T-bond rate rises on US fiscal woes; P30B raised

Yields on longer-dated local debt of the government rose during Tuesday’s sale of Treasury bonds (T-bonds), tracking the movements in US Treasuries amid worries that President Donald Trump’s tax agenda could bloat America’s deficit and debt.

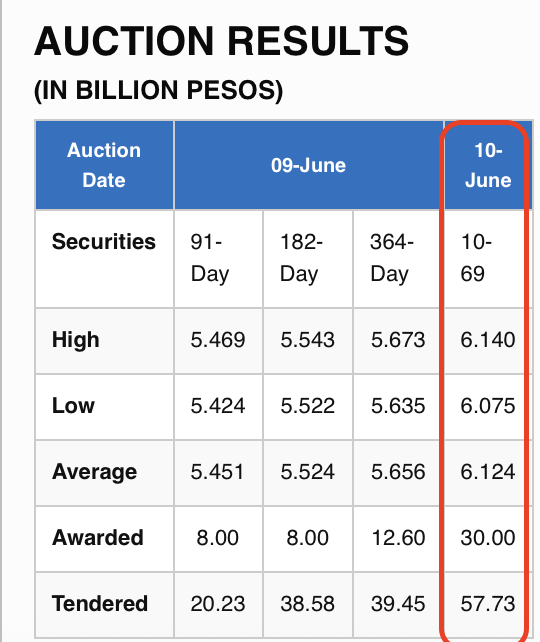

The Bureau of the Treasury (BTr) raised its target amount of P30 billion via re-issued T-bond, which has a remaining term of seven years and three months.

Auction results showed the offering attracted P57.7 billion in total bids, exceeding the original size of the issuance by 1.9 times.

The T-bond fetched an average rate of 6.124 percent, higher than the 6.081 percent recorded in the previous auction of seven-year debt notes more than a month ago.

It was also more expensive than the 6.072 percent quoted for the comparable tenor in the secondary market as of June 9.

“The seven-year T-bond average auction yield rose due to higher US Treasury yields recently amid concerns on Trump’s tax plan that could lead to wider US budget deficit and debt,” said Michael Ricafort, chief economist at Rizal Commercial Banking Corp.

For this year, the Marcos administration is targeting to borrow P2.55 trillion from creditors at home and abroad to plug a projected budget hole amounting to P1.54 trillion, or equivalent to 5.3 percent of the country’s gross domestic product.

By sources of financing, the government will borrow P507.41 billion from foreign investors in 2025. The remaining P2.04 trillion is targeted to be raised domestically, of which P60 billion will be via short-dated Treasury bills and P1.98 trillion via T-bonds.