RLC, BCDA to build new ‘district’ in Taguig

There will soon be another sprawling community within Taguig, this time courtesy of Gokongwei-led Robinsons Land Corp. (RLC).

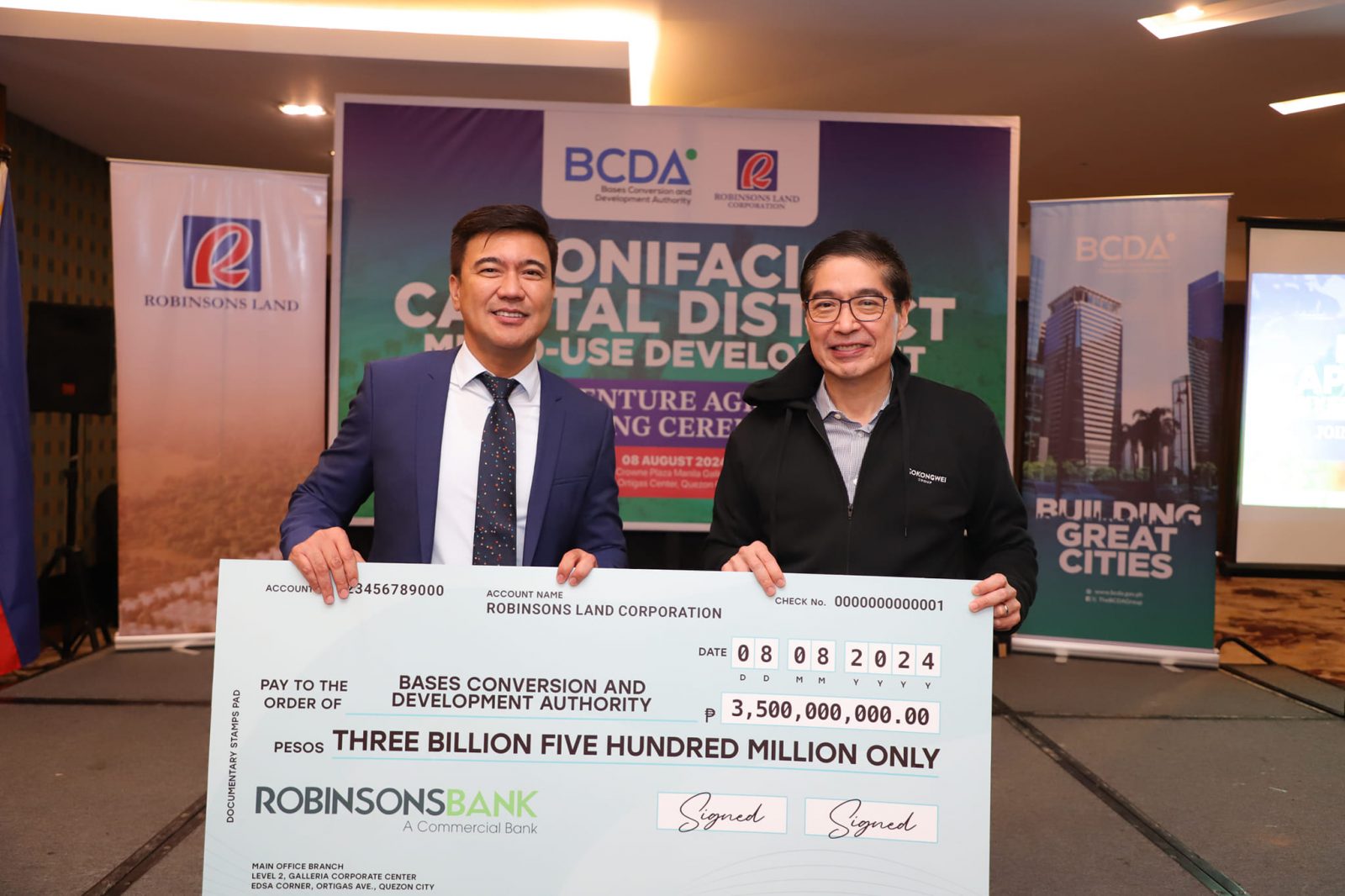

This after it partnered with the Bases Conversion and Development Authority (BCDA) to jointly develop a major project with the agency, banking on the booming commercial industry in the city and upcoming infrastructure projects to drive growth.

The real estate giant on Friday said the Bonifacio Capital District would rise within a 61,761-square-meter property in Taguig and feature residential, commercial, office, hotel and recreational spaces.

“Robinsons Land is committed to doing our part in nation building as we create sustainable, innovative and dynamic spaces that enhance the quality of life for the communities we serve,” RLC senior vice president and general manager Mybelle Aragon-GoBio said in a statement.

This is another major community to be developed within Taguig after Fort Bonifacio, a former military base, was officially converted by the Ayala Group and the BCDA into a civilian area now known as the thriving Bonifacio Global City (BGC).

Bonifacio Capital District, according to RLC, will be within reach of major thoroughfares, including Lawton Avenue, Chino Roces Extension and the South Luzon Expressway.

To the north, RLC said it would be bordered by the planned Bonifacio South Main Boulevard that was expected to allow better access to key areas in Taguig, including BGC.

For its part, the BCDA said the project was part of its initiative to create “sustainable communities for businesses, residents and commuters, while also maximizing our assets’ economic potential.”

“With the help of RLC, we hope to create a model development for areas surrounding subway and railway stations to be developed within the BCDA’s economic zones and properties,” BCDA president and CEO Joshua Bingcang said.

RLC has yet to say when it plans to start the development.

Robust earnings

The company also reported on Friday that its first-half earnings surged by 25 percent to P7.25 billion on the strong performance of its investment properties, offsetting lower gains from the residential segment.

Excluding a one-time gain from the reclassification of its GoTyme investment, RLC’s net income during the period inched up 9 percent to P6.52 billion.

Revenues likewise rose by 9 percent to P21.33 billion.

Its investment portfolio—malls, offices, hotels and warehouse segments—saw a 15-percent uptick in revenues to P15.86 billion.

This accounts for three-fourths of the company’s total revenues in the January to June period.

“We remain committed to delivering value to our customers and shareholders, and we are optimistic about our growth prospects for the remainder of the year,” RLC chair, president and CEO Lance Gokongwei said in a separate statement.

Revenues from Robinsons Malls grew by 12 percent to P8.71 billion as consumer spending rose.

Rental revenues increased by 14 percent to P6.23 billion. As of end-June, total mall leasable space was at 1.62 million square meters with over 8,400 retailers.

The top line of Robinsons Offices had a modest 6-percent growth to P3.92 billion as occupancy rate improved to 86 percent from 84 percent.

Strong performance across all segments caused a 42-percent surge in the revenues of Robinsons Hotels and Resorts to P2.85 billion.

Meanwhile, RLC Residences saw a 10-percent dip in revenues to P4.86 billion, reflecting the weak performance of the middle income sector in the industry.

Although it had already recovered from its slump in the second quarter, the overall net sales take-up was slashed by half to P6.1 billion year on year. INQ