Manila Water, Maynilad adjust rates starting Oct

For the last quarter of the year, Manila Water Company. Inc. would be hiking its rates while Maynilad Water Services would be reducing theirs due to the foreign currency differential adjustment (FCDA).

This was announced on Monday by the Metropolitan Waterworks and Sewerage System (MWSS), which said its board of trustees had approved the rate adjustments covering the last three months of the year.

In particular, Manila Water would be implementing a hike of P0.86 per cubic meter and Maynilad, a decrease of P0.29 per cubic meter, effective on Oct. 1.

For Manila Water customers using 20 cubic meters monthly, this would mean an additional P8.10 in their water bills, and P16.54 for those using 30 cubic meters.

On the other hand, Maynilad customers consuming 20 cubic meters monthly would see their water bills go down by P3.14 while those using 30 cubic meters would pay P6.43 less.

Low-income lifeline customers or those consuming 10 cubic meters or less would be exempted from the FCDA.

The FCDA is a quarterly reviewed tariff mechanism that allows the water concessionaires to recover losses or give back gains following movements in the value of the peso against foreign currencies. Both Manila Water and Maynilad have foreign currency-dominated loans that are used to finance the expansion and enhancement of their water and sewerage services.

Public consultation

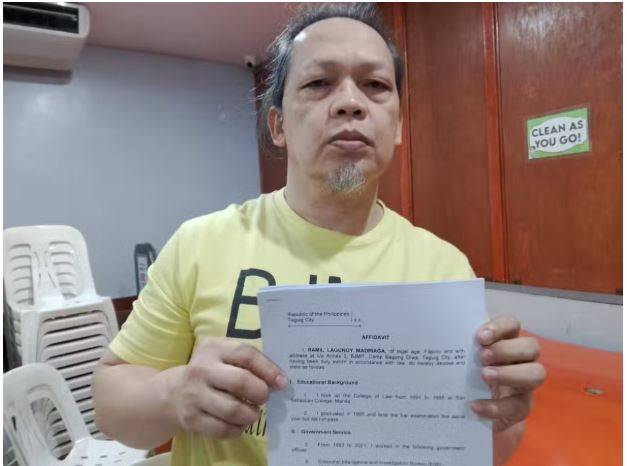

The rate adjustments followed a public consultation held by the MWSS in July to solicit comments from consumers.

The implementation of the FCDA component had been suspended after the water concessionaires and the Duterte administration signed a revised concession agreement in November 2021, that was amended in 2023.

The FCDA was reinstated, but covered only MWSS loans serviced by the concessionaires, as well as principal payments and undrawn amounts of their foreign currency-denominated loans existing as of June 29, 2022.

The amended deal likewise introduced a modified FCDA for concession loans approved after June 29, 2022, but this could be tapped only during “extraordinary” fluctuations in the Philippine peso. A cap was also placed on the amount that could be recovered.