Inflation, slow demand eat into fortunes of 50 richest Filipinos

Slower economic growth in the first quarter, high borrowing costs, inflation and a weak peso did not just affect the daily lives of ordinary Filipinos but also the fortunes of the country’s wealthiest.

Forbes Magazine on Thursday said more than half of the country’s 50 richest became less wealthy this year.

It said their wealth nearly flatlined at $80.8 billion from $80.4 billion last year as the Philippine economy expanded by 5.7 percent in the first quarter of 2024, slower than last year’s 6.4 percent, and the peso fell 6 percent against the US dollar.

While the Sy siblings of the SM group retained the top spot, their net worth shrank to $13 billion from $14.4 billion in 2023, reflecting the weaker peso.

Lance Gokongwei and his siblings behind the family conglomerate JG Summit Holdings Inc. were likewise kicked out of the Top 10 after their wealth dipped by 37 percent to $1.9 billion, placing them at the 11th spot from seventh previously.

“Shares of their flagship JG Summit are down from a year ago, as its petrochemicals unit got impacted by weaker global prices and high operating costs,” Forbes said.

Ports and casino billionaire Enrique Razon Jr. of International Container Terminal Services Inc. (ICTSI) and Bloomberry Resorts took the No. 2 spot for the first time and became the biggest dollar gainer for the second year in a row. His wealth soared by $3 billion to $11.1 billion, according to Forbes.

Property tycoon Manuel Villar slipped to third from No. 2 last year, although his net worth increased by $1.2 billion to $10.9 billion.

The former senator, who was the sole Filipino included in Forbes’ earlier list of the Top 200 billionaires across the globe, currently heads property developer Vista Land and Lifescapes.

Mixed results

Ramon Ang of diversified conglomerate San Miguel Corp. was in fourth place with a net worth of 3.8 billion, up by $400 million.

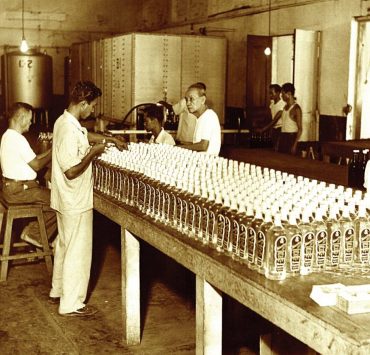

Rounding out the top 10 on the list were DMCI Holdings Inc.’s Isidro Consunji and siblings with a fortune of $3.4 billion, up from $2.9 billion last year; Tony Tan Caktiong of Jollibee Foods Corp., $2.9 billion (down from $3.2 billion); Lucio Tan of Philippine National Bank, Philippine Airlines and Asia Brewery, $2.65 billion (up from $2.6 billion); Jaime Zobel de Ayala, $2.6 billion (down from $2.8 billion); husband and wife Lucio and Susan Co of the Puregold chain of retail stores, $2.3 billion (unchanged from last year), and the Aboitiz Family, $2.2 billion (down from $3.15 billion).

The Consunjis’ DMCI Holdings reported a 29-percent decline in net income in the first six months of the year to P11.1 billion on lower gains from its energy and real estate business.

Notable gainer

Forbes said a notable gainer was education magnate Eusebio Tanco (No. 22), whose wealth rose 35 percent to $815 million on rising shares of his online gaming company DigiPlus Interactive, which benefited from the government’s crackdown on illegal offshore gambling firms.

The June initial public offering (IPO) of Citicore Renewable Energy Corp. (CREC), one of only three listings on the Philippines Stock Exchange so far this year, propelled construction tycoon Edgar Saavedra (No. 43) back to the list after a four-year gap, Forbes Asia said.

Saavedra’s former business partner, Michael Cosiquien, was the other returnee at No. 48. Cosiquien now runs his separate venture, ISOC Holdings, with interests in logistics, energy, property and infrastructure.

CREC, the sponsor of publicly traded Citicore REIT Corp., listed on the bourse in June following its P5.3-billion IPO. CREC is also the third company under the Megawide Group to go public.

Minimum wealth

According to Forbes, the minimum net worth to make the list was $170 million, down slightly from $180 million last year.

The list was compiled using shareholding and financial information obtained from the families and individuals, stock exchanges, analysts and other sources, it said.

Unlike the Forbes World’s Billionaires rankings, the list included family fortunes, including those shared among extended families.

Net worths were based on stock prices and exchange rates as of the close of markets on July 19, 2024, and private companies were valued based on similar companies that are publicly traded.

The list can also include foreign citizens with business, residential or other ties to the Philippines, or citizens who don’t reside in it but have significant business or other ties to the country.

An example was Indonesian-born Hartono Kweefanus, chair emeritus of Monde Nissin, a food manufacturer based in the Philippines known for its instant noodles and snacks. He and his family were at No. 17 of the list, with a wealth of $980 million. INQ