The cancer returns: Rizal’s warning, floodgate reckoning

In the twilight of the 19th century, José Rizal penned “Noli Me Tangere” and “El Filibusterismo,” novels that exposed the moral decay and institutional corruption of the Spanish colonial rule.

His words were razor-sharp, dissecting the cancer that infected Philippine society—greed, abuse of power and the betrayal of the Filipino spirit.

His death in 1896 became the spark that ignited a revolution, not just against Spain, but against the idea that Filipinos were powerless.

More than a century later, Rizal’s diagnosis remains tragically relevant. The cancer he described has not been cured but has metastasized. Today, the Philippines faces a new reckoning, not against foreign colonizers, but against itself.

In the movie “Heneral Luna” (2015) Gen. Antonio Luna tells the Cabinet, “Brothers, we have an enemy bigger than Americans: ourselves.”

This is an acknowledgment of the fact that Filipinos are, indeed, fighting themselves amid this floodgate scandal.

The floodgate scandal: Anatomy of a betrayal

The floodgate scandal is not merely a case of corruption; it is a revelation of systemic state capture. Billions of pesos allocated for flood control projects were siphoned off through ghost infrastructure, substandard construction and collusion among contractors, government officials and lawmakers.

Whistleblowers like engineers Brice Ericson Hernandez and Jaypee Mendoza have testified that up to 70 percent of the flood control budget vanished, amounting to over P1 trillion in losses over 15 years.

This is not just theft; it is betrayal. Communities in Bulacan, Metro Manila and Central Luzon remain vulnerable to floods, while the funds meant to protect them were funneled into luxury cars, shell companies and political war chests.

The scandal has triggered the “Trillion-peso March,” with over 50,000 Filipinos marching in Metro Manila, demanding transparency, accountability and governance.

President Marcos Jr. has created an Independent Commission for Infrastructure (ICI), but skepticism remains. Will this be another Agrava commission? Another PCGG (Philippine Commission for Good Government)? Symbolic but toothless?

Economic fallout: A nation bleeding

The economic implications are staggering.

Direct losses: The Department of Finance estimates P42.3 billion to P118.5 billion in economic losses from 2023 to 2025 alone, equivalent to 95,000 to 266,000 lost jobs.

Investor confidence: Foreign investors are pulling back. South Korea backed out of a $503-million loan, and ESG (environment, social and governance)-aligned capital is fleeing due to governance risks.

Currency depreciation: The Philippine peso has weakened past 58 to the dollar, reflecting political instability and capital flight.

Interest rates: While the Bangko Sentral ng Pilipinas (BSP) recently cut rates to 5 percent, the scandal may force a reversal if inflation spikes due to lost infrastructure and weakened investor sentiment.

