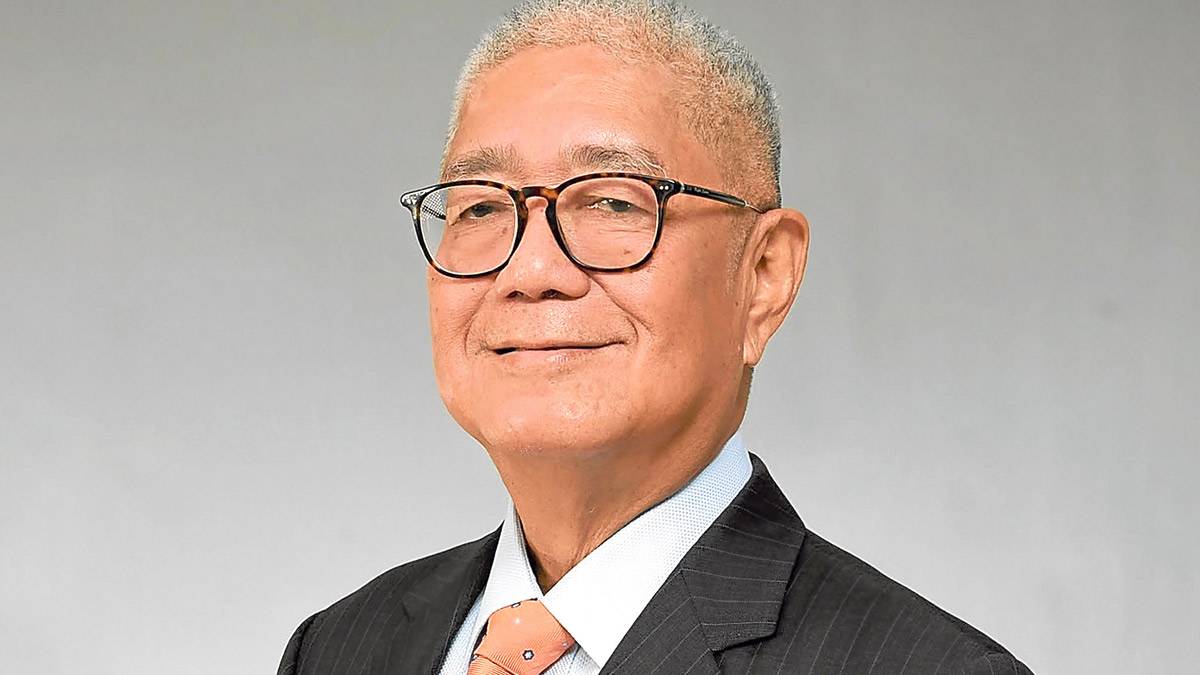

Remolona: BSP may resume RRR cuts this year

The Bangko Sentral ng Pilipinas (BSP) will resume cutting the reserve requirement of banks this year, a move that would release billions of peso in loanable funds to the economy at a time borrowing costs are poised to go down.

And further reductions to the reserve requirement ratio (RRR) are on deck next year while the central bank is on easing mode, BSP Governor Eli Remolona Jr. told a press conference on Wednesday. He did not say the exact size of the upcoming RRR cuts, but stressed that he wanted a “substantial” reduction.

“We will reduce reserve requirements substantially this year and then there may be further reductions by next year,” Remolona said.

“We’ve discussed the timing of it,” he added. “But the idea is to reduce the reserve requirements in a substantial way.”

After announcing a 25-basis point (bp) cut in the benchmark rate to 6.25 percent back in August, Remolona had said he would include in the next meeting agenda of the Monetary Board (MB) the possibility of slashing the RRR from the “ridiculously high” level of 9.5 percent.

The RRR refers to the certain amount of deposits that banks must set aside as standby funds, which do not generate returns because they cannot be used for lending activities. This is to ensure that lenders are able to meet their liabilities in case of sudden withdrawals.

Remolona had, in the past, repeatedly expressed his wish to reduce banks’ reserve requirement to 5 percent from the current level, which is still higher than most peers in Southeast Asia despite being reduced to single-digit level. On one occasion, the central bank chief even said that, ideally, the RRR should be “zero” like in the United States.

By slashing the RRR, the BSP is allowing banks to deploy more cash for lending, which can help boost an economy that historically gets about 70 percent of its fuel on consumption. That said, Remolona believed that the BSP can only cut the RRR while interest rates are low, which can stimulate bank lending.

But the BSP boss said the upcoming RRR reduction would not have an immediate impact on the economy because interest rates are still high, which may prompt banks to deposit their additional cash back with the central bank and earn an attractive yield.

“Our transmission mechanism has long lags,” he said.

Moving forward, the BSP said it will aim for a “calibrated” shift to an easy monetary policy stance, with Remolona previously floating the possibility of another 25-bp rate cut either at the October or December meeting of the MB.