Tariff tantrum, growth woes sour equity investors’ appetite

At the beginning of the second quarter, a storm was brewing in the equities market.

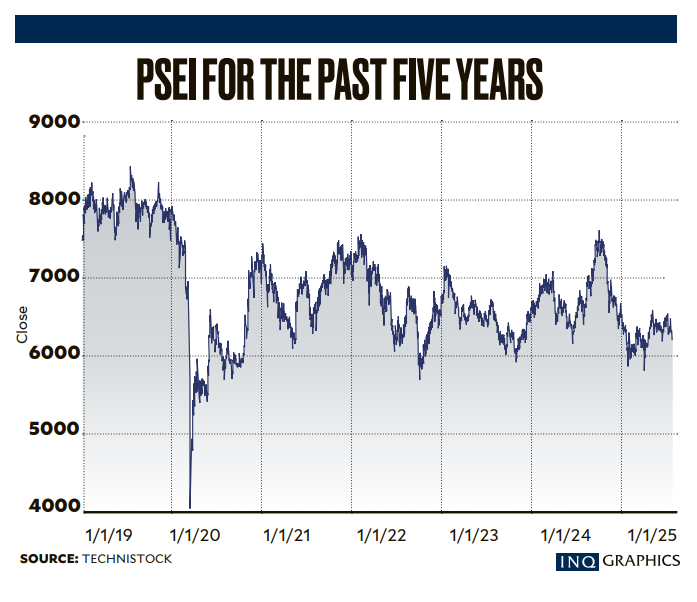

As with a storm cloud heavy with rain, the Philippine Stock Exchange Index (PSEi) was brimming with several negative factors that set up its eventual decline.

First, United States President Donald Trump threatened to impose a 17-percent tariff on goods coming from the Philippines, potentially impacting several sectors of the economy relying on the American export market. This is part of his “Liberation Day” pronouncement that aimed to hike tariffs on dozens of trading partners, citing the need to correct the trade imbalance with the US.

Experts repeatedly dismissed the duties as having only a minimal impact on the Philippine economy, citing its prime status as one of the US’ oldest allies. But in the end, investors did not seem to think this was enough.

“The local market moved with a downward bias mainly due to [Trump’s] tariff policy that has cast uncertainties on global trade and has so far stopped the Federal Reserve from continuing its policy easing,” Japhet Tantiangco, research head at Philstocks Financial Inc., tells the Inquirer.

Trump’s 90-day pause triggered some kind of reprieve, but it was not sustainable, especially since negotiations with key national governments seesawed, and so did global markets.

While trading was generally active–net value turnover averaged P5.7 billion daily, higher than P5.02 billion in the same period last year–the local stock barometer ended the semester down by 2.51 percent to 6,364.94.

This is also well below the index’s peak of 7,500 in October, or the beginning of the monetary policy easing cycle of the Bangko Sentral ng Pilipinas (BSP) and before Trump returned to office.

Slow GDP spillover

Also adding to the heavy sentiment at home is slower-than-expected economic growth in the first quarter, ending at 5.4 percent, or weaker than the 5.9-percent pace recorded in the same period last year.

April Tan, chief equity strategist at COL Financial Inc., says the “magnitude and unpredictability” of Trump’s tariff policy ultimately weighed on global economies.

She points out that the Philippine government has reacted to the volatility by reducing its gross domestic product growth forecast for the year to 5.5 to 6.5 percent from 6 to 8 percent previously.

On top of this, companies also registered “unimpressive” earnings growth in the first quarter.

Data from COL show that in the January to March period, listed companies on the radar of the stock broker grew by a median rate of 6.4 percent. Property, telecommunications and gaming sectors particularly faced rising pressures that could “erode profitability in the coming months,” Tan notes.

“Given these challenges and the elevated level of uncertainty across multiple fronts, we believe a rerating of Philippine equities is unlikely this year,” she adds.

But despite the setbacks, there were moments of optimism.

Inflation began easing due to lower rice and oil prices, and, combined with election-related spending and a boost in consumers’ spending power, there was some type of light for the bourse.

The BSP also continued its policy cuts, slashing the rate for overnight borrowing by a total of 50 basis points to 5.25 percent. For investors, this may be enough of a mood boost for the remainder of the year.

Opportunities

For Maybank Securities Inc. head of research Kervin Sisayan, the strength needed for the PSEi’s uphill climb in the second semester lies in the opportunities it can take advantage of.

For one, the local currency is expected to improve to 56 against the greenback by year-end, banking on the underlying strength of the domestic economy.

“We also expect another rate cut to help fuel economic growth in the medium to long term. This could help provide a boost to our equity market,” Sisayan says in an email, adding that their index target was at 7,000 for the year.

Tan echoes Sisayan’s sentiments. Should the BSP slash rates further later in the year, this could “increase investor appetite for high dividend-paying stocks,” such as utility companies and real estate investment trusts.

“The consumer sector is poised to benefit from the ongoing disinflation trend. Because of this, it will most likely outperform during the second half,” Tan adds.

Additionally, Tantiangco says investors will keep an eye out for any major developments related to global tariff policies, especially since the Philippines was eventually imposed with a 19-percent duty. While lower than the 20 percent rate Trump announced in July, this is still noticeably higher than the initial 17 percent.