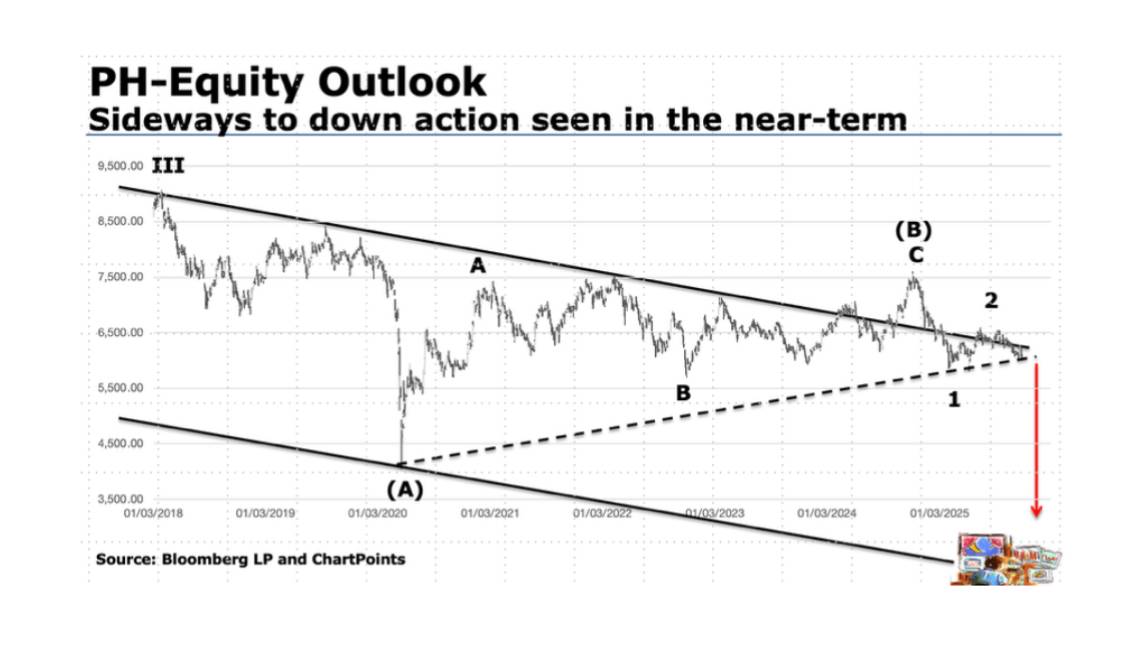

Stock market decline: The Philippine Stock Exchange Index (PSEi) has dropped below the 6,000 psychological support level, with a 4-percent decline in less than a month.

The scandal has created a toxic mix of political risk, fiscal uncertainty and social unrest. It threatens the Philippines’ investment-grade rating and undermines its medium-term fiscal framework.

Forex and interest rates: Fragile stability

The peso’s depreciation is not just a technical issue; it reflects a deeper erosion of trust. Traders cite political unrest and the fear of contagion arising from US tariff uncertainty as reasons for the sell-off.

Risks toward the 60:$1 levels are highly probable in the coming months. If the BSP is forced to raise rates to defend the currency, it could choke off growth and worsen unemployment. Meanwhile, the government’s debt servicing costs are rising. With 16 percent of national revenues dedicated to interest payments, any increase in rates could derail fiscal consolidation efforts.

What is worrisome is that the trend of interest rates since 2020 has been on the rise. With upside risks to inflation medium-term bias for interest rates remains tilted to the upside.

Stock market sentiment: A crisis of confidence

The PSEi’s decline is not just about numbers—it’s about sentiment. Investors are pricing in risk, not waiting for verdicts.

The scandal has triggered persistent selling pressure, with foreign outflows and tepid trading volumes.

Property stocks have been hit hardest, reflecting fears that infrastructure spending by the government will stall. Mining and oil have shown resilience, but the broader market remains bearish.

We are in a holding pattern. Growth is slowing; confidence is shaky, and corruption is clouding the outlook.

The fundamentals are there—but we’re not firing on all cylinders.

The steep discount to our peers reflects doubt. If no real reforms are implemented that would provide transparency, accountability and governance, growth downgrades will continue.

The index could deteriorate further towards the 5,500 levels.

The current technical patterns are already pointing to a downtrend. Clearly, the charts paint that pattern precedes politics.

Will the Philippines recover?

Recovery is probable—but not guaranteed.

The creation of the ICI is a step forward, but its success depends on transparency, accountability, prosecutorial power and political will. The swift filing of charges by Secretary Vince Dizon is encouraging, but systemic reform is needed to restore public trust.

The Philippines must:

- Purge the corrupt networks: Dismantle collusion between lawmakers and contractors, enforce conflict-of-interest laws and prosecute not just scapegoats but kingpins.

- Rebuild public trust through whistleblower protection, citizen oversight platforms and independent audits.

- Restore fiscal discipline: Redirect funds to genuine climate resilient infrastructure, social programs, climate resilience and adhere to good governance.

- Signal to investors that the Philippines is serious about reform, through credible governance and ESG compliance.

The revolution within

Rizal once wrote, “There are no tyrants where there are no slaves.”

Today, the tyrants are not foreign; they are Filipinos. And the slaves are not bound by chains, but by apathy.

The revolution that follows the floodgate scandal will not be fought with guns, but with truth, transparency, accountability, good governance and civic courage.

It will be Filipinos against Filipinos—but not in violence—in a battle for the soul of the nation.

If the Philippines can rise from this scandal, it will not just recover; it will transform the nation. But if it fails, Rizal’s cancer will continue to spread, and the dream of a just, prosperous and resilient republic will remain just that but a dream.

(The author is one of the Philippines’ most respected analysts and market strategists. He is senior adviser at Reyes Tacandong & Co., and independent director at PH Resorts Group Holdings Inc. and DITO CME. For over 20 years, he was chief market strategist at BDO Unibank. A certified technical analyst, he combines data-driven precision with strategic foresight, making him a trusted voice in Southeast Asia and global economic fora.)