Stocks wrestling with the bears amid prolonged global woes

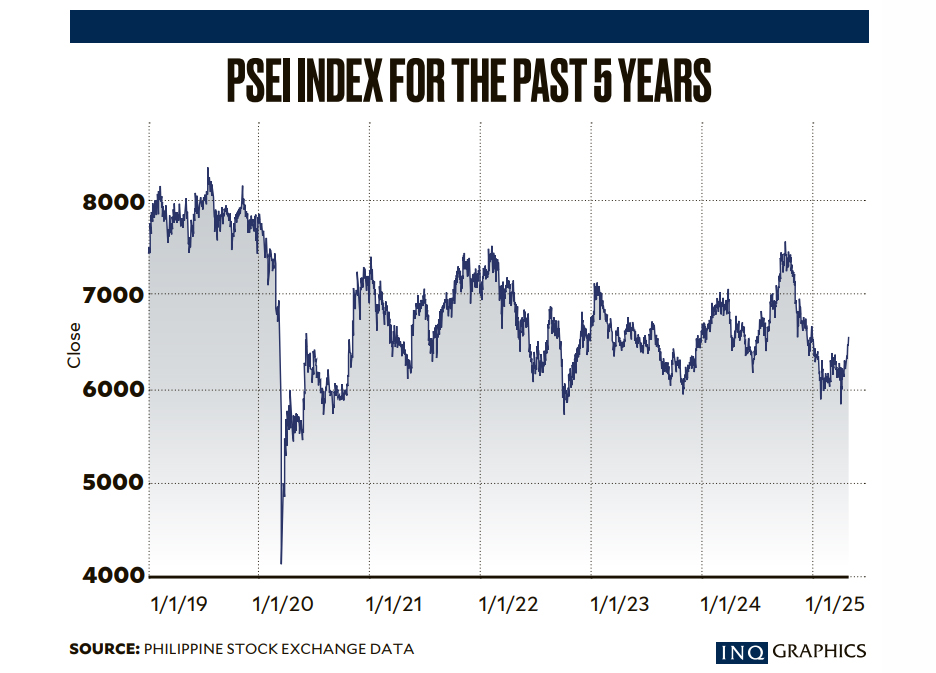

In the beginning of the year, there was a certain electricity in the air surrounding the local bourse. After ending 2024 higher for the first time in five years, there was optimism that the Philippine Stock Exchange Index (PSEi) may have a good run.

It was no secret, after all, that experts were seeing an improvement in the local economy, thus making room for the central bank to cut its rates by as much as 75 basis points.

But in the shadows were the protectionist policies promised by US President Donald Trump, when he reclaimed victory in the November 2024 polls and made his inevitable return to the White House.

For a while, investors were certain that the Philippines would be protected from the brewing trade war due to its status as one of the United States’ oldest allies. By the end of January, however, Trump had reiterated his promise to impose higher import tariffs, and we later found out that the Philippines wouldn’t be spared.

Tipping point

The tipping point for the PSEi was the below-target gross domestic product (GDP) growth last year. The Philippine economy grew at an average of 5.6 percent, and while this was faster than the 5.5-percent growth in 2023, it was still well below the Marcos administration’s goal of 6 percent to 6.5 percent. In the first quarter of 2025, annual growth further slowed to 5.4 percent.

“The index continued to lose ground due to a confluence of factors, like the continued rise in US yields, persistent weakness of the peso against the [US dollar] and slower-than-expected Philippine GDP growth in 2024,” Ron Acoba, chief investment strategist at Trading Edge Consultancy, told the Inquirer.

Thus, the local stock barometer wiped out its hard-fought gains and fell into bear territory on Jan. 31. It has since then clawed back 10 percent so far this year.

This type of movement in the stock market—falling by at least 20 percent from a recent high—mimics that of the animal it was named after, as bears typically swipe their paws downward to attack their prey.

In the PSEi’s case, it declined by 22.4 percent to the 5,800 level from its peak of 7,500 back in October. It ended the first four months down by 2.9 percent so far this year, narrowing earlier losses.

Trump started the second quarter with his “Liberation Day” tariffs, with the Philippines waking up to a 17-percent tariff, pushing the local bourse further down, but to more attractive levels.

Rastine Mercado, research director at Chinabank Securities, said that the valuation of the local bourse “may be too cheap to ignore—especially as we expect corporate earnings growth to continue through this year.”

Mercado likewise does not see the index going below its recent low of 5,800—a level reflecting high investor uncertainty—especially since the PSEi is trading at less than 9.5 times its expected future earnings, making it attractive to investors and ripe for a rally.

“While we expect the local market to remain reactive to external developments … we think that our market should eventually pull ahead when the dust settles,” Mercado said in an email. “We think that fund flows out of the US—especially as views of downward rerating in their equity markets gain traction—could find their way to us given our attractive valuations and expectations of sustained corporate earnings growth.”

Although Trump’s tariffs are on a temporary 90-day halt, Acoba noted that the reaction of global markets may be enough to shake the president out of his trade war frenzy and eventually give in to negotiations. In fact, Trump has already begun easing trade policies and hinted at major trade deals with key trading partners, including India.

“We are in the position that Trump is well aware of how protracted uncertainties regarding his tariff policies will affect the US economy, the US stock market and his image,” Acoba said.

‘Shelter amid the storm’

Despite slashing its PSEi target to 6,700 from 7,000, JP Morgan Securities sees the Philippines’ domestic-focused market as “a shelter amid the trade storm.”

In its April 23 Asean Equity Strategy report, the securities arm of JPMorgan Chase pointed out that the 17-percent reciprocal tariff rate on the Philippines was relatively lower versus the 25-percent global rate and the 30-to-46-percent rate across the region.

“This, combined with abundant labor force and competitive costs, should make the Philippines an attractive destination for FDI (foreign direct investment) flows over the next few years,” it said.

With 77 percent of the economy driven by domestic consumption and exports accounting for only 16 percent of GDP, the Philippines may be shielded in the event of a global slowdown.

Obstacles remain

However, Unicapital Securities Inc. offered a different perspective. In its April 14 strategy report, the stockbroker noted that the tariff back-and-forth between the United States and China, two of the world’s largest economies, may cloud views of aggressive rate cuts by the Bangko Sentral ng Pilipinas.

Unicapital added that the US-China trade war could “disrupt trade and reduce global demand,” resulting in lower export revenues for the Philippines and lower demand for the local currency.

“Although the 90-day tariff pause has provided short-term relief, elevated tariffs on Chinese goods and potential policy shifts may keep markets volatile,” it said. “Clear signs of compromise could boost confidence, while setbacks may trigger renewed sell-offs in vulnerable sectors.”

“Investors will need to see more stability in trade policy for any market bounce to have legs,” Unicapital added.

Still, Acoba pointed out the trade war may present opportunities and allow investors to seek yields and growth in emerging markets like the Philippines.

“This, after a period of continued volatility, will allow the local market to recover, perhaps back to 7,400 to 7,500,” Acoba said.