Gov’t mulls mandatory PSE listing for online gambling firms

The government is exploring the possibility of forcing companies behind online gambling platforms to go public and subject them to the strict disclosure rules of the local stock exchange to increase transparency in the controversial sector.

Speaking to reporters, Finance Secretary Ralph Recto said the potential listing of online gaming operators on the Philippine Stock Exchange (PSE) is just one of the several measures being considered for the fast-growing, but highly scrutinized, industry.

“It might even be good if all the licenses issued by [ Philippine Amusement and Gaming Corp.] to online gaming, maybe, should also be required to list in the stock exchange. That’s another thing that we’re looking at,” Recto said.

Taxes, fees

“We can force them to list so we know who are the people behind it. It becomes more transparent,” he added.

Publicly listed firms are required to regularly disclose material information about their operations, finances and ownership structures-rules designed to protect investors and ensure fair market practices.

Recto said applying the same standards to online gaming firms would help shed light on the real owners of these operators and ensure greater accountability.

Apart from the possible stock market listing, the government is also considering increasing the taxes and fees imposed on online gaming operators.

He said a 10-percent increase in total taxes and fees may generate an additional P10 billion for the government annually.

DigiPlus backs regulation

He also said regulators may require simultaneous compliance: higher remittances and mandatory listing for licensed e-games.

Among the notable gambling-related names in the PSE were DigiPlus Interactive Corp.—the company behind BingoPlus, ArenaPlus, SpinPlus and GameZone—and integrated casino-resort operator Bloomberry Resorts Corp., a new player in domestic e-games with its heavily promoted MegaFUNalo platform.

DigiPlus, whose share price has been severely battered by the tense regulatory environment, said it was backing “smart, balanced regulation” to protect its patrons, recognizing the rise of illicit platforms.

“We believe regulation is the path to player protection,” DigiPlus chair Eusebio Tanco said in a statement on Thursday. “It’s the only way to safeguard players, preserve jobs and close the door on illegal, underground platforms that operate without any oversight.”

Worst performance

DigiPlus on Thursday suffered its worst stock market performance in history, toppling it from its throne of being the country’s top-performing gaming stock.

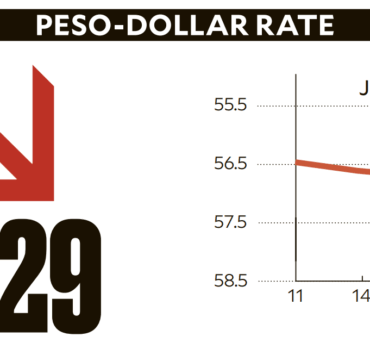

Its share price dove by 29.96 percent to P19.54 each, marking its bloodiest day ever. It is now down 70 percent from its 52-week high of P65.3 on June 11, or weeks before lawmakers began calling for an outright ban on online gambling.

Barriers

Bloomberry Resorts Corp., which recently launched MegaFUNalo, a direct competitor to DigiPlus, also slid by 5.62 percent to P4.03 per share.

Japhet Tantiangco, research head at Philstocks Financial Inc., said the drop was still due to “the current policy narratives against online gaming.”

“The said policies, if implemented, will pose as barriers to customer entry,” Tantiangco added. “This, in turn, would limit online gaming firms’ revenue generation.”

DigiPlus currently operates BingoPlus, ArenaPlus and GameZone, making it the most popular online gaming operator in the country.

It said all its users undergo strict know-your-customer verification, including government ID checks and age gating, or limiting access only to those of gaming age.

Safe gaming

DigiPlus has likewise been implementing “behavioral nudges” during games to prevent excessive gaming, and providing referral pathways to licensed mental health experts.

“With the right rules in place, the Philippines can be a model for safe, transparent online gaming in Asia,” Tantiangco said. “We are ready to work hand-in-hand with regulators, legislators and community groups to make that vision real.”

Gatchalian bill

The industry faced strong headwinds after Sen. Sherwin Gatchalian filed a bill seeking stricter regulation to address rising gambling addiction. The proposal triggered a brutal sell-off in gaming-related stocks, wiping out billions of pesos in market value. The losses continued after the Bangko Sentral ng Pilipinas announced plans to limit the use of e-wallets for betting.

Malacañang earlier said it would support the Department of Finance’s proposal to tax online gaming operators as long as the measure is well-studied.

At present, licensed operators of e-games pay a 30-percent remittance rate and auditing fees to Pagcor, as well as a 5-percent franchise tax to the Bureau of Internal Revenue.

Altogether, Recto said the government expects to collect over P200 billion from the sector in 2025.