Ford and Suzuki overtake Nissan as industry sales continue downtrend

Two months ago in September, the big news in the automotive industry was that sales volume had declined.

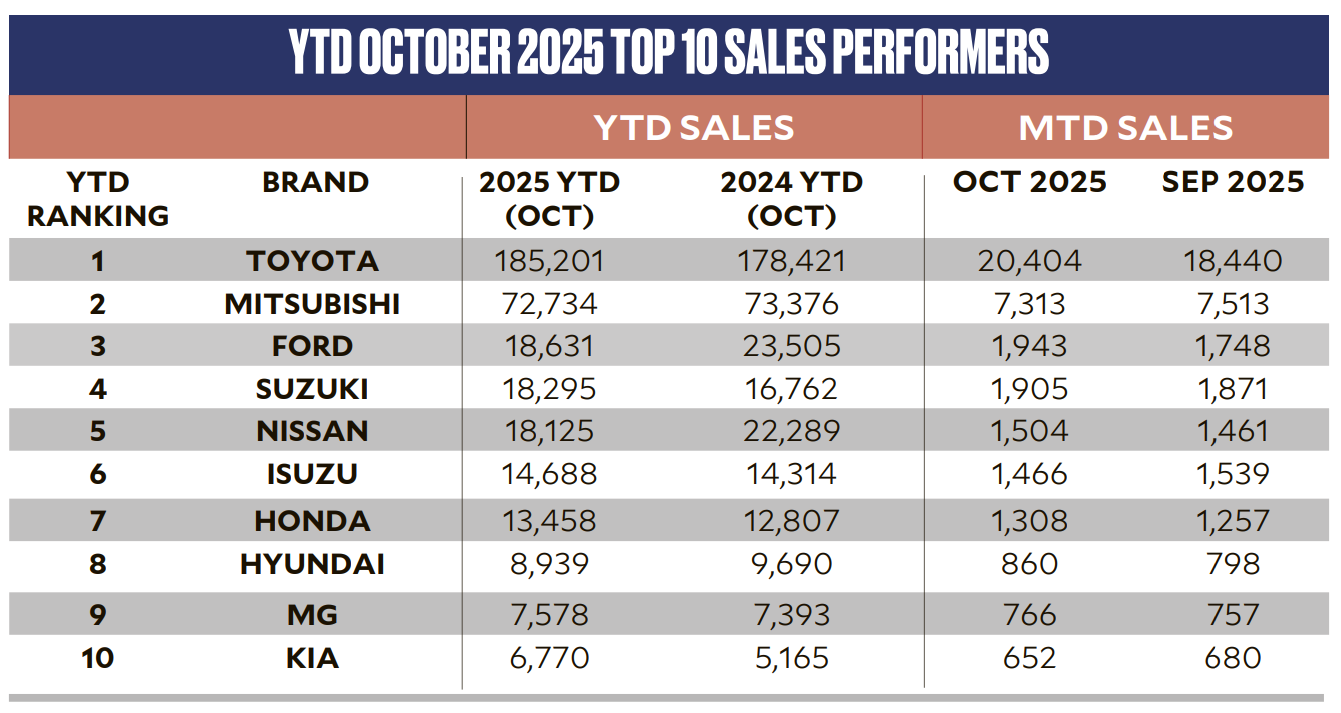

Last month produced another surprise: Nissan PH Inc., which had been No. 3 in sales performance, was overtaken by Suzuki PH Inc. and dropped to no. 5 after Ford Motor Co. PH Inc. had dislodged it in August. All along until last August, Nissan had been perched at no. 3 followed by Ford at no. 4 and Suzuki at no. 5.

(As for market leader Toyota Motors PH Corp. and runner-up Mitsubishi Motors PH Corp., In the Philippine auto industry it is a given that their respective sales figures are impossible to equal, much less overtake.)

The combined sales report of the Chamber of Automotive Manufacturers of the Philippines, Inc. (CAMPI) and the Truck Manufacturers Association for year-to-date October 2025 resumed the downtrend that had begun in September. Total industry sales reached 383,424 units compared to 384,310 in YTD October 2024, indicating a minus 0.2 percent variance.

TRACING THE SLOWDOWN

As of YTD June 2025, the industry was still growing with YTD total industry sales scoring a 2.0 percent increase with 230,912 units sold versus 226,279 in the same year-ago period.

But among the top five circle, brand sales were slowing. Nissan was no. 3 with 11,859 units sold YTD versus 13,939 YTD June 2024. Ford was no. 4 with 10,953 units sold versus 14,460 YTD June 2024. Suzuki at no. 5 bucked the year-on-year downtrend by posting 10,732 YTD sales versus 9.650 YTD in June 2024.

For July 2025, CAMPI reported YTD total industry sales of 269,207 units compared to 265,610 in July 2024, reflecting a 1.4 percent increase. Still some growth but less than June’s 2.0 percent. In July 2025, Nissan was no. 3 with 13,629 units sold YTD versus 15,819 YTD July 2024. Ford closely followed at no. 4 by selling 13,323 units YTD compared to 16,817 YTD July 2024. Suzuki again defied the slowdown by scoring YTD sales of 12,622 versus 11,499 YTD in July 2024.

Despite the growth slowdown in July 2025, CAMPI president Rommel Gutierrez said in a press statement: “We are optimistic that the momentum will carry forward into the second half of the year.”

0.2 PERCENT GROWTH IN AUGUST

CAMPI’s August 2025 YTD report finally confirmed the industry downtrend when YTD sales reached 305,381 units compared to 304,765 YTD August 2024, showing a slight 0.2 percent growth year-on-year. Still, CAMPI rated it a “steady performance.”

The YOY downtrend was also reflected among the brands. Nissan was still no. 3 with YTD sales of 15,610 units versus 18,270 YTD in August 2024. Ford was no. 4 with YTD sales of 14,940 units, down from 18,961 YTD in August 2024. Suzuki was snapping at Ford’s heels by scoring 14,519 units in YTD sales versus 13,206 YTD in August 2024, thereby still bucking the downtrend.

FORD OVERTAKES NISSAN, MINUS 0.3 % GROWTH IN SEPTEMBER

CAMPI reported that last September, YTD sales stood at 343,410 units, “nearly matching last year’s volume of 344,307 units.” But actually, it reflected a 0.3 percent negative YTD growth although month-on-month, there was a 5.1 percent growth over August since total vehicle monthly sales reached 38,029 units.

It was in September that Ford dislodged Nissan from the no. 3 slot. YTD, Ford sold 16,688 units, much less than its YTD September 2024 sales of 21,438, but 67 more than Nissan’s YTD September 2025 sales of 16,621 units. In September 2024, Nissan’s YTD score was 20,322 units.

Meanwhile, Suzuki kept the no. 5 slot by selling 16.390 units YTD versus 14,970 YTD sales in September 2024. Unlike Ford and Nissan, still growing in sales YOY.

NISSAN DROPS TO NO. 5, NEGATIVE GROWTH LOWER IN OCTOBER

CAMPI announced total industry sales YTD October 2025 of 383,424 units, down by minus 0.2 percent from 384,310 units sold in the same year-ago period. CAMPI nonetheless called it “a steady performance” and pointed out that month-on-month sales improved by 5.2 percent to 40,014 units versus September’s 38,029 units.

Ford retained the no. 3 perch by posting 18,631 unit sales, YTD October 2025, while Suzuki sneaked past Nissan to the no. 4 slot by recording 18,295 unit sales, 170 units more than Nissan’s 18,125. At the same time, Suzuki outshone the two because unlike Ford and Nissan, its YTD October 2025 YTD sales record improved by 1,533 units over its YTD October 2024 sales of 16,762 units.

Ford’s 18,631 unit sales YTD October 2025, on the other hand, was 4,874 units less than its year-ago same period sales of 23,505 units. Nissan’s YTD October 2025 sales of 18,125 units was 4,164 units less than its YTD October 2024 sales of 22,289 units.

SUMMING UP

The statistics show that YTD auto industry sales stopped growing last September compared to the YTD of the same month in 2024. Among Ford, Nissan and Suzuki, the latter was the only brand to buck the downward trend in YTD same month sales.

Number one market leader Toyota also defied the YTD sales decline by selling 185,201 units YTD October 2025 compared to 178,421 in YTD October 2024, or a whopping 6,780 unit sales improvement.

Runner-up Mitsubishi sold 642 units less YTD October 2025 by posting 72,734 unit sales versus October 2024 YTD’s 73,376.

Summing up, the brands emerging as the heroes of YTD October 2025 are Toyota (albeit as expected) and surprise! Suzuki.