Youth appetite for gold rises as Chinese economy loses luster

SHUNDE, CHINA—The sound of gentle tapping filled a jewelry workshop in southern China as a craftsman hammered pine leaf patterns onto a soft slab of gold in the style of old ink paintings.

Elaborate traditional pieces created by master goldsmiths have always been popular in China, bought as gifts for special occasions like the Lunar New Year or simply as investments.

But jewelers are now having to consider a new and fast-growing consumer base—younger people, who are increasingly keen to buy gold, seeing it as a safe investment in uncertain economic times.

Key to gold’s current popularity is China’s lackluster post-COVID recovery, which is hitting young people especially hard as youth unemployment soars and traditional investment options such as property suffer, analysts say.

“In the past, only the older generation would buy gold jewelry,” Tan Ruikun, master craftsman with legacy jewelry giant Chow Tai Fook, told Agence France-Presse (AFP) on a recent visit to the workshop in Guangdong province.

“Young people are different now; they will also buy it because of its ability to retain value.”

Sitting at cubicles and frowning with concentration, his colleagues twisted loops of gleaming metal into intricate patterns and peered through microscopes to add sparkling gems to gold pendants—the latter a style developed after feedback from younger customers.

“If younger elements are added in the design, it will appeal to young people even more,” explained Tan.

In a bustling Shanghai jewelry market, 30-year-old freelancer Zhang Jie told AFP that “it’s hard for young people to save money.”

Buying gold means “the money is still with you in a different way,” she said.

Millennials and Gen Z are “becoming a huge driving force” in the rising popularity of gold, Nikos Kavalis of Metals Focus told AFP.

“The last few years have seen attitudes change dramatically,” he said.

That reflects Chow Tai Fook’s recent consumer research, which suggested Gen Z was more attracted to buying gold than any other age group under 40.

“Pure gold jewelry continues to serve as a safe haven for Chinese consumers amid recent economic conditions,” the report noted.

‘Stable’ assets

Gold jewelry was among the best-performing consumer goods in China last year, as the post-pandemic recovery lost its shine in the face of flagging domestic consumption and declining business confidence.

A long-running property sector crisis and more recent stock market rout have further dented investors’ options.

The market in central Shanghai where AFP met Zhang, the freelancer, was buzzing with customers before the Lunar New Year.

Global gold prices hit an all-time high in December, so “people may see it as a more stable value of assets,” she said.

Feng Ning, a 24-year-old medical industry worker, had similar motivations.

“When I started earning my own money … I bought other luxury products, but they would depreciate a lot when you want to exchange them for cash,” she said.

“My friends (and I) have switched to choosing gold.”

One small shop in the labyrinthine market was notably busier than others, with almost every inch of its counters crowded.

The reason, said another store owner, was that it was famous on the Instagram-like platform Xiaohongshu—attracting younger customers.

China chic

Chow Tai Fook has also leveraged social media to adapt to this new interest, managing director Kent Wong told AFP.

The 95-year-old company is keen to position itself as more than just a brand for the old, wealthy and traditional.

Typical jewelry pieces include enormous dangling necklaces made of nine descending pigs, a symbol of fertility given as part of wedding customs in southern China.

But gold consumption in China last year was driven by “products lighter than 10 grams, or cheaper than RMB2,000 ($278),” according to the World Gold Council (WGC), reflecting the smaller budgets of millennial and Gen Z customers.

Xiaohongshu users share videos of glass bottles full of gold beans or other charms, showcasing their savings as they add to their treasure pile.

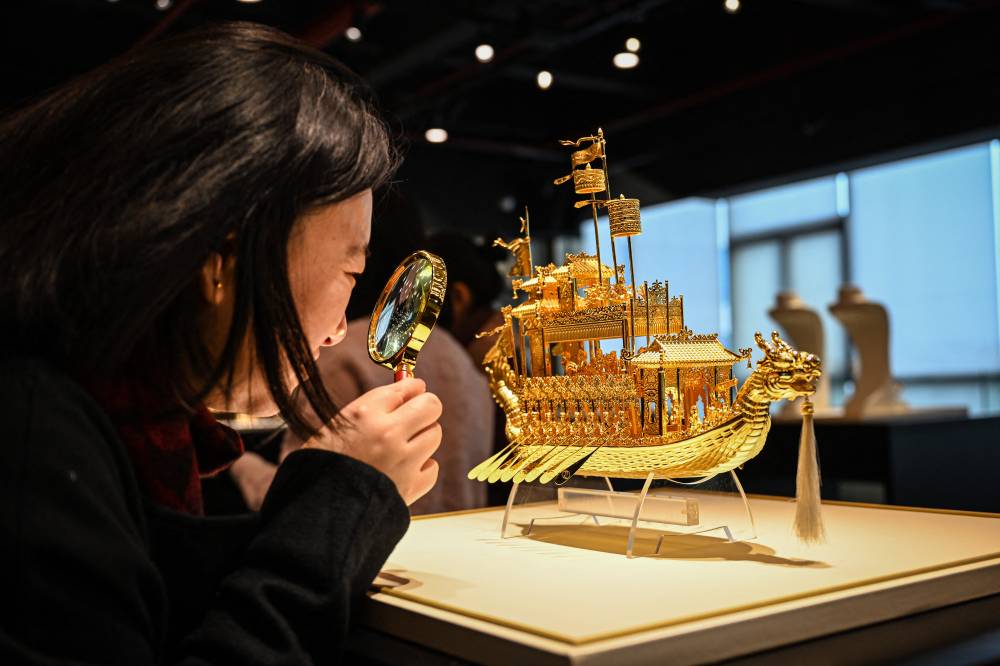

Legacy jewelers have cabinets full of such golden amulets, but they also design bigger pieces aimed at young consumers.

A phenomenon noted by both the WGC and Wong was “guochao”—translated as “national wave” or “China chic”—the rise of brands that celebrate Chinese cultural identity.

“Young people are becoming more and more confident about Chinese culture,” said Wong.

The company recently ran a popular series that reimagined Tang dynasty museum pieces as modern jewelry.

“This is giving new life through our current aesthetics,” said Wong.

“I think this is how to pass on our traditional things.”

AFP is one of the world's three major news agencies, and the only European one. Its mission is to provide rapid, comprehensive, impartial and verified coverage of the news and issues that shape our daily lives.