The passive-income blueprint: Retirement through dividends

We all have an idyllic vision of retirement—spending time with friends and family, traveling the world and pursuing our passions.

In reality, the retirement trifecta—the loss of steady employment income, the likely obsolescence of our skills and declining health—often stands as a roadblock to these aspirations.

Ideally, you want the ability to harvest a passive income stream that will enable you to maintain the quality of life that you’ve worked so hard to build during your retirement years.

Dividend growth investing—investing in companies that have the ability to consistently pay and increase their dividends—presents a potent strategy for those seeking financial stability.

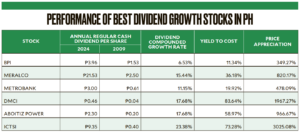

To concretize this notion, examine the table exhibiting the best-performing dividend growth stocks in the Philippine Stock Exchange (PSE) over the past 15 years.

Notice the dramatic increase in annual dividend payouts and the substantial price appreciation of the stocks on this prestigious list.

For simplicity, imagine a hypothetical P100,000 investment in International Container Terminal Services Inc. made on the first trading day of 2009. That same year, the company would have paid you approximately P3,134.79 in dividends.

By 2024, your annual dividend income would have grown to around P73,280—without selling a single share. Meanwhile, the market value of your initial P100,000 investment would have soared to over P3.02 million.

Cherry-picking, you say? Consider this: the Dividend Growth Portfolio that the DragonFi Research team manages has delivered a total return of 49.31 percent since its inception on Nov. 29, 2023. Its year-to-date return currently stands at 19.29 percent.

We achieved this despite the PSE Index’s lackluster performance, which was up just 1.22 percent for 2024 and down by 5.84 percent year-to-date.

People normally default to stashing their retirement funds in traditional savings vehicles such as time deposits and money market funds.

While these investment products will always have a role to play, they typically offer lower and stagnant returns, which may not keep pace with inflation, potentially diminishing the retiree’s purchasing power over time.

In contrast, dividend growth stocks not only provide regular income but also the potential for dividend growth and capital appreciation that may result in higher total returns.

The Dividend Harvest Strategy

At DragonFi, we champion a passive income approach called the Dividend Harvest Strategy.

At its core, we encourage clients to establish, nurture and eventually harvest a steady stream of income through real estate investment trusts (REITs) and dividend growth stocks.

Instead of focusing on stocks with the highest dividend payouts, this strategy analyzes the quality of the dividends by focusing on three key factors—size, safety and growth potential.

By focusing on these three metrics, we are able to identify the winning stocks which can be held for a longer period of time.

Key takeaway

Dividend investing is one of the best ways to build a passive income stream that is both diversified and relatively easy to manage. Dedicating time to learning the principles behind this will literally pay dividends.

One of the most frequent questions I get from potential investors is this: “Do I need a large amount of capital to build a viable passive income stream for retirement?” The answer is a resounding no. The key lies in developing a consistent habit of investing early and often.

Retirement experts recommend setting aside 10 percent of your annual income in your 20s and increasing this to 15 percent in your 30s.

The power of compounding is the most potent wealth-building force known to man, and it works best over a long-time horizon.

If you’re a young investor in your 20s or 30s, you already have something that even the richest person in the world can’t buy. Time.

More powerful with PERA

The voluntary savings program called Personal Equity and Retirement Account (PERA) is a tax-advantaged retirement account where investment income, such as dividends and interest, is earned tax-free. It also offers several additional benefits, including tax-free corporate contributions when PERA is incorporated into an employee’s total compensation package.

Beyond being an efficient retirement savings vehicle, PERA also enhances generational wealth creation, thanks to its estate tax exemption.

DragonFi Securities recently became the first and only Securities and Exchange Commission-accredited PERA administrator.

Soon, clients will be able to implement their dividend investing strategies in a more tax-efficient manner, allowing their investments to compound at a much higher rate.

The author is chief executive officer of DragonFi Securities, one of the country’s fastest-growing investment apps.