Museum visitors to get first sight of Charles III banknotes

LONDON—People in the UK can get their first glimpse on Wednesday of banknotes bearing King Charles III’s image.

They will be revealed to the public at the opening of the Bank of England’s “The Future of Money” exhibition.

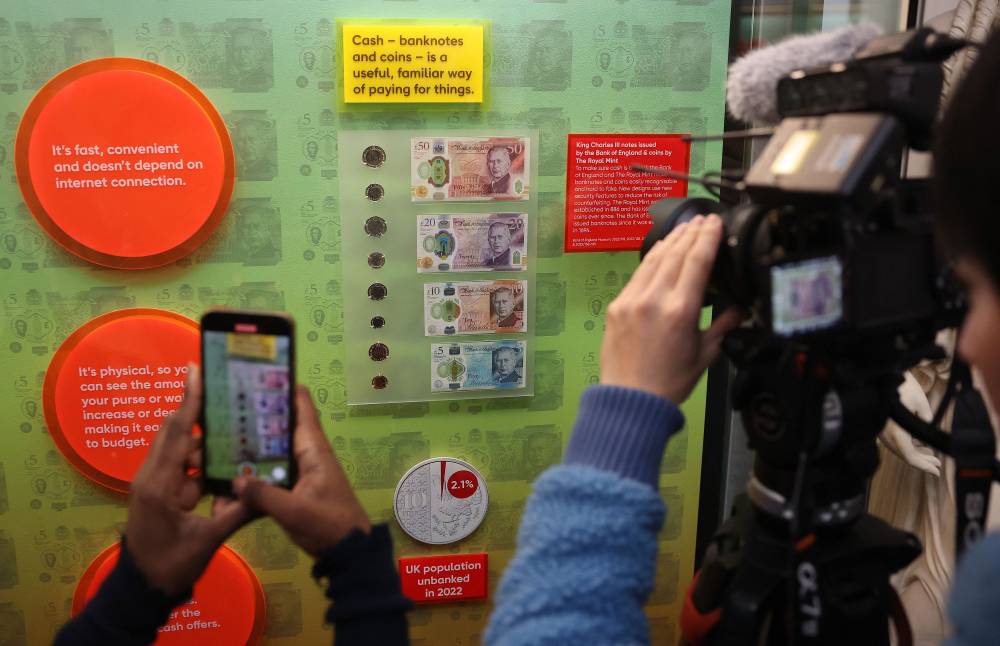

The four new banknotes with the king’s portrait—£5, £10, £20 and £50—go on display at the central bank’s in-house museum at its London headquarters, before entering circulation on June 5.

Based on a photograph owned by the royal household and made available in 2013, Charles approved the final designs of the notes featuring his engraved portrait in late 2022.

That was just months after he became king following the death that September of his mother Queen Elizabeth II.

“This is the first time that the Bank of England has issued a note with a new monarch on it, because Queen Elizabeth has been on our banknotes since the 1960s,” the museum’s curator Jennifer Adam explained.

“So it’s the first time that we as a public will have seen this transition,” she told AFP at a press preview.

The landmark comes as Charles battles a cancer diagnosis announced earlier this month. He has withdrawn from public-facing duties while he undergoes treatment.

Banknotes bearing Elizabeth’s portrait will remain legal tender, with the new cash “gradually replacing” those withdrawn “due to being old and worn,” Adam said.

“So it will be some time before there’s plentiful supply around.”

Polymer material

The new notes are polymer—which has been slowly replacing paper money in the UK since 2016—and feature Charles’ image on the front as well as in the see-through security window.

Coins bearing Charles’ head—based on a portrait by British sculptor Martin Jennings—which entered circulation in December 2022 are also on temporary display at the museum.

The site details the history of the Bank of England—which has been issuing some banknotes since it was established in 1694—as well as a multitude of other money-making information.

It highlights how the bank took over the printing of notes from the finance ministry in 1928.

A £1 note series launched in 1960 was its first to feature a portrait of the monarch, while from 1970 they began to include historical figures on the other side.

Winston Churchill (£5), Florence Nightingale (£10), William Shakespeare (£20) and Alan Turing (£50) have all since graced banknotes.One constant on all Bank of England-issued cash for the past 330 years is its Britannia emblem, depicting the helmeted female warrior holding a trident and shield.

Since 17th century

The museum also permanently houses centuries-old coins and gold bars—the bank stores around 400,000 in its vaults—as well as its first banknotes produced in the late 17th century.

“The Future of Money” exhibition, set to run alongside the permanent displays until September 2025, delves into modern trends, from the emergence of digital currencies to the current lifespan of cash.

It chronicles the UK decline in the use of, noting that banknotes made up just 14 percent of payments in 2022 compared to 55 percent in 2011. That could drop to just 7 percent by 2032, according to the museum.

Britain has lost 15,000 cash dispensing machines and 2,000 bank branches in the last five years.

Despite that, the institution notes the UK government last year passed legislation to protect access to cash—perhaps given more than 1 million people do not have a bank account.

AFP is one of the world's three major news agencies, and the only European one. Its mission is to provide rapid, comprehensive, impartial and verified coverage of the news and issues that shape our daily lives.