SEC sues Villar Land for market manipulation, insider trading

The Securities and Exchange Commission (SEC) has filed a criminal complaint against Villar Land Holdings Corp. and several of its officers and related entities for alleged market manipulation, insider trading and misleading disclosures that distorted the company’s share prices.

In a complaint filed with the Department of Justice on Jan. 30, the SEC charged Villar Land, formerly Golden MV Holdings Inc., with violations of Sections 24.1(d) and 26.3 of Republic Act No. 8799, or the Securities Regulation Code (SRC), for making false or misleading statements and engaging in acts that allegedly defrauded investors.

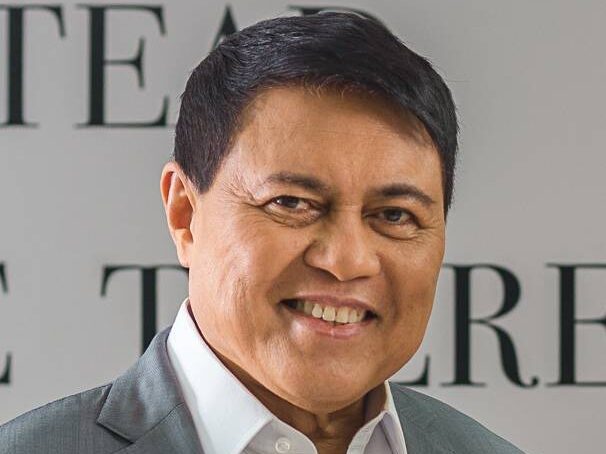

Respondents include Villar Land chair and former Sen. Manuel “Manny” Villar Jr., former Sen. Cynthia Villar, directors Cynthia Javarez, Manuel Paolo Villar, incumbent Senators Camille Villar and Mark Villar, as well as independent directors Ana Marie Pagsibigan and Garth Castañeda.

When sought for comment, Villar Land said it would respond to the allegations once it receives a copy of the complaint.

“Villar Land and its directors will answer all the allegations leveled against them after formal receipt of the alleged complaint,” the company said in a statement.

Villar Land, incorporated on Nov. 16, 1982, is mainly engaged in the development and sale of memorial lots. According to its Philippine Stock Exchange listing, it currently has more than 30 developments nationwide.

The SEC also charged related firms Infra Holdings Corp. and MGS Construction, along with their officers and authorized signatories, for alleged violations of Section 24.1(b) of the SRC, which prohibits price manipulation.

The case stemmed from the SEC’s investigation into Villar Land’s public disclosures and trading activities.

The regulator cited the company’s disclosure of its 2024 financial statements, which reported total assets of P1.33 trillion and net income of P999.72 billion, up sharply from P1.46 billion the year before.

The company attributed the increase to a revaluation of its real estate holdings.

Valuation reports

The SEC alleged that these figures were released before the completion of the company’s external audit. When audited financial statements were later submitted, Villar Land reported total assets of only P35.7 billion, significantly lower than the earlier disclosed amount.

The SEC further alleged that related entities engaged in trading activities that created artificial demand and supported the company’s share price.

It also cited an alleged insider trading transaction involving Camille Villar in 2017.

In November 2025, the SEC revoked the accreditation of Villar Land’s property appraiser, E-Value Phils. Inc. and imposed a P1-million fine after finding its valuation reports unreliable.

At the time, the regulator said E-Value’s valuations failed to comply with the International Valuation Standards (IVS) and could not be trusted as a basis for financial reporting.

It also ordered three Villar Land subsidiaries—Althorp Land Holdings, Chalgrove Properties and Los Valores Corp.—to submit new appraisal reports.

“It is evident that [E-Value] failed to uphold the fundamental principles of independence, professional competence, and objectivity required under the [IVS] and the Code of Ethics and Responsibilities for Real Estate Practitioners,” the SEC’s Office of the General Accountant said.

It warned even back then that the misrepresentations carried wider market risk since Villar Land is a publicly listed company and the valuations had been used in the audited financial statements of its subsidiaries. This, it said, could potentially mislead the investing public.

Investor confidence

In a statement on Saturday, SEC Chair Francis Lim said the commission remains firm in addressing fraudulent and manipulative acts that undermine investor confidence and distort capital markets.

“In this light, the SEC is firm in addressing fraudulent and manipulative acts that mislead the investing public and distort our capital markets,” Lim said.

“The Commission likewise enjoins publicly listed companies to uphold the highest standards of good corporate governance to help strengthen and sustain investor confidence badly needed by our capital markets,” he added.