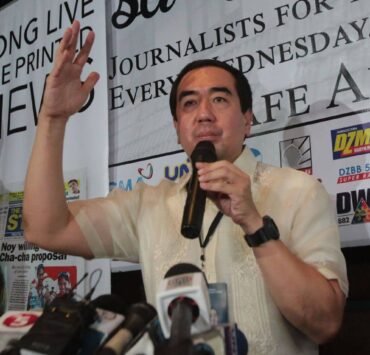

GSIS execs seek chief’s exit over P8.8-B losses

Current and former high-ranking officials of the Government Service Insurance System (GSIS) have called for the “immediate and irrevocable” resignation of Jose Arnulfo “Wick” Veloso, the president and general manager of the state-run pension fund, accusing him of “poor investment decisions” that resulted in losses amounting to P8.8 billion.

In a strongly worded letter to Veloso dated Oct. 14, past and present members of the GSIS’s board of trustees alleged that the fund’s top executive had pursued risky investments “marked by a disturbing lack of transparency.”

“Your continued presence at the helm of the GSIS puts the welfare of its 2.6 million members—dedicated public servants who have entrusted their life savings and future security to this institution—in imminent danger,” they wrote.

“The primary mandate of the GSIS is to manage its funds with utmost prudence, diligence, and loyalty. Your current trajectory suggests a departure from this sacred mandate, prioritizing transactions that serve interests other than those of the members,” they added.

The letter was signed by Ma. Merceditas Gutierrez, chair of the legal oversight committee; Emmanuel de Leon Samson, chair of the risk oversight committee; Rita Riddle, chair of the audit committee; board member Evelina Escudero; and former board members Jocelyn de Guzman Cabreza and Alan Luga.

The signatories also cited what they described as “a pattern of actions seemingly designed to bypass proper governance,” including the alleged practice of splitting investment transactions—a “clear tactic,” they wrote, intended to evade the mandatory board review for investments exceeding P1.5 billion.

They accused Veloso, who recently returned to his post after a preventive suspension ordered by the Office of the Ombudsman, of “fabricating issues and weaponizing administrative procedures to retaliate against [board] members exercising their fiduciary duty of oversight.”

Keep ‘politics’ out

In a statement, Veloso said he would stay in office for as long as he has the trust of President Marcos, adding that the call for resignation was “not entirely unexpected.”

“I categorically state that the allegations against me are baseless. I am addressing them squarely and transparently in the proper legal forum, where they rightfully belong,” he said. “I appeal to everyone to spare GSIS from politics.”

“Our performance speaks for itself,” Veloso said, citing figures as of August 2025. He pointed to GSIS’s total assets climbing to P1.92 trillion and a total income of P231.06 billion, with net income reaching P100.02 billion.

“These results clearly demonstrate that, despite market headwinds, GSIS remains financially strong, resilient, and highly profitable,” he added.

Veloso, who also sits on the board, noted that only four of its nine members signed the letter.

“As an appointee of the President, I serve at his pleasure. I will continue to fulfill my responsibilities as President and General Manager of the GSIS for as long as I have his trust and confidence.” he said.

In July, Veloso and several other GSIS officials were suspended by the Ombudsman after an anonymous complaint questioned the fund’s P1.45-billion investment in Alternergy Holdings Corp. The other GSIS officials were executive vice presidents Michael Praxedes and Jason Teng, vice presidents Aaron Samuel Chan and Mary Abigail Cruz-Francisco, officer Jaime Leon Warren, and acting officer Alfredo Pablo.

The six-month suspension, the Ombudsman said, was intended to prevent those accused from influencing the investigation.

Suspension lifted

In the same month, the Confederation for Unity Recognition and Advancement of Government Employees (Courage) and ACT Teachers pressed for swift action on the Ombudsman case, saying “heads should roll” for GSIS’s “unauthorized” and “irresponsible” investment in Alternergy.

Courage is composed of state employees and ACT represents public school teachers, who are among the biggest contributors to the pension fund.

The Ombudsman’s order was lifted in September after the antigraft body determined there were “insufficient grounds” to believe the officials’ continued stay in office would affect the inquiry.

Also in July, Finance Secretary Ralph Recto said the Department of Finance would check if Veloso and the others violated “any rule imposed by law or board resolution” when they made certain investment decisions.

Sen. Sherwin Gatchalian threw his support behind the probe “as this shows the government’s commitment to accountability and transparency in all public institutions, especially those managing workers’ funds.”

In their letter, the signatories pointed not only to the Alternergy investment but also to other “transactions of particular concern” that they said had been split to avoid oversight.

They alleged that GSIS’s dual-tranche investments in Monde Nissin Corp., Nickel Asia Corp., Bloomberry Resorts Corp. and DigiPlus Interactive Corp. have already incurred combined losses of P3.67 billion.

Sen. Risa Hontiveros in August called for a probe into GSIS’s P1.2-billion investment in DigiPlus, an online gambling operator, which suffered a brutal sell-off over the past three months amid calls to ban online games.

‘Unacceptable risk’

The GSIS officials also flagged a proposed P456-million investment in Figaro Culinary Group Inc., noting that the company “failed to meet the P15-billion minimum market capitalization requirement” and that the proposed investment “is more than 50 times the maximum allowable exposure of P8.5 million.” Data from the stock exchange showed Figaro has a market capitalization of P3.28 billion.

They further warned that GSIS’s investments in private equity funds managed by Neuberger Berman and NightDragon would introduce “a grave and unacceptable level of risk to members’ retirement funds, fundamentally violating this core mandate.”

The letter also questioned GSIS’s investment in Udenna Land Inc., calling it a “rescue” of businessman Dennis Uy’s Clark Global City project, as well as what they described as the “reckless” bulk purchase of condominium units for resale from 8990 Housing Development Corp.

Incurred since 2023

The executives likewise criticized the proposed acquisition of The Centrium, a corporate center in Parañaque City, saying the transaction proceeded despite “questionable and conflicting valuations issued by various private appraisers, as well as by the Parañaque Assessor’s Office and the Commission on Audit.”

“Poor investment decisions have led to GSIS huge losses of P8.8 billion,” they said. “Despite our repeated inquiries and formal requests for your explanation, you have failed to provide a substantive response or engage in a discussion regarding these critical concerns.”

“To prevent further erosion of trust and to safeguard the future of our members, your resignation is the only honorable and viable course of action,” they added.

The losses cited in the letter were incurred since 2023, a year after Veloso was named GSIS chief by President Marcos.

Veloso was the president and CEO of the Philippine National Bank (PNB) prior to his appointment to GSIS. He was an international banker and was appointed as the first Filipino CEO at HSBC Philippines until he transferred to PNB in 2018.