League of Cities backs scrutiny of tax shares

BAGUIO CITY—The League of Cities of the Philippines (LCP) is backing a group of mayors that is seeking to determine how much they are actually getting as their legal share of the national revenue.

The Mayors for Good Governance (M4GG) suspects that local government units (LGUs) were being “shortchanged” by the national government of the 40 percent they were entitled to from the annual revenue collection, instead of the 31 percent that they have been receiving, according to their calculations.

Crusade vs corruption

In a statement issued on Thursday by its acting president, Quezon City Mayor Joy Belmonte, the LCP said that the public would benefit from a “full and transparent accounting of the National Tax Allotment (NTA),” which replaced the Internal Revenue Allotment (IRA) that LGUs were getting from the national government.

Formed in 1988, the LCP serves as the organization that advocates for programs to improve governance in the nation’s 149 cities while giving more focused attention to their peculiar needs. The Local Government Code empowered it to speak for the cities.

Baguio Mayor Benjamin Magalong, the LCP secretary general, and Belmonte are co-convenors of M4GG, which is composed of about a hundred mayors who have been crusading against entrenched corruption in the bureaucracy.

To ensure ‘just share’

Magalong said on Monday that the group had sought a dialogue with Finance Secretary Ralph Recto to review the computations of local government tax shares.

Recto has not formally responded as of Thursday night although Magalong said that the finance chief was open to a discussion.

Belmonte said the accounting review ensured “that our cities receive the necessary resources for effective governance.”

“As the demand for improved basic service delivery continues, securing adequate resources to finance these services is of paramount concern for our constituents,” she said in the statement for the LCP.

“We must address these concerns to ensure that the just share of the local government units is compiled and distributed correctly in accordance with the law.”

2018 SC ruling

The NTA is the expanded coverage of local government shares from the original internal revenue collections to include other government sources of earnings like tariffs from imported items and customs duties, and value-added tax (VAT).

It was mandated by the Supreme Court in a 2018 ruling. The court said that the phrase “internal revenue” in Section 284 of Republic Act No. 7160, or the Local Government Code of 1991, which limited the scope of local government tax shares, was unconstitutional.

The court directed the national government to include “all collections of national taxes in the computation of the base of the just share of [local government units] … except those accruing to special purpose funds and special allotments for the utilization and development of the national wealth.”

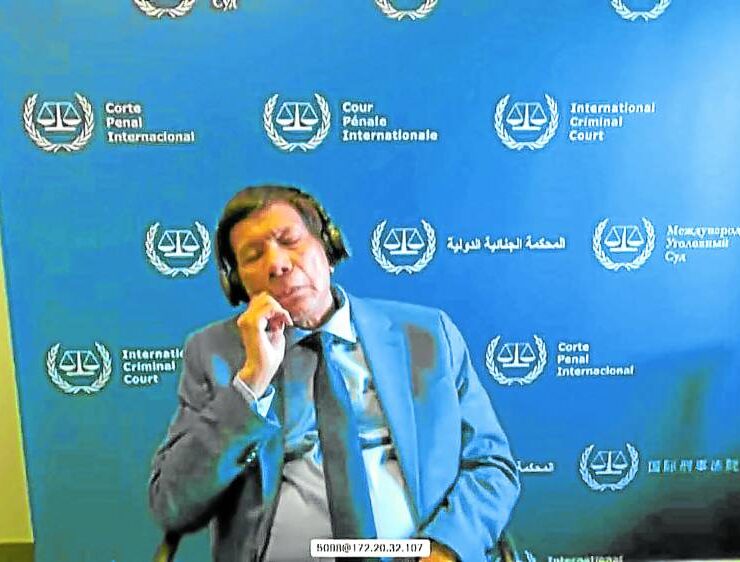

The landmark ruling is known as the “Mandanas-Garcia Doctrine,” so named after lead petitioners Hermilando Mandanas, the Batangas governor, and former Bataan Gov. Enrique Garcia.

‘Prospective application’

The high court acknowledged the likely impact the decision would have on national spending. It explicitly shut down future discussions about what the state owed local governments “on the ground that this decision shall have prospective application.”

Enforced by the administration of former President Rodrigo Duterte, the government made a “complete devolution” of powers to the local government and required the country’s 82 provinces, 1,493 municipalities, 149 cities and 42,045 barangays to “first cover the cost of providing the services and facilities devolved by the national government before applying the same for other purposes.”

Senate bill

In a 2019 Senate bill to institutionalize the NTA, Sen. Imee Marcos referred to a study by the LCP of “a compounded internal revenue allotment shortfall of about P1.5 trillion” for fiscal years 1991-2019. This was attributed to the non-inclusion in the national tax revenue base of the national taxes, such as revenue collections of the Bureau of Customs from VAT, documentary stamp taxes and excise on imported goods, which accounted for about 74 percent of the IRA shortfalls, she said.

“Instead of the full 40 percent share mandated by law, LGUs are only actually receiving an average of about 30 percent of the collection of national taxes or only 14 percent of the annual national budget (General Appropriations Act, or GAA),” according to the senator.

This year’s GAA appropriated P1.034 trillion in the NTA for LGUs.

Ending up begging

Speaking to reporters on the sidelines of this year’s Panagbenga Baguio Flower Festival launching ceremony on Monday, Magalong said that funding would have “a key impact on local governments if empowering them is a genuine goal.”

Some LGUs, however, end up begging for additional funds from lawmakers to make ends meet, he said, “So what happens to 3rd class to 5th class municipalities with no pull in Congress?”