Taiwan’s AI-powered economy soars

In Taipei, real estate agent Jason Sung is betting that home prices around a high-tech industrial park in the northern part of Taiwan’s capital will soon take flight—because of computer chip maker Nvidia.

The area is where Nvidia plans to build its new Taiwan headquarters as it rapidly expands on the island, set to surpass Apple to become the biggest customer of Taiwan semiconductor maker TSMC (Taiwan Semiconductor Manufacturing Corp.), the biggest contract manufacturer of the advanced chips needed for artificial intelligence (AI).

Nvidia CEO Jensen Huang describes Taiwan as the “center of the world’s computer ecosystem.” It’s riding high on the global AI frenzy.

Its economy grew at an 8.6-percent annual pace last year, and it’s hoping to maintain that momentum after it recently sealed a trade deal with US President Donald Trump that cut US tariffs on Taiwan to 15 percent from 20 percent.

Growing risk

“We have been lucky,” said Wu Tsong-min, an emeritus economics professor at National Taiwan University and a former board member of Taiwan’s central bank.

But Taiwan’s heavy reliance on computer chip makers and other technology companies carries the growing risk of the AI craze turning out to be a bubble.

Escalating tensions with Beijing, which claims independently governed Taiwan as mainland China’s territory, are another abiding threat, despite the island’s vital role in global chip and AI supply chains.

An island of about 23 million people, Taiwan depends heavily on exports. They jumped nearly 35 percent year-on-year in 2025, as shipments to the United States surged 78 percent due to ballooning AI demand.

That’s thanks largely to TSMC, and electronics giant Foxconn, which makes AI servers for Nvidia and is a major supplier to Apple.

Massive changes

Taiwan has undergone massive economic changes while shifting from mainly labor-intensive industries, such as plastics and textiles to advanced manufacturing like semiconductor fabrication.

The AI frenzy has made TSMC one of the world’s top 10 most valuable companies. Its profit jumped 46 percent last year to $1.7 trillion Taiwan dollars ($54 billion).

The chipmaker is investing heavily both in Taiwan and in new factories in Arizona in the United States. It produces more than 90 percent of the world’s most advanced chips.

Foxconn, formally known as Hon Hai Precision Industry Co., has doubled its value since 2023. The maker of Apple’s iPhone and iPads now produces AI servers and racks and has a partnership with OpenAI to supply AI data center equipment.

Taiwan’s heavy reliance on its technology industry means its biggest risk is that growth will be “very highly contingent on the AI boom and tech race continuing,” said Lynn Song, chief economist for Greater China at ING Bank.

“I’m also very nervous about it,” C.C. Wei, TSMC’s chair said when asked about a potential AI bubble during an earnings call in January. “Because we have to invest about $52 billion to $56 billion (this year).”

No slowdown signs

In a recent report, analysts from Fitch Ratings argued that AI demand will remain strong at least in the near term. In the longer term, however, the risks “will depend on the evolution of AI, as well as trade and investment policies and the adaptability of Taiwanese firms,” they wrote.

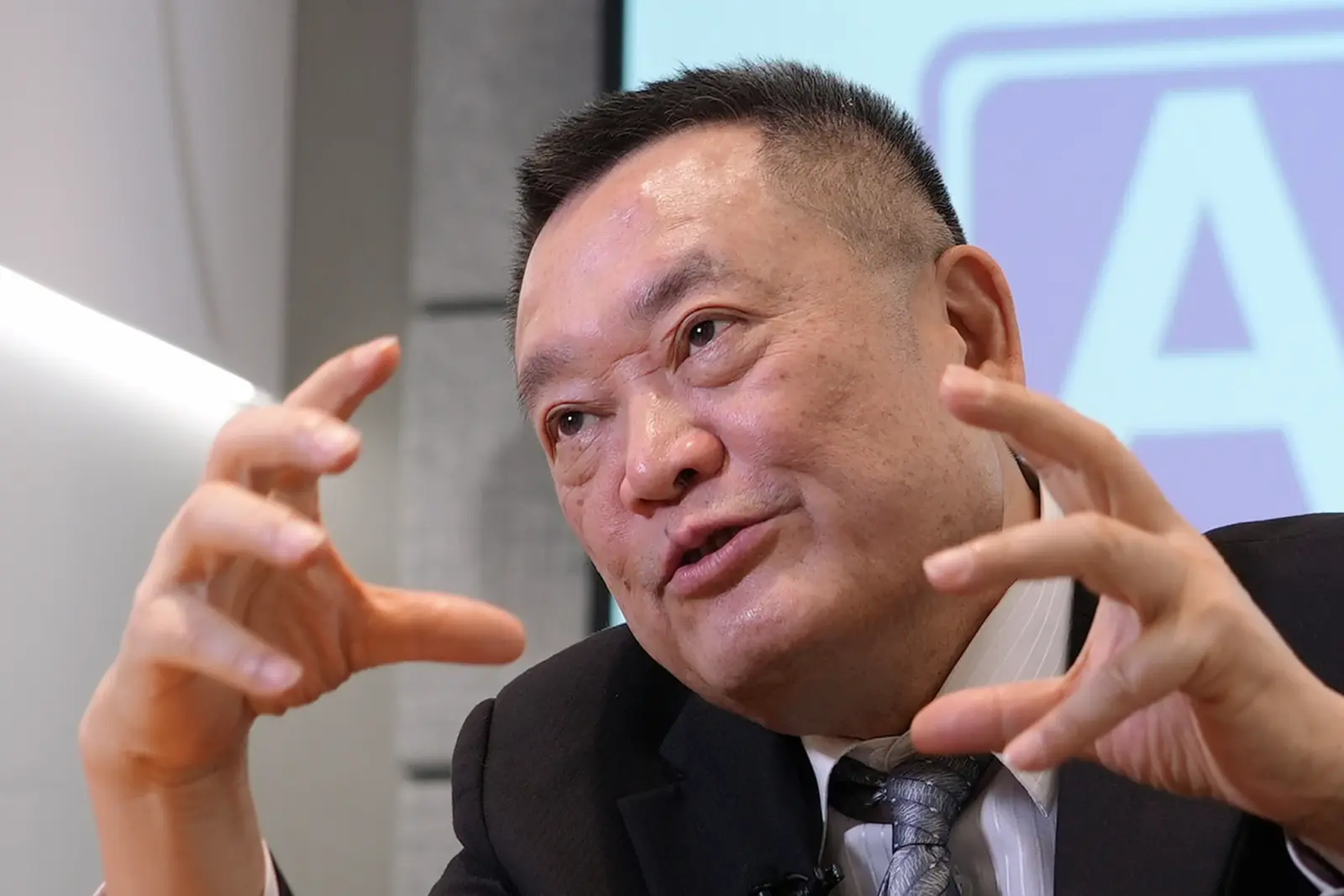

Taiwanese electronics company Asia Vital Components (AVC), a key supplier of liquid cooling systems for Nvidia, is investing heavily in research and development. Its chair, Spencer Shen, said he saw no signs of a slowdown in AI-related demand so far.

“We do not believe this is a bubble,” Shen told The Associated Press (AP) in an interview. “AI is driven by companies with real products and massive cash flows, like Amazon, Microsoft, Google and Meta.”

Some in Taiwan believe that its pivotal role in the technology sector, especially as a maker of computer chips whose main material is silicon, helps to protect the island from attack by communist-ruled Beijing.

While some have called for Taiwan to diversify its economy away from technology to reduce risks, others argue that doubling down on its world-leading technology is the way forward. “It is our greatest strength,” said Shen of AVC.