Senator pushes first EVAT cut in 37 years

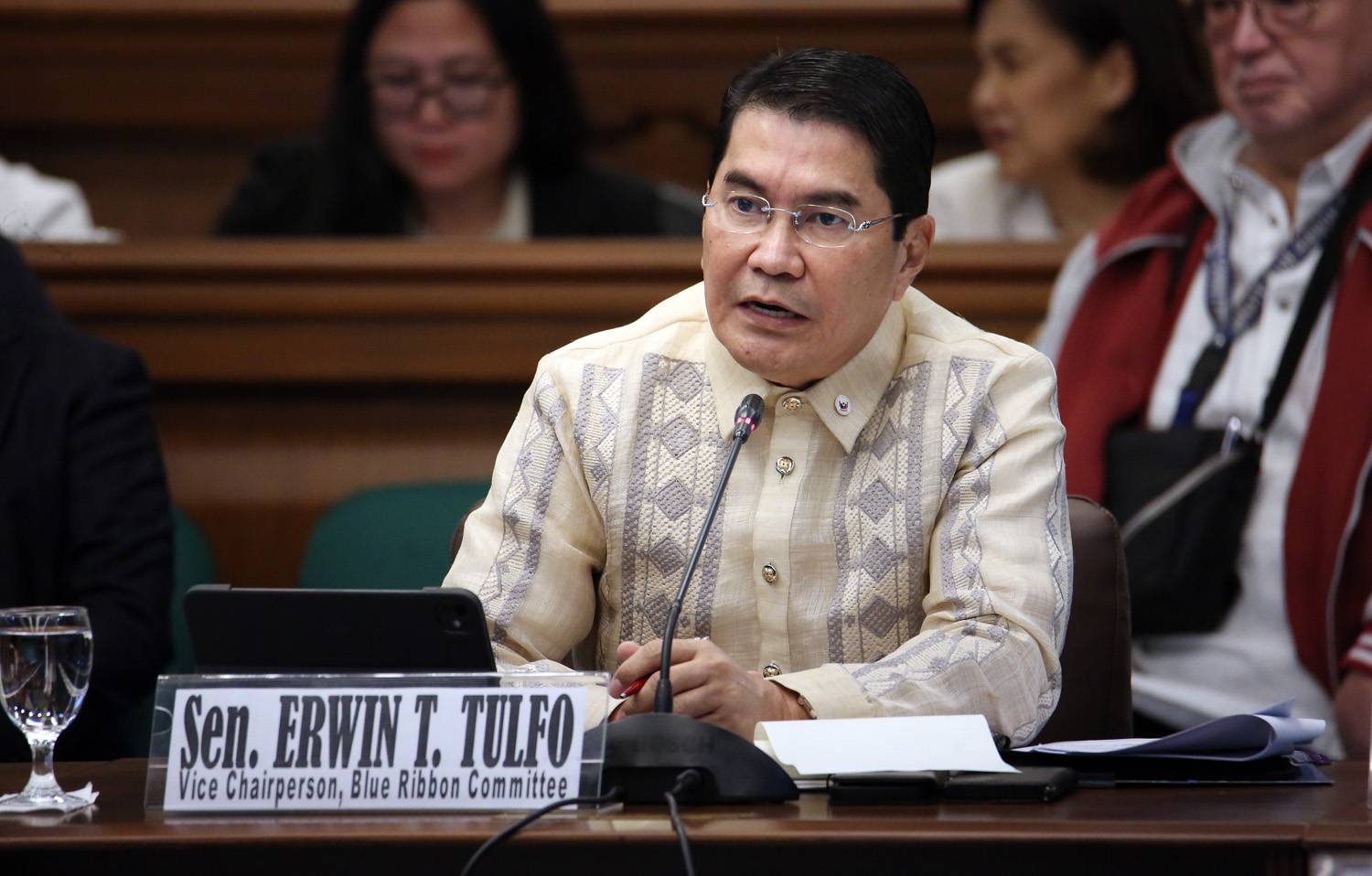

For the first time since it was imposed in 1987, Sen. Erwin Tulfo has sought to reduce the country’s 12-percent expanded value-added tax (EVAT) to its original 10 percent in a bid to boost household purchasing power and stimulate consumption.

In Senate Bill No. 1552, Tulfo argued for the reduction of the EVAT, which is the highest in Southeast Asia, to bolster the country’s gross domestic product.

Currently, the Philippines and Indonesia impose the highest VAT in the region at 12 percent, followed by Cambodia, Vietnam and Laos at 10 percent.

Other neighbors maintain even lower rates, such as Singapore at 9 percent, Thailand at 7 percent, Myanmar at 5 percent (commercial tax) and Timor-Leste at 2.5 percent (sales tax).

“We are among the countries with highest VAT in Southeast Asia, and this has been a heavy burden to low- and middle-income households because a significant portion of their income goes toward taxes instead of essential needs,” noted Tulfo in a statement.

“The VAT Reduction Bill will not only lighten the load for ordinary Filipinos but will also make our country more competitive among our Southeast Asian neighbors,” he added.

To ensure fiscal discipline, the bill includes a safeguard that empowers the President, upon the recommendation of the Secretary of Finance, to temporarily revert the tax to 12 percent.

He said this trigger would occur if the Development Budget Coordination Committee projects that the national deficit would exceed programmed targets for any given fiscal year.

“Reducing the VAT does not just benefit specific sectors; it covers everyone—regardless of income bracket. Filipinos deserve better, so we should give them more,” Tulfo said.

Complex story

According to the government’s Philippine Institute of Development Studies, the tax was first conceived in 1987 under Executive Order No. 237 signed by then President Corazon Aquino, but was not implemented until 1988.

The law has been amended or expanded several times, like in 2005 when VAT was increased from 10 percent to 12 percent under Republic Act No. 9337, or the Reformed VAT law. The increase in the VAT rate from 10 percent to 12 percent took effect on Feb. 1, 2006, via Revenue Memorandum Circular No. 7-2006 of the Bureau of Internal Revenue (BIR).

Since it was first imposed, the total VAT collections ranged from P4.3 billion to P139.1 billion from 1988 to 2004. the EVAT take was generally in the uptrend except in 1998 when it dropped by 10.6 percent.

When RA 9337 was implemented in 2005, total VAT collections tripled from P156.7 billion in 2005 to P259.8 billion in 2006.

There was a significant increase in the VAT collection of the BIR (60.4 percent); and the Bureau of Customs (72.7 percent) in 2006, with the increase in VAT rate from 10 percent to 12 percent. VAT collection continued to increase from P274.04 billion in 2007 to P621.95 billion in 2016.

But government tax analysts have also complained about the exemptions that have made the tax less effective than it was originally meant to be.