Start of monetary easing cycle excites the bulls

Months after what analysts called a “disappointing year so far” for the local bourse, experts are now impressed to see that the benchmark stocks index has been performing well, so much so that some predictions have been upgraded–but still with caution.

“We believe that the market has performed in line with our expectations,” Claire Alviar, assistant manager for research and online engagement at Philstocks Financial Inc., tells the Inquirer in an email.

According to Alviar, improving economic conditions have allowed companies to grow their earnings by an average of 12.75 percent in the first nine months of the year, or within Philstocks’ target rate of 5 to 15 percent.

Much of the optimism is credited to the central banks of Manila and Washington that have both so far delivered their own 50-basis-point interest rate cut this year, jolting life into traders who have long been yearning for a catalyst.

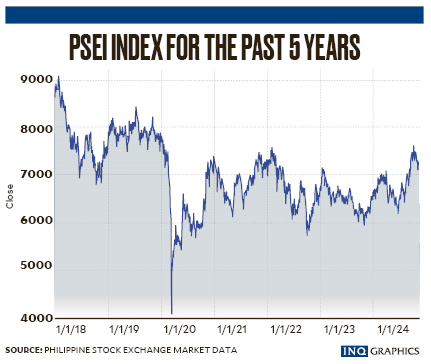

The so-called “Sweet September,” which was peppered with positivity due to the recent monetary policy easing and cooling inflation, allowed the Philippine Stock Exchange Index (PSEi) to enter the bull market for the first time in two years.

Like the energy of the raging animal it was named after, the bull territory signifies that the local stock barometer has surged by at least 20 percent from a recent low. In the PSEi’s case, it charged into the bull market on Sept. 23 when it closed at a 31-month high of 7,417.25, a 20.44-percent climb from its low of 6,158.48 in June.

As a result, experts at Unicapital Securities Inc. have revised their target for the PSEi to 7,600 from the previous 7,000. This entails an increase of at least 17.83 percent from the closing value of 6,450.04 last year.

It is also based on a price-to-earnings ratio of 13x and an anticipated 17-percent growth in earnings per share, according to Unicapital research head Wendy Estacio-Cruz. This means that investors are willing to pay 13 times a company’s expected earnings, signaling market optimism.

“We expect further policy easing to boost corporate earnings through a lower cost of capital and increased consumer spending,” Cruz notes.

Not enough push for the bulls

It is noticeable, however, that the bourse is far from the heights it reached six years ago, when it was comfortably perched at the 9,000 level for the first time in history.

The last time that the PSEi breached the elusive 7,500 level was on Oct. 7, and it has since yet to reenter the psychological resistance level despite having the usual suspects needed for a boost.

What may have been the problem?

Jonathan Ravelas, senior adviser at Reyes Tacandong & Co., points out that there are missing catalysts and possible deterrents, especially with Donald Trump’s comeback to the White House.

“Rate cuts are not enough to drive the market in a sustainable way because there is still an upside risk to inflation,” Ravelas says in an interview.

Investors are cautious of a “Trump 2.0” mainly because the Republican administration is expected to be riddled with import tariff hikes, heightened interest rates, and a possible shift away from equities as cryptocurrencies are likewise poised to become a potential third asset class.

This was proven by the 2-percent slump of the PSEi hours after Trump claimed victory on Nov. 7, when the index surrendered the 7,000 level after nearly two months.

Rising geopolitical conflict in the Middle East also remains a potential downside risk, with Israel intensifying its attacks on Iran, reopening the wounds of economies across the globe that also suffered from Russia’s invasion of Ukraine years prior.

These headwinds have pushed Ravelas to maintain his 7,100 year-end outlook for the PSEi.

At the same time, Alviar says, “Lingering global issues could still dampen sentiment at home … The state of the US economy under its new administration will be crucial, as shifts in US policy could influence global markets, including ours.”

Bull market still possible; 8,000 in sight

While analysts are factoring in these potential risks to equities, they also say that a bull market is still within reach–but with the right elements.

“A bull market in 2025 remains highly possible as we anticipate improved economic conditions, driven by lower interest rates and a manageable inflation rate,” Alviar says.

Current market conditions–with the Bangko Sentral ng Pilipinas cutting its key policy rate for overnight borrowing by a total of 50 bps to 6 percent, record-high earnings results from blue-chip firms–make a breach of the 8,000 mark attainable, she adds.

“At home, we anticipate manageable inflation, along with the BSP continuing to reduce interest rates,” Alviar says.

Ravelas likewise expects the PSEi to reach 8,500 in the first half of the year before gradually declining. While the veteran analyst does not project another rate cut this year, he says the BSP may just slash rates by 25 bps per quarter next, for a total of 100 bps. to 5 percent.