DOF: Gov’t not shortchanging LGUs in share of nat’l taxes

Municipalities are not being shortchanged by the government in their national tax allotment (NTA) share, the Department of Finance (DOF) said on Sunday.

In a statement, Finance Secretary Ralph Recto said he would meet with local government leaders this week to discuss the accounting of the 40-percent share of cities and municipalities from national taxes, adding that “nothing is shortchanged” in the implementation of a landmark Supreme Court ruling that gave towns a bigger slice of the revenue pie.

The DOF is committed to “transparency and strict compliance” with the Supreme Court decision on the Mandanas-Garcia case and relevant laws in transferring more financial resources to local government units (LGUs), Recto emphasized.

“We are very much welcome and open to having continued dialogues with our LGUs to help them strengthen their fiscal capacities and optimize resource utilization to deliver more and better services to Filipinos,” he added.

The finance chief issued the statement after the anticorruption movement Mayors for Good Governance (M4GG) had asked the DOF for a full accounting of the LGUs’ share from national taxes.

Citing the computations of M4GG, Baguio City Mayor Benjamin Magalong, a founder of the group, said the amounts that LGUs had been receiving were short of what was mandated by the SC decision.

He was referring to the high court’s ruling back in 2018 that significantly increased the tax base on which the share of LGUs is computed from, thus supporting fiscal decentralization in the government.

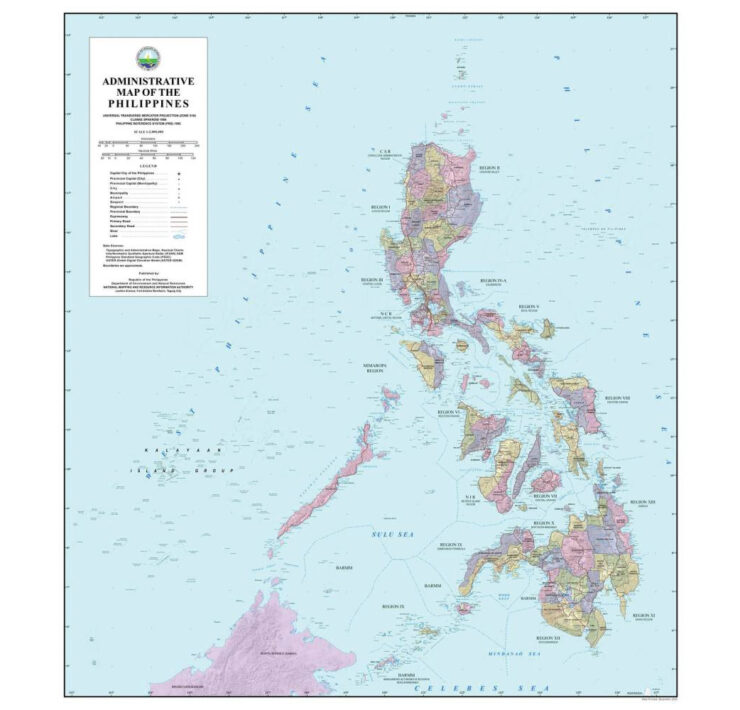

That decision, which took effect in 2022, expanded the base from which the NTA share of LGUs is computed to consist of revenues generated not just by the Bureau of Internal Revenue (BIR) but also receipts of the Bureau of Customs and other collecting agencies.

Deductions

The DOF said that while it had been compelled by the high tribunal to include all national tax collections in the computation of the NTA base, that same ruling exempted those revenues dedicated to special purpose funds and special allotments for the use and development of government resources.

In determining such deductions, the DOF says it is guided by the SC decision, as well as by Section 29 (3), Article VI and Section 7, Article X of the 1987 Constitution.

Section 29 (3), Article VI of the Charter states that “[a]ll money collected on any tax levied for a special purpose shall be treated as a special fund and paid out for such purpose only. If the purpose for which a special fund was created has been fulfilled or abandoned, the balance, if any, shall be transferred to the general funds of the Government.”

In its decision, the high court said that the phrase “internal revenue” in Section 284 of Republic Act No. 7160, or the Local Government Code of 1991, which limited the scope of local government tax shares, was unconstitutional.

However, although the court directed the national government to include all collections of national taxes in the computation of the base of the just share of LGUs, it provided the phrase “… except those accruing to special purpose funds and special allotments for the utilization and development of the national wealth.”

Meanwhile, Section 7, Article X provides that “[l]ocal governments shall be entitled to an equitable share in the proceeds of the utilization and development of the national wealth within their respective areas, in the manner provided by law, including sharing the same with the inhabitants by way of direct benefits.”

Under the 2025 national budget, LGUs will receive an NTA of P1.03 trillion.

Transparent accounting

Before the SC decision, LGUs got their share only from revenues of the BIR, prompting local officials led by Batangas Gov. Hermilando Mandanas and former Bataan Gov. Enrique Garcia to sue the national government in 2013 and demand for “just shares” of LGUs.

But Magalong claimed that municipalities were receiving an NTA share of only 31 percent instead of the 40 percent ordered by the high court.

However, he did not specify the years when M4GG encountered issues with the local government share, nor did he disclose the amount owed to Baguio by the national government.

The League of Cities of the Philippines (LCP) later joined the clamor.

In a statement issued last week by its acting president, Quezon City Mayor Joy Belmonte, the LCP said the public would benefit from a “full and transparent accounting of the [NTA].”

Magalong, the LCP secretary general, and Belmonte are coconveners of M4GG.

Belmonte said the accounting review would ensure “that our cities receive the necessary resources for effective governance.”

“As the demand for improved basic service delivery continues, securing adequate resources to finance these services is of paramount concern for our constituents,” she said in the statement for the LCP.

“We must address these concerns to ensure that the just share of the [LGUs] is compiled and distributed correctly in accordance with the law.”