What could derail this flow driven stock market rally?

The Philippine Stock Exchange Index is up 5.5 percent year to date, outperforming the Standard & Poor’s 500, which is flat. The rally has been supported by a weaker US dollar, which allowed the peso to appreciate to 58.11 after touching 59.35 in January.

Another key driver has been the global rotation out of expensive US technology stocks into more traditional companies trading at cheaper valuations. This shift reflects growing concerns about a potential artificial intelligence (AI) bubble, the disruptive impact of AI on software firms and whether massive AI infrastructure spending by large tech companies will deliver adequate returns. The rotation is evident in US market performance: the tech-heavy Nasdaq is the weakest major index year to date, down 3 percent, while the more traditional Dow Jones Industrial Average has gained 3 percent.

Emerging markets have been among the main beneficiaries of this shift. The MSCI Emerging Markets Index is up 10.7 percent year to date, while inflows into US-listed emerging market exchange-traded funds reached record levels in January. As part of this asset class, the Philippine market has attracted renewed foreign interest, with net foreign buying totaling P16.4 billion year to date—a reversal from the sustained outflows seen throughout 2025.

Corporate earnings have also provided support. Early fourth-quarter results have been encouraging, with BPI reporting double-digit loan growth and improving margins, Globe posting a rebound in its mobile and corporate data businesses and Monde signaling healthy demand and sequential margin improvement in its earnings preview.

However, caution remains warranted.

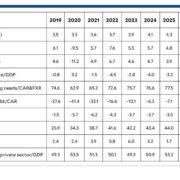

The Philippines’ fourth-quarter gross domestic product growth slowed to 3 percent from 3.9 percent, well below the 3.7 percent consensus forecast, largely due to a sharp contraction in government infrastructure spending and slower private consumption. If history is any guide, fiscal weakness linked to anticorruption efforts could persist as public spending took roughly two years to recover following the Priority Development Assistance Fund or Pork Barrel scam more than a decade ago.

Consumer spending also faces headwinds. The average unemployment rate rose to 4.6 percent in the fourth quarter from 3.4 percent a year earlier, while foreign direct investment declined 22.1 percent to $7.1 billion in the first 11 months of last year—limiting prospects for job creation.

External risks are likewise building. US labor market data have softened, with ADP reporting only 22,000 jobs added in January, far below expectations. Layoff announcements also surged, with employers reporting 108,435 job cuts—up 118 percent year-on-year and the highest January total since 2009.

Although official data from the Bureau of Labor Statistics showed a stronger gain of 130,000 jobs, this figure warrants caution given the agency’s history of significant downward revisions. In fact, its estimate of average monthly job gains for 2025 was recently cut by nearly 70 percent to only 15,000.

If labor market weakness begins to pressure corporate earnings—particularly among traditional sectors—the current rotation out of technology stocks may not hold. Instead, a broader US market correction could emerge, with potential spillover effects on global equities, including emerging markets such as the Philippines.

Given these risks, short-term traders should recognize that much of the rally has been flow-driven rather than fundamentally driven. A disciplined buy-low, sell-high approach and strict risk management are essential, especially as foreign flows can reverse quickly.

For long-term investors, staying invested still makes sense given attractive valuations and dividend yields relative to bonds. That said, position sizing remains crucial, as cheap stocks can become even cheaper in volatile markets.

Maintaining some cash is also prudent, as liquidity provides the flexibility to capitalize on opportunities that may arise from heightened volatility